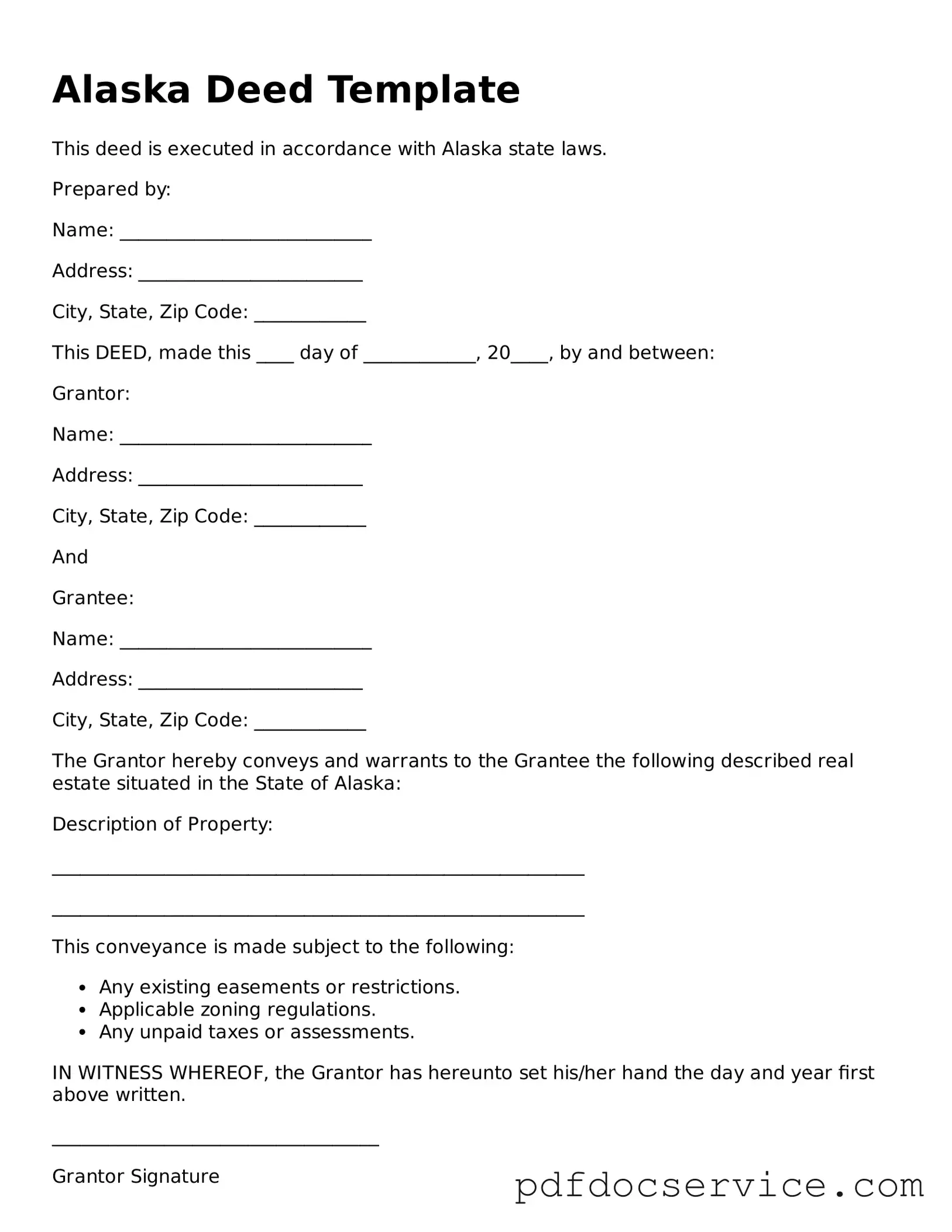

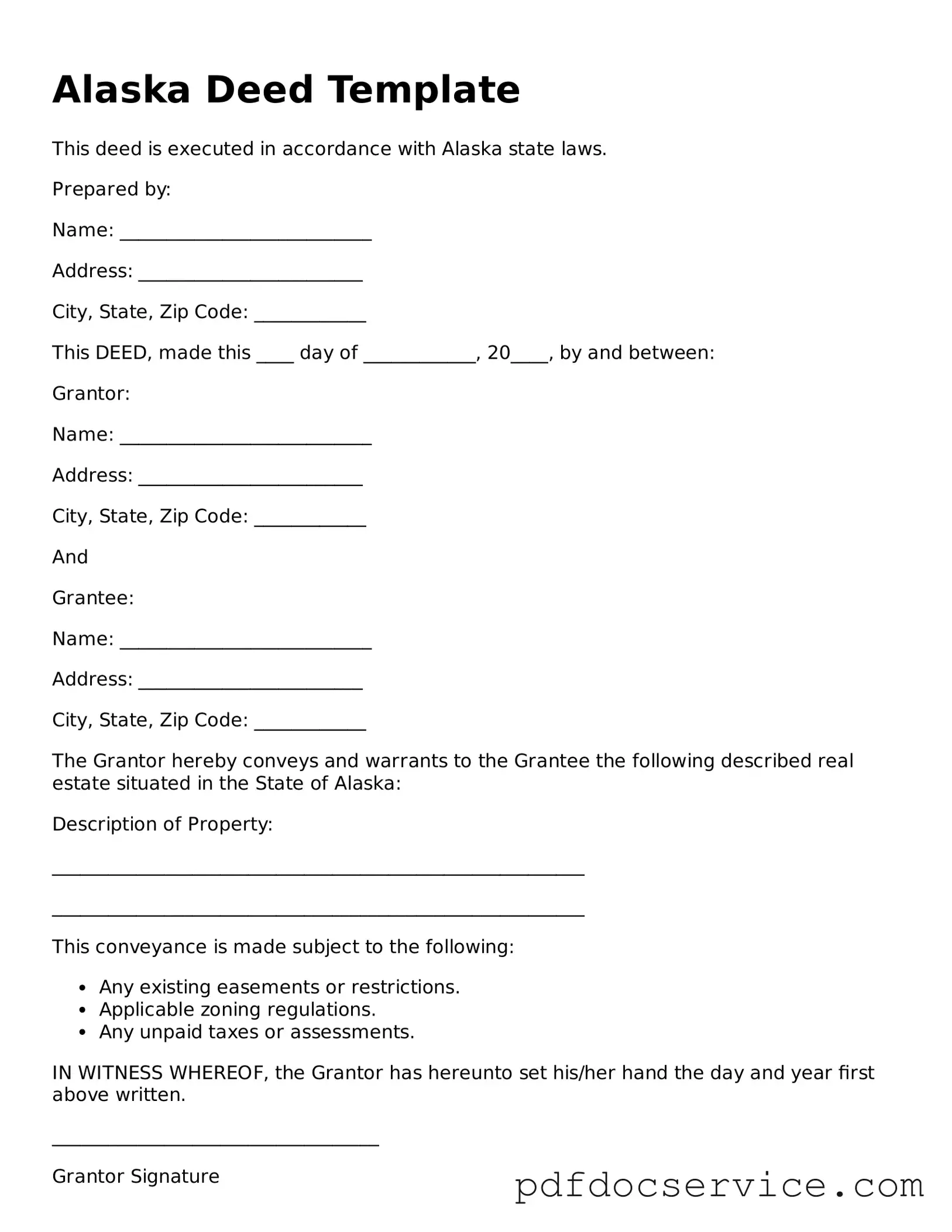

An Alaska Deed form is a legal document used to transfer ownership of real estate in the state of Alaska. It outlines the details of the property being transferred, the parties involved, and any conditions associated with the transfer. This document is essential for ensuring that the transfer is recognized by the state and protects the rights of both the buyer and the seller.

What types of deeds are available in Alaska?

There are several types of deeds that can be used in Alaska, including:

-

Warranty Deed:

This type guarantees that the seller has clear title to the property and has the right to sell it.

-

Quitclaim Deed:

This deed transfers whatever interest the seller has in the property without any guarantees about the title.

-

Grant Deed:

This provides some assurance that the property has not been sold to anyone else and that it is free from liens.

Do I need to have the deed notarized?

Yes, in Alaska, a deed must be notarized to be legally effective. This means that the person signing the deed must do so in the presence of a notary public, who will verify the identity of the signer and witness the signing process. This step helps prevent fraud and ensures the document is valid.

Filling out an Alaska Deed form involves several key steps:

-

Identify the parties involved: Include the names and addresses of both the grantor (seller) and grantee (buyer).

-

Describe the property: Provide a detailed description of the property being transferred, including its legal description.

-

Specify the consideration: Indicate the amount of money or other value exchanged for the property.

-

Sign and date the form: Ensure that all parties sign the deed in front of a notary public.

After completing the deed, it must be filed with the local recording office in the borough where the property is located. This step is crucial for making the transfer public and protecting the new owner's rights. There may be a small fee associated with the filing process.

Are there any taxes associated with transferring property in Alaska?

Yes, when transferring property in Alaska, there may be transfer taxes or recording fees. The amount can vary based on the property's value and the local jurisdiction. It's advisable to check with the local recording office or a tax professional for specific details regarding any applicable fees.

While you can use a generic deed form, it is highly recommended to use an Alaska-specific deed form. Each state has unique laws and requirements, and using a form tailored to Alaska can help ensure that all necessary information is included and that the document complies with state regulations.

What should I do if I have questions about my deed?

If you have questions about your deed or the property transfer process, consider consulting a legal professional who specializes in real estate law. They can provide guidance specific to your situation and help you navigate any complexities that may arise during the transfer.