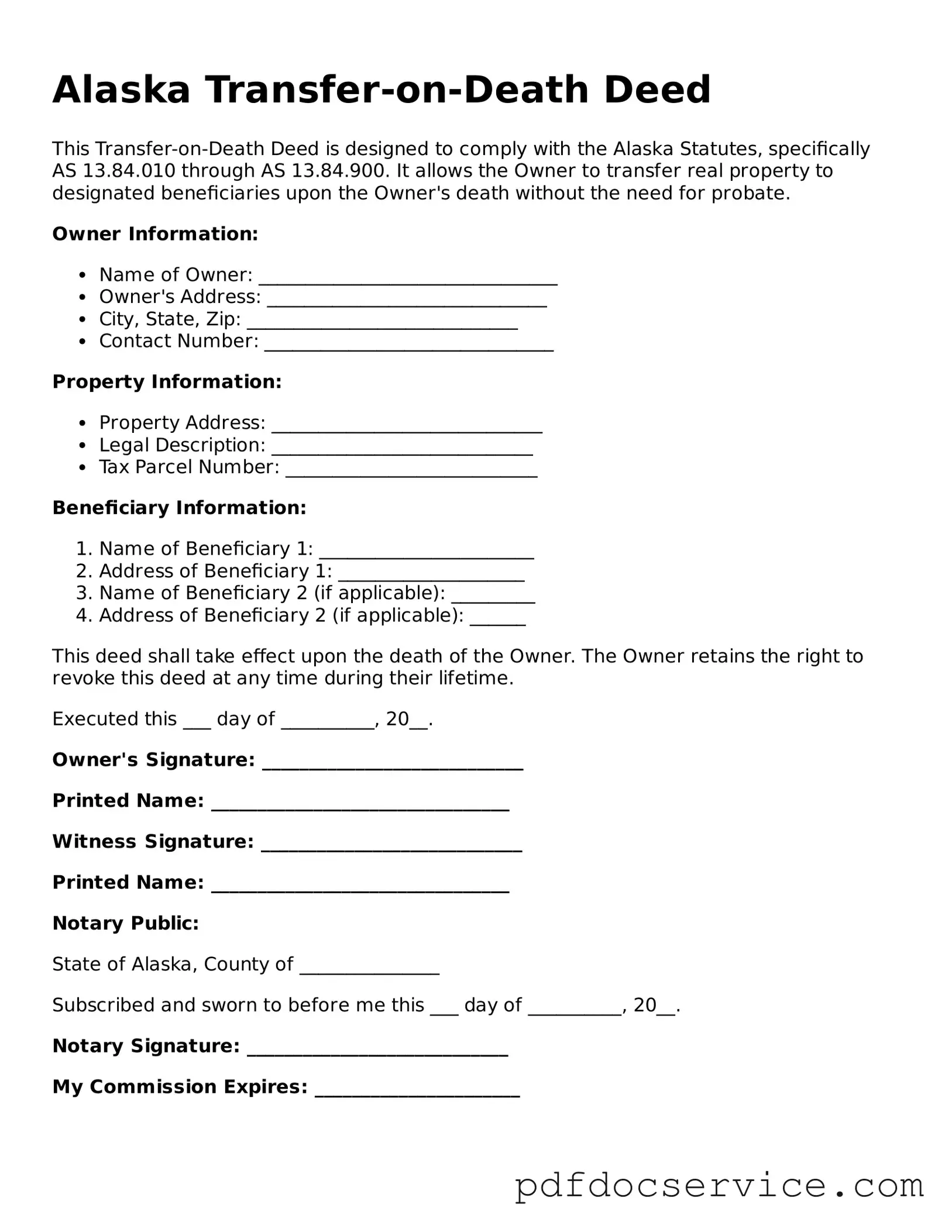

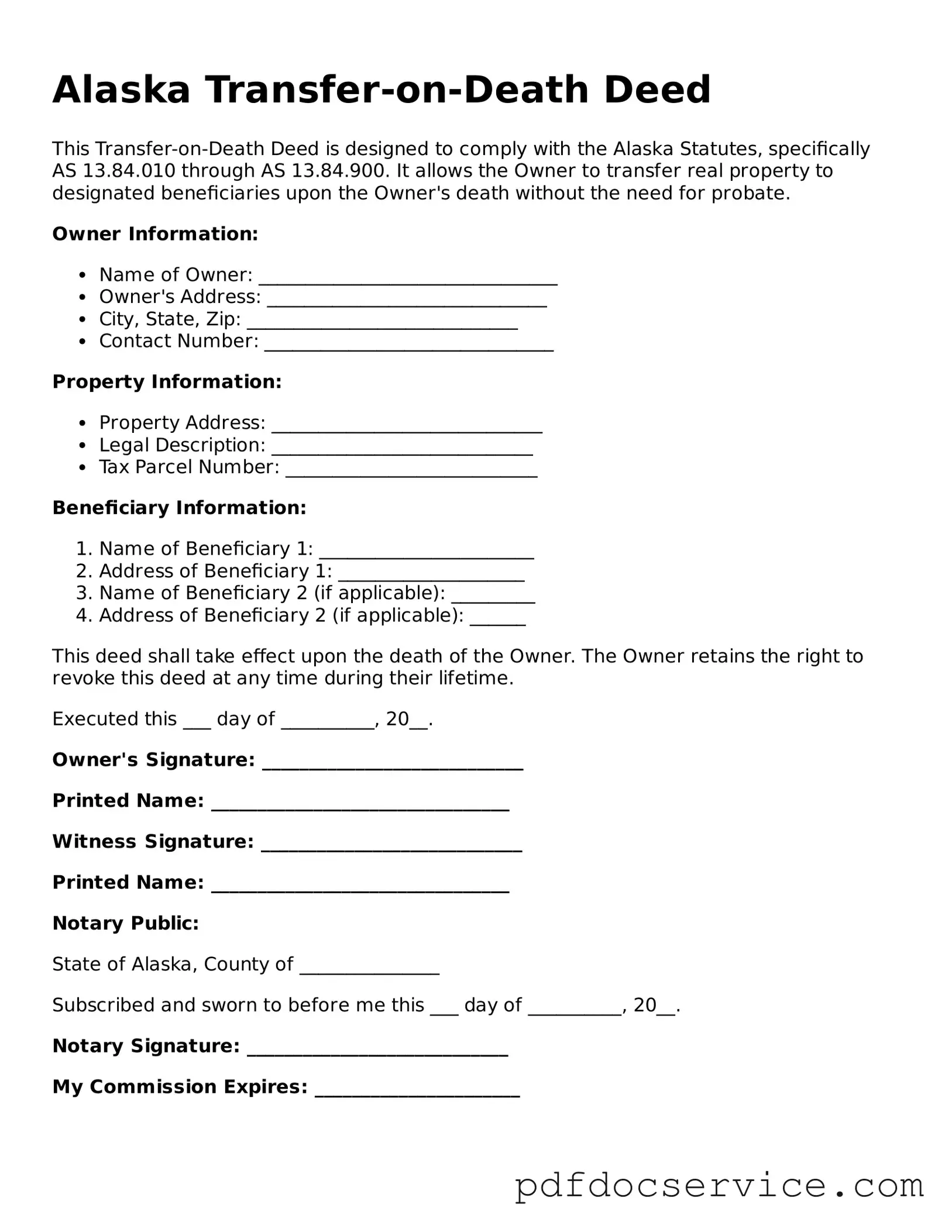

Printable Transfer-on-Death Deed Template for Alaska

The Alaska Transfer-on-Death Deed form allows property owners to designate a beneficiary who will receive their property upon their death, without the need for probate. This legal tool provides a straightforward way to transfer real estate, ensuring that your wishes are honored. Understanding how this form works can help you make informed decisions about your estate planning.

Open Transfer-on-Death Deed Editor

Printable Transfer-on-Death Deed Template for Alaska

Open Transfer-on-Death Deed Editor

Open Transfer-on-Death Deed Editor

or

Get Transfer-on-Death Deed PDF

Finish the form now and be done

Finish Transfer-on-Death Deed online using simple edit, save, and download steps.