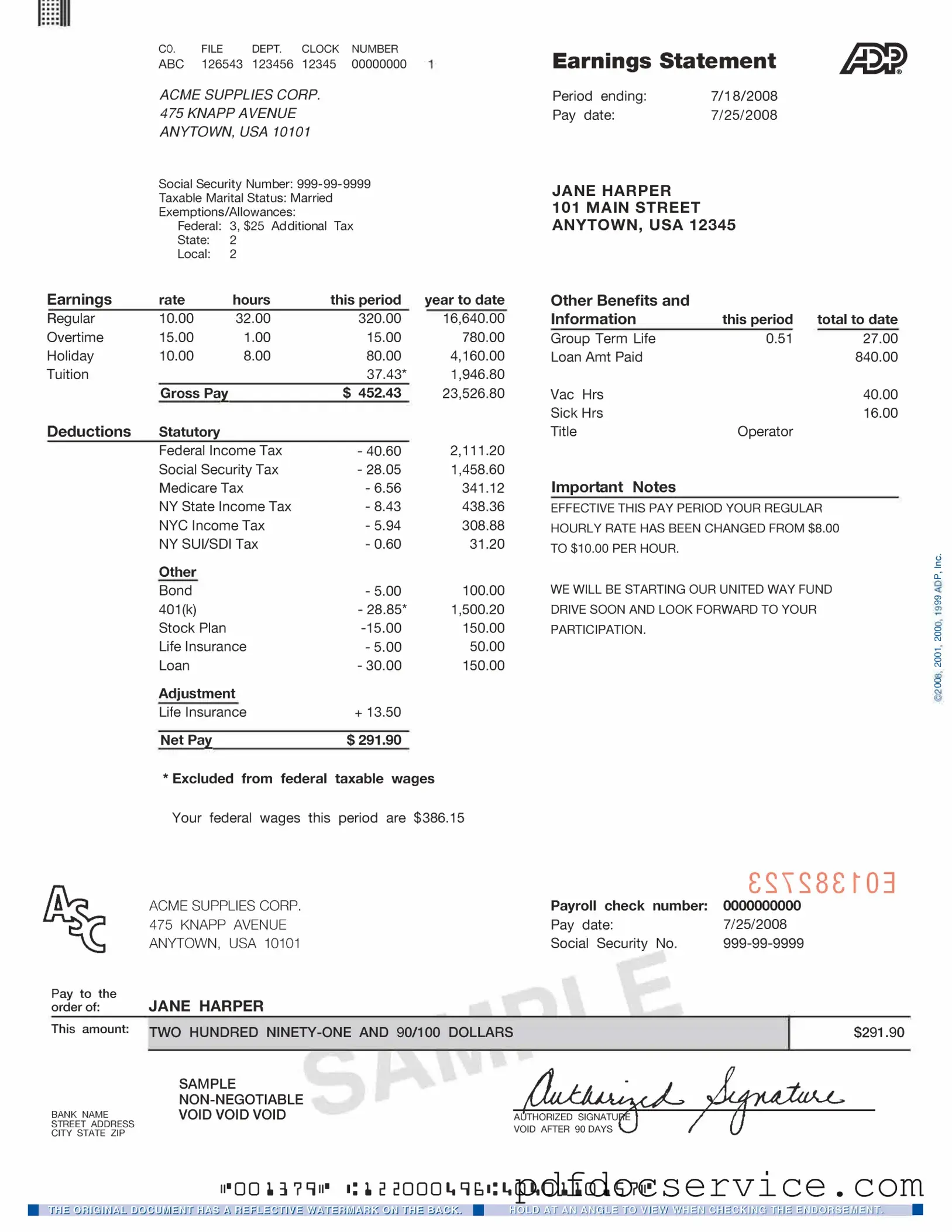

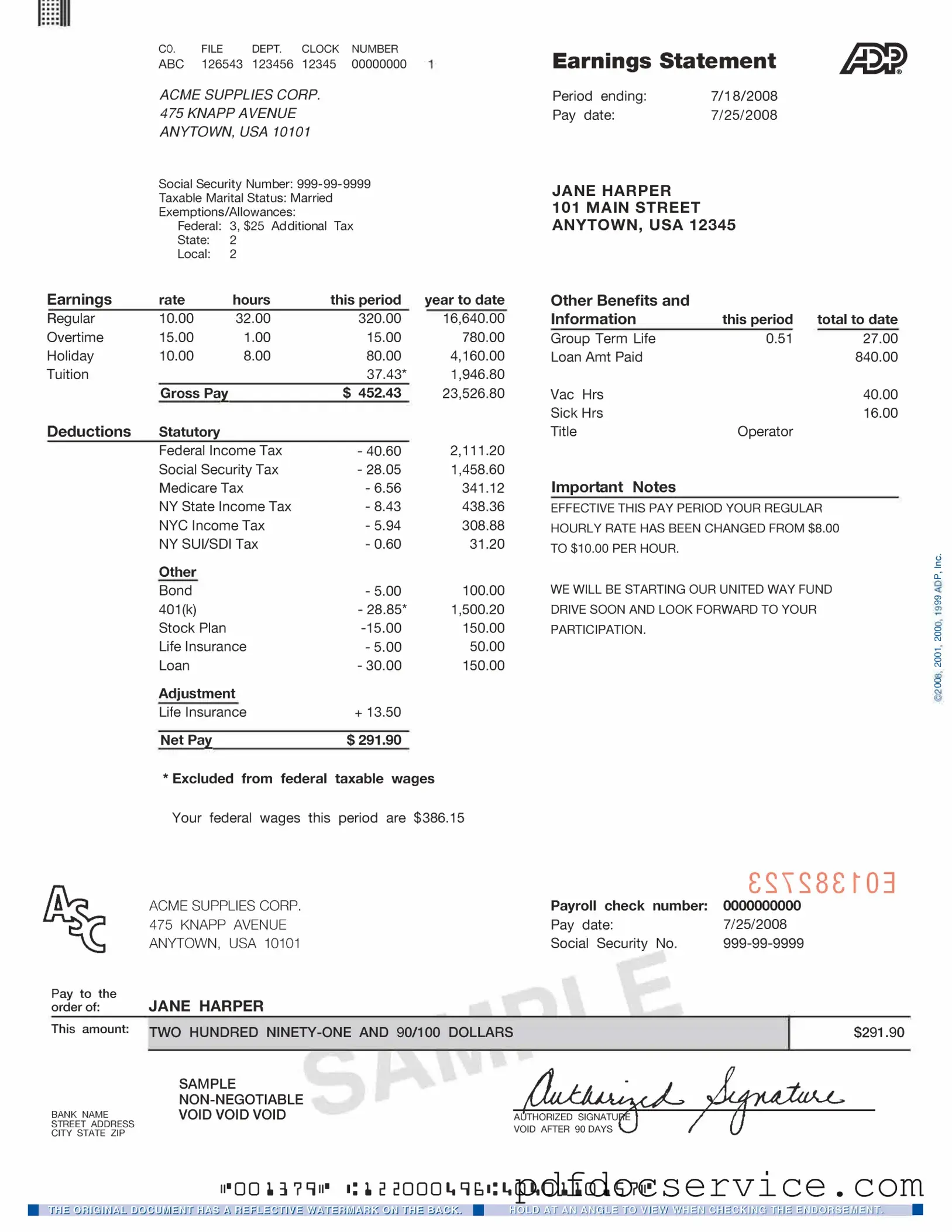

The ADP Pay Stub form is a document provided by ADP, a payroll services company, that outlines an employee's earnings for a specific pay period. It details the gross pay, deductions, and net pay, allowing employees to understand their compensation and any deductions taken from their earnings. This form serves as a record of income and can be used for various purposes, such as applying for loans or verifying income for rental agreements.

How can I access my ADP Pay Stub?

Employees can access their ADP Pay Stub through the ADP portal. To do so, follow these steps:

-

Visit the ADP website and navigate to the login page.

-

Enter your username and password to log in to your account.

-

Once logged in, locate the "Pay Statements" or "Pay Stubs" section.

-

Select the desired pay period to view and download your pay stub.

If you do not have an account, you may need to contact your employer's HR department for access instructions.

The ADP Pay Stub contains several key pieces of information, including:

-

Employee Information:

Name, address, and employee ID.

-

Pay Period:

The specific dates for which the pay is calculated.

-

Gross Pay:

The total earnings before any deductions.

-

Deductions:

Taxes, insurance, retirement contributions, and other withholdings.

-

Net Pay:

The amount the employee takes home after deductions.

This information helps employees understand their earnings and the various deductions that affect their take-home pay.

What should I do if I notice an error on my pay stub?

If an employee discovers an error on their ADP Pay Stub, it is important to address it promptly. The following steps are recommended:

-

Review the pay stub carefully to confirm the error.

-

Gather any supporting documentation, such as timecards or previous pay stubs.

-

Contact your employer's payroll or human resources department to report the discrepancy.

-

Provide the necessary documentation and details about the error.

Employers typically have procedures in place to investigate and correct errors in payroll processing.

Can I use my ADP Pay Stub for tax purposes?

Yes, the ADP Pay Stub can be used for tax purposes. It provides a detailed breakdown of your earnings and deductions for the year. Employees often use their pay stubs to help prepare their tax returns, as they reflect income and the amount of taxes withheld. However, it is essential to retain your W-2 form, which is issued by your employer at the end of the year, as it provides the official record of your income for tax filing purposes.