What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike a warranty deed, it does not guarantee that the property is free of liens or other claims. Essentially, the grantor (the person transferring the property) relinquishes any interest they may have in the property without making any promises about its title.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in specific situations, such as:

-

Transferring property between family members, such as during a divorce or inheritance.

-

Clearing up title issues, where one party wants to relinquish their claim to the property.

-

Transferring property into a trust or business entity.

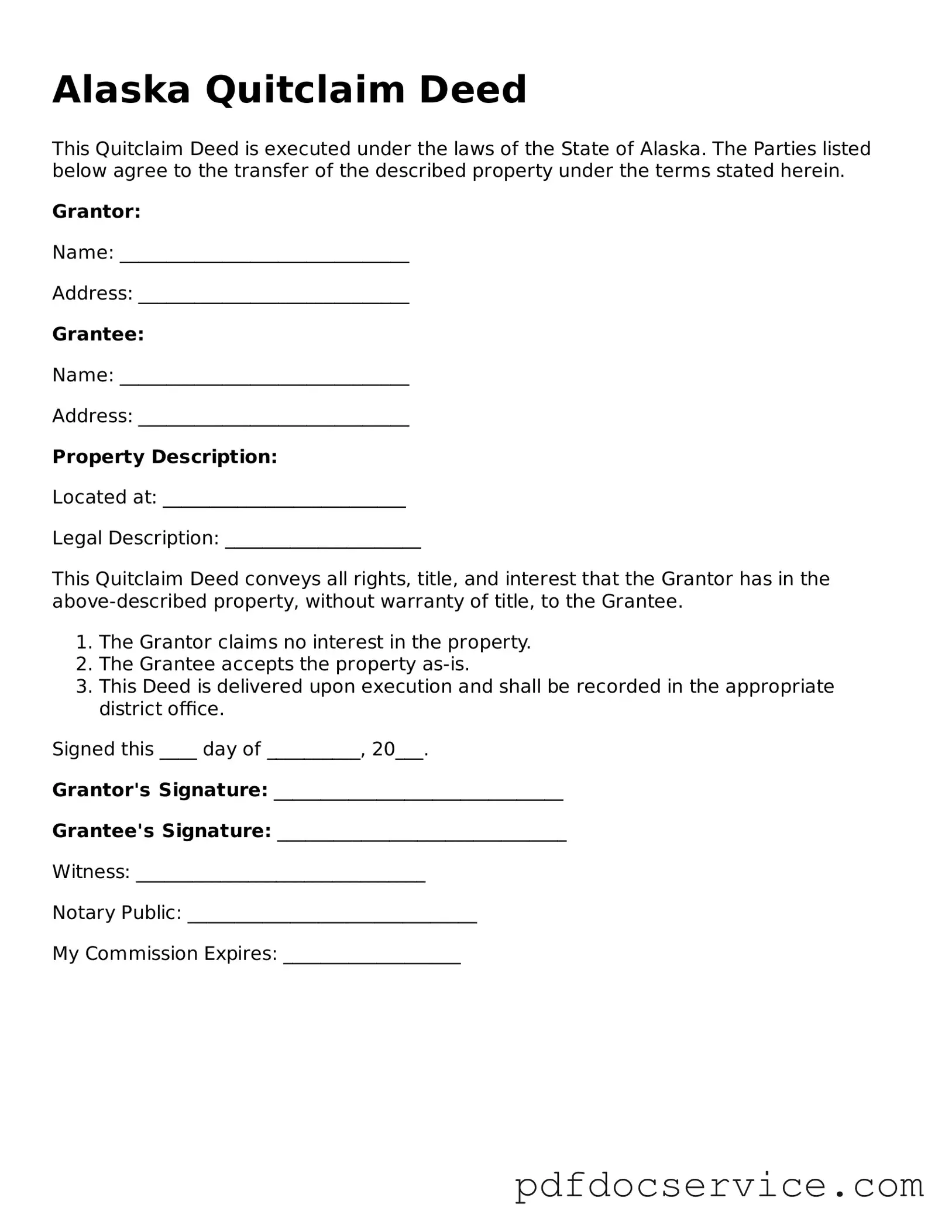

To complete an Alaska Quitclaim Deed, you typically need to include the following information:

-

The names and addresses of the grantor and grantee.

-

A legal description of the property being transferred.

-

The date of the transfer.

-

The signature of the grantor, which must be notarized.

Do I need to have the Quitclaim Deed notarized?

Yes, in Alaska, the signature of the grantor must be notarized for the Quitclaim Deed to be valid. This step ensures that the identity of the signer is verified and adds an extra layer of authenticity to the document.

How do I file a Quitclaim Deed in Alaska?

After completing the Quitclaim Deed, you must file it with the appropriate local government office, usually the Recorder's Office in the borough where the property is located. There may be a filing fee, so it's advisable to check with the office beforehand.

Are there any tax implications when using a Quitclaim Deed?

While transferring property via a Quitclaim Deed may not incur immediate tax consequences, it’s essential to consult a tax professional. Depending on the situation, there could be implications related to property taxes, capital gains taxes, or gift taxes.

Can a Quitclaim Deed be reversed?

Generally, once a Quitclaim Deed is executed and recorded, it cannot be reversed. The transfer of ownership is considered final. If there are concerns about the deed, it may be wise to seek legal advice before proceeding with the transfer.

What are the risks associated with using a Quitclaim Deed?

One of the main risks of using a Quitclaim Deed is that it offers no warranties about the title. If there are existing liens or claims against the property, the grantee assumes those risks. Additionally, if the grantor did not actually own the property, the grantee receives nothing. It is crucial to conduct a title search before proceeding with this type of transfer.

Is legal assistance necessary when preparing a Quitclaim Deed?

While it is possible to prepare a Quitclaim Deed without legal assistance, it is often advisable to consult an attorney, especially if the situation is complex. An attorney can ensure that the deed is properly drafted, executed, and filed, helping to avoid potential legal issues in the future.