What is an Auto Insurance Card?

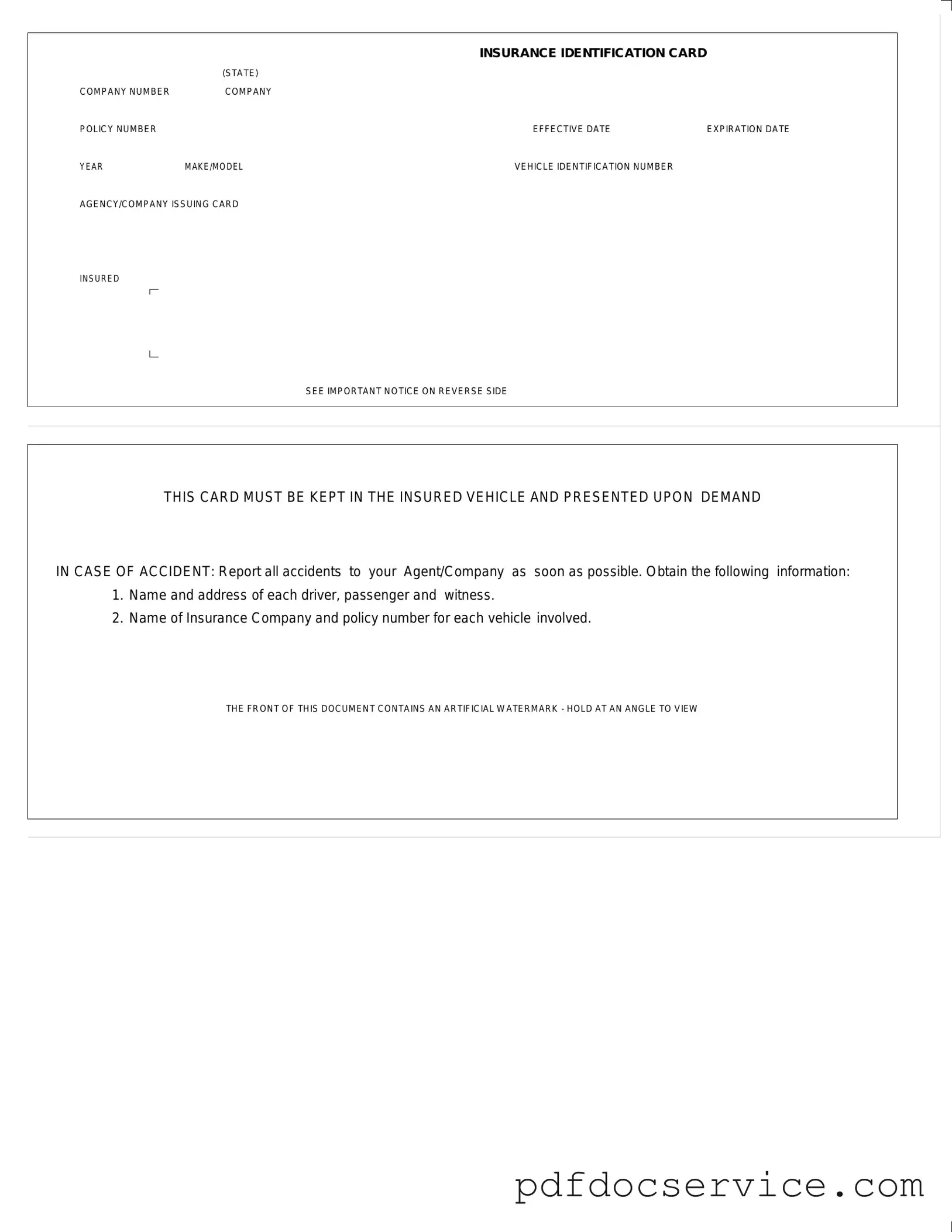

An Auto Insurance Card is a document that proves you have valid auto insurance coverage. It includes essential information such as your insurance company, policy number, and vehicle details. This card must be kept in your vehicle at all times.

The Auto Insurance Card typically contains the following details:

-

Insurance identification card (state)

-

Company number

-

Company policy number

-

Effective date

-

Expiration date

-

Year, make, and model of the vehicle

-

Vehicle identification number (VIN)

-

Agency or company issuing the card

Why is it important to keep the Auto Insurance Card in the vehicle?

Keeping the Auto Insurance Card in your vehicle is crucial because it serves as proof of insurance. In the event of an accident, law enforcement or other parties involved may request to see this card. Failure to present it can lead to penalties or complications during the claims process.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance provider immediately. They can issue a replacement card, which you can typically receive via mail or electronically. It's important to replace it as soon as possible to ensure you have proof of coverage when needed.

What happens if I get into an accident?

In case of an accident, follow these steps:

-

Present your Auto Insurance Card upon request.

-

Report the accident to your insurance agent or company as soon as possible.

-

Collect necessary information from all parties involved, including names, addresses, and insurance details.

Taking these actions helps streamline the claims process and ensures that all parties have the required information.

What is the purpose of the artificial watermark on the card?

The artificial watermark on the Auto Insurance Card serves as a security feature. It helps to prevent fraud and ensures that the card is legitimate. To view the watermark, hold the card at an angle.

How do I know if my Auto Insurance Card is valid?

Your Auto Insurance Card is valid as long as the policy is active and has not expired. Check the effective and expiration dates printed on the card. If you are unsure about your coverage status, contact your insurance provider for confirmation.

Can I use a digital version of my Auto Insurance Card?

Many states allow digital versions of the Auto Insurance Card. Check your state’s regulations to confirm if this is permissible. If allowed, you can keep a digital copy on your smartphone or another device for easy access.

If you notice any incorrect information on your Auto Insurance Card, contact your insurance provider immediately. They can update your information and issue a corrected card. It is essential to have accurate details to avoid complications during claims or legal matters.