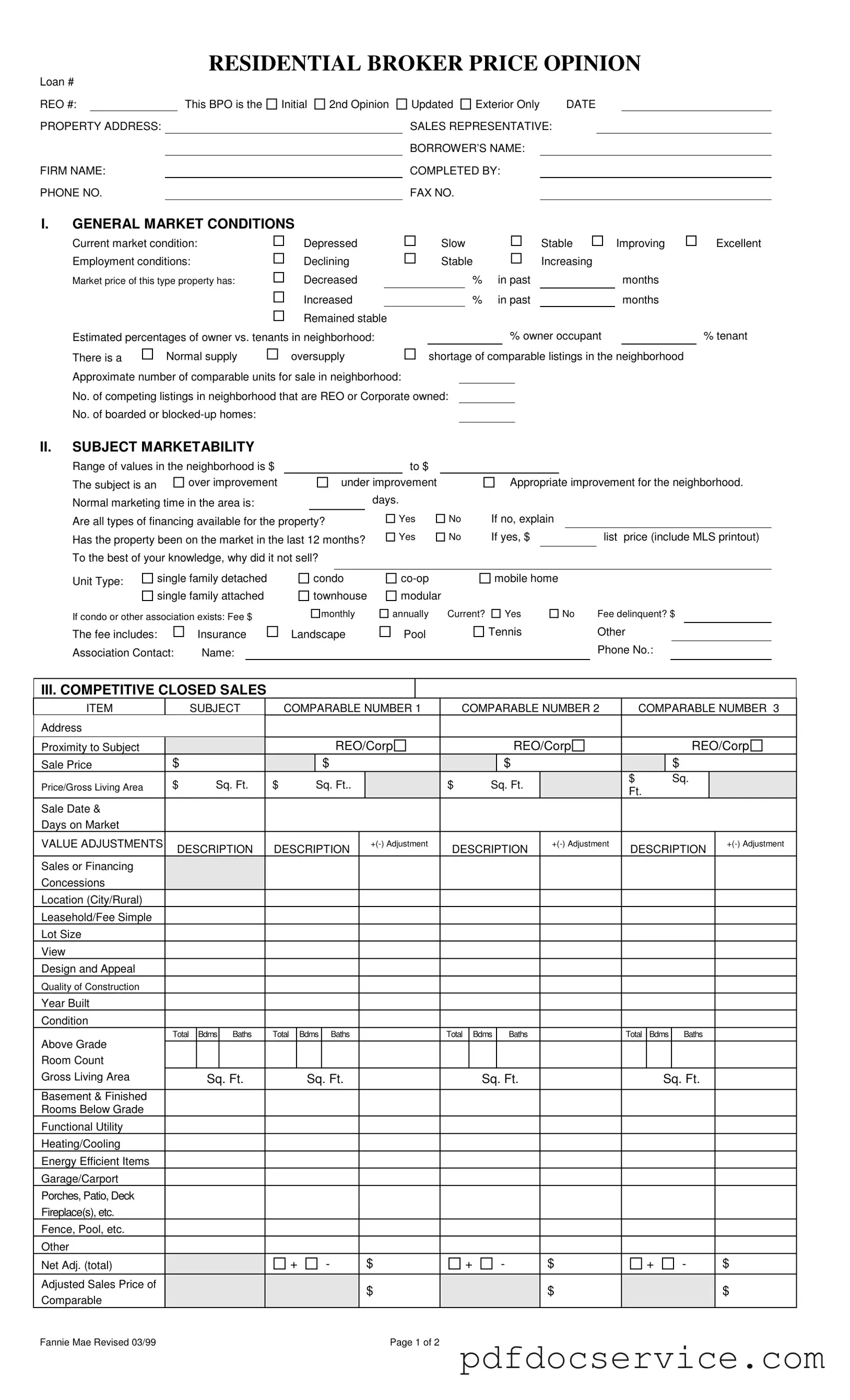

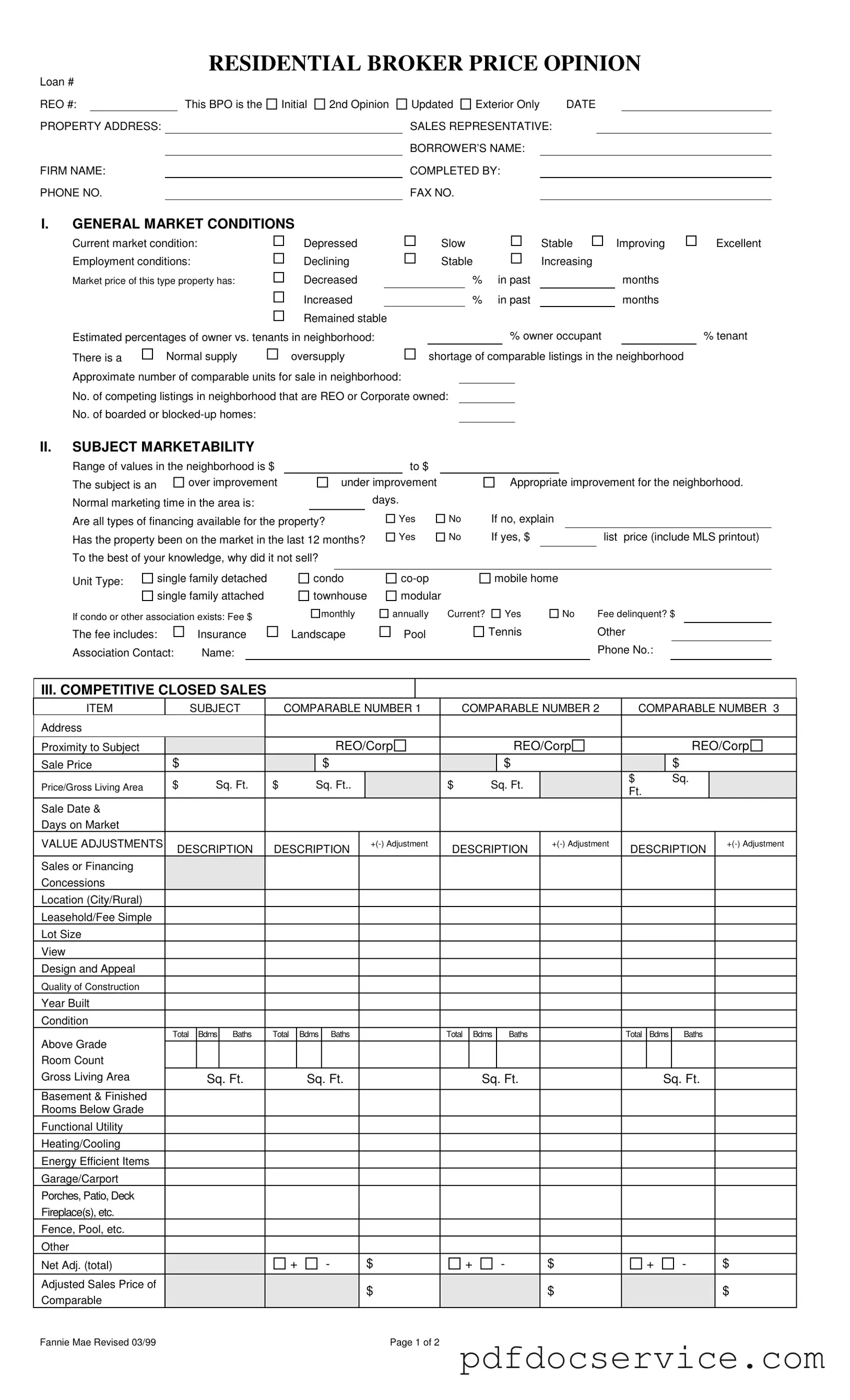

Fill Your Broker Price Opinion Form

The Broker Price Opinion (BPO) form is a tool used to assess the value of a property based on various market conditions and comparable sales. This form provides critical insights for lenders, real estate agents, and potential buyers, helping them make informed decisions. By analyzing factors such as market trends and property conditions, the BPO offers a comprehensive overview of a property's estimated worth.

Open Broker Price Opinion Editor

Fill Your Broker Price Opinion Form

Open Broker Price Opinion Editor

Open Broker Price Opinion Editor

or

Get Broker Price Opinion PDF

Finish the form now and be done

Finish Broker Price Opinion online using simple edit, save, and download steps.