What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the United States. They serve as a charter for the corporation and outline essential details such as the company’s name, purpose, and the number of shares it is authorized to issue. Filing these articles is a crucial first step in the incorporation process, providing the business with a separate legal identity.

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is necessary for several reasons:

-

It legally creates your corporation, granting it the right to operate as a distinct entity.

-

It protects your personal assets from business liabilities.

-

It may provide tax benefits and help in raising capital.

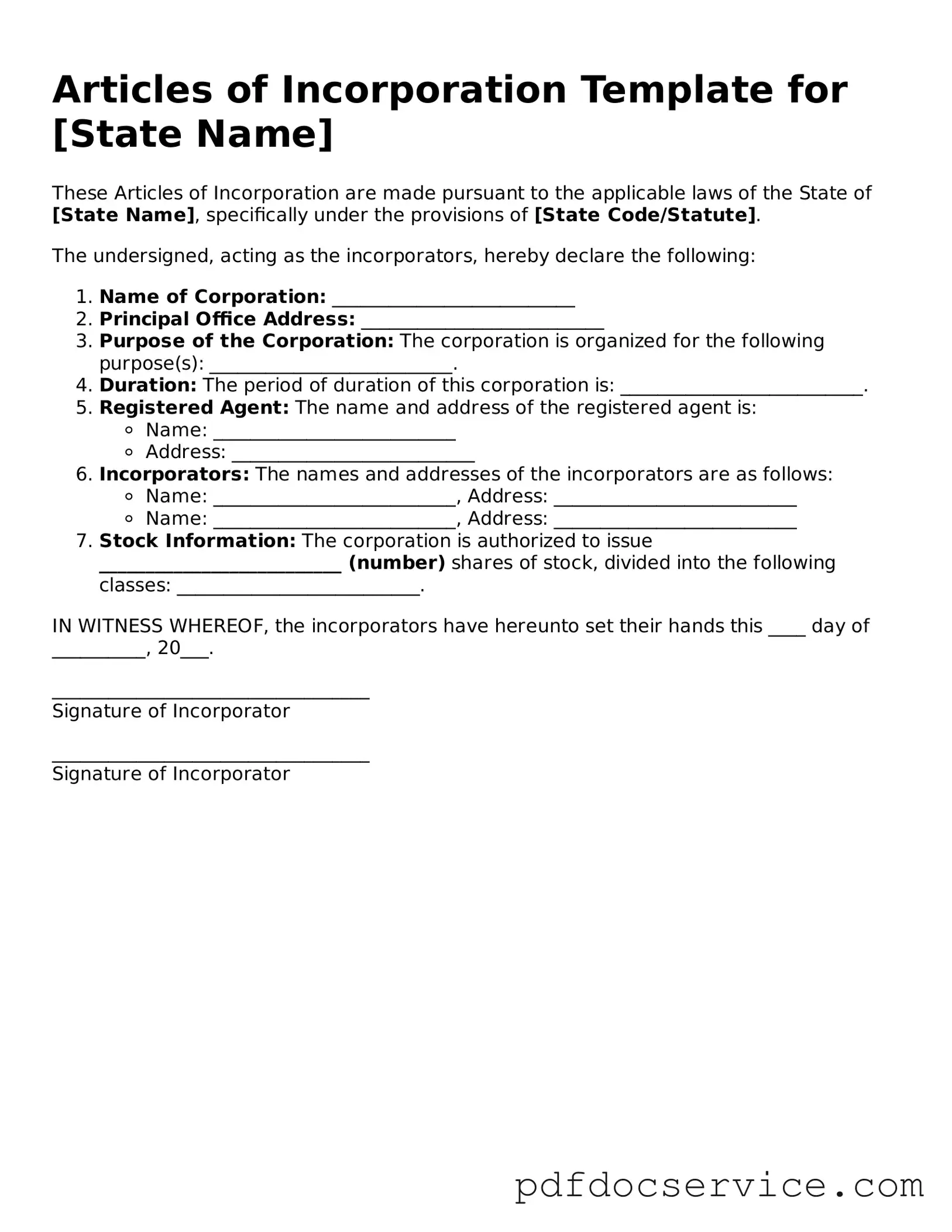

What information is typically required in the Articles of Incorporation?

While requirements can vary by state, common information included in Articles of Incorporation generally consists of:

-

The corporation's name.

-

The purpose of the corporation.

-

The registered agent's name and address.

-

The number of shares the corporation is authorized to issue.

-

The names and addresses of the incorporators.

How do I file Articles of Incorporation?

To file Articles of Incorporation, follow these steps:

-

Choose a unique name for your corporation that complies with state regulations.

-

Gather the necessary information and complete the Articles of Incorporation form.

-

Submit the form to your state’s Secretary of State office, either online or by mail.

-

Pay the required filing fee, which varies by state.

How long does it take to process Articles of Incorporation?

The processing time for Articles of Incorporation can differ based on the state and the method of filing. Generally, online submissions are processed faster, often within a few business days. Mail submissions may take longer, sometimes up to several weeks. Always check with your state’s Secretary of State office for specific timelines.

Can I amend my Articles of Incorporation later?

Yes, you can amend your Articles of Incorporation if necessary. Common reasons for amendments include changes in the corporation’s name, address, or the number of shares authorized. To amend, you typically need to file a specific form with your state and pay any applicable fees. It's important to follow your state’s guidelines to ensure the amendment is valid.

What are the consequences of not filing Articles of Incorporation?

Failing to file Articles of Incorporation means your business will not be recognized as a corporation. This can lead to personal liability for business debts and legal issues. Additionally, you may miss out on potential tax benefits and the ability to raise capital through the sale of shares. It is crucial to complete this step to protect your interests and establish your business legally.