What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. This document outlines the terms of the sale, including the items being sold, the purchase price, and any conditions that may apply. It serves as proof of the transaction and can be important for both the buyer and the seller for record-keeping and legal purposes.

When should I use a Business Bill of Sale?

A Business Bill of Sale should be used whenever a business is sold, whether it involves the entire business or specific assets such as equipment, inventory, or intellectual property. It is advisable to use this document in any transaction where ownership is changing hands to ensure clarity and protect the interests of both parties involved.

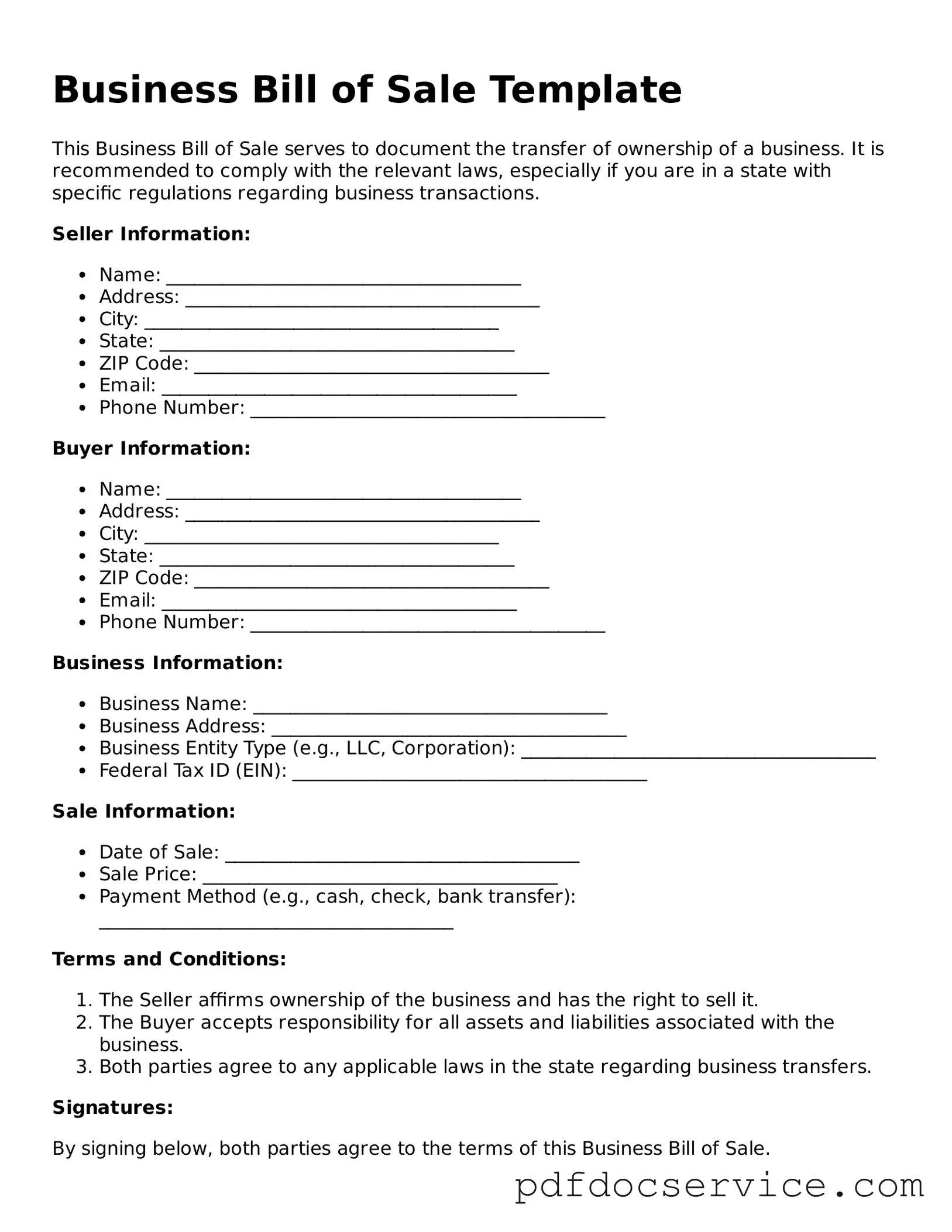

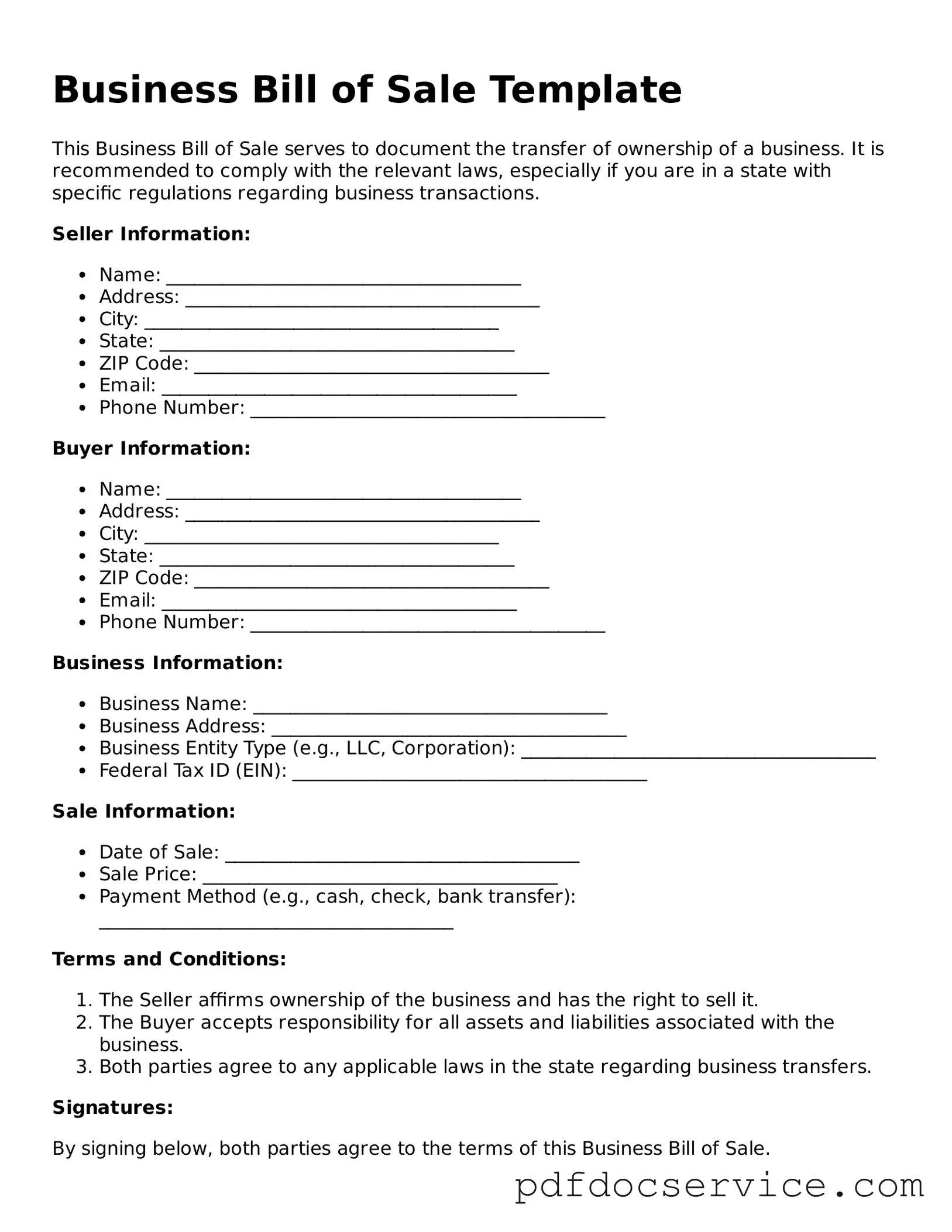

Typically, a Business Bill of Sale includes the following information:

-

The names and addresses of the buyer and seller

-

A detailed description of the business or assets being sold

-

The purchase price

-

The date of the transaction

-

Any warranties or representations made by the seller

-

Signatures of both parties

This information helps ensure that all parties understand the terms of the sale and have a clear record of the transaction.

Is a Business Bill of Sale legally binding?

Yes, a Business Bill of Sale is legally binding once it is signed by both parties. It acts as a contract that outlines the agreement between the buyer and seller. However, to ensure its enforceability, both parties should fully understand the terms and conditions outlined in the document before signing.

Do I need a lawyer to create a Business Bill of Sale?

While it is not mandatory to have a lawyer draft a Business Bill of Sale, consulting with a legal professional can provide valuable guidance. A lawyer can help ensure that the document meets all legal requirements and adequately protects your interests. For simple transactions, many templates are available that can be used as a starting point.

Can a Business Bill of Sale be modified after it is signed?

Once a Business Bill of Sale is signed, it is generally considered final. However, if both parties agree to modifications, they can create an amendment to the original document. This amendment should be documented in writing and signed by both parties to ensure clarity and enforceability.

What should I do with the Business Bill of Sale after the transaction?

After the transaction is complete, both the buyer and seller should keep a copy of the Business Bill of Sale for their records. It is important to store it in a safe place, as it may be needed for tax purposes or in the event of any disputes in the future. Additionally, the buyer may need the document to register the business or transfer licenses associated with the business.