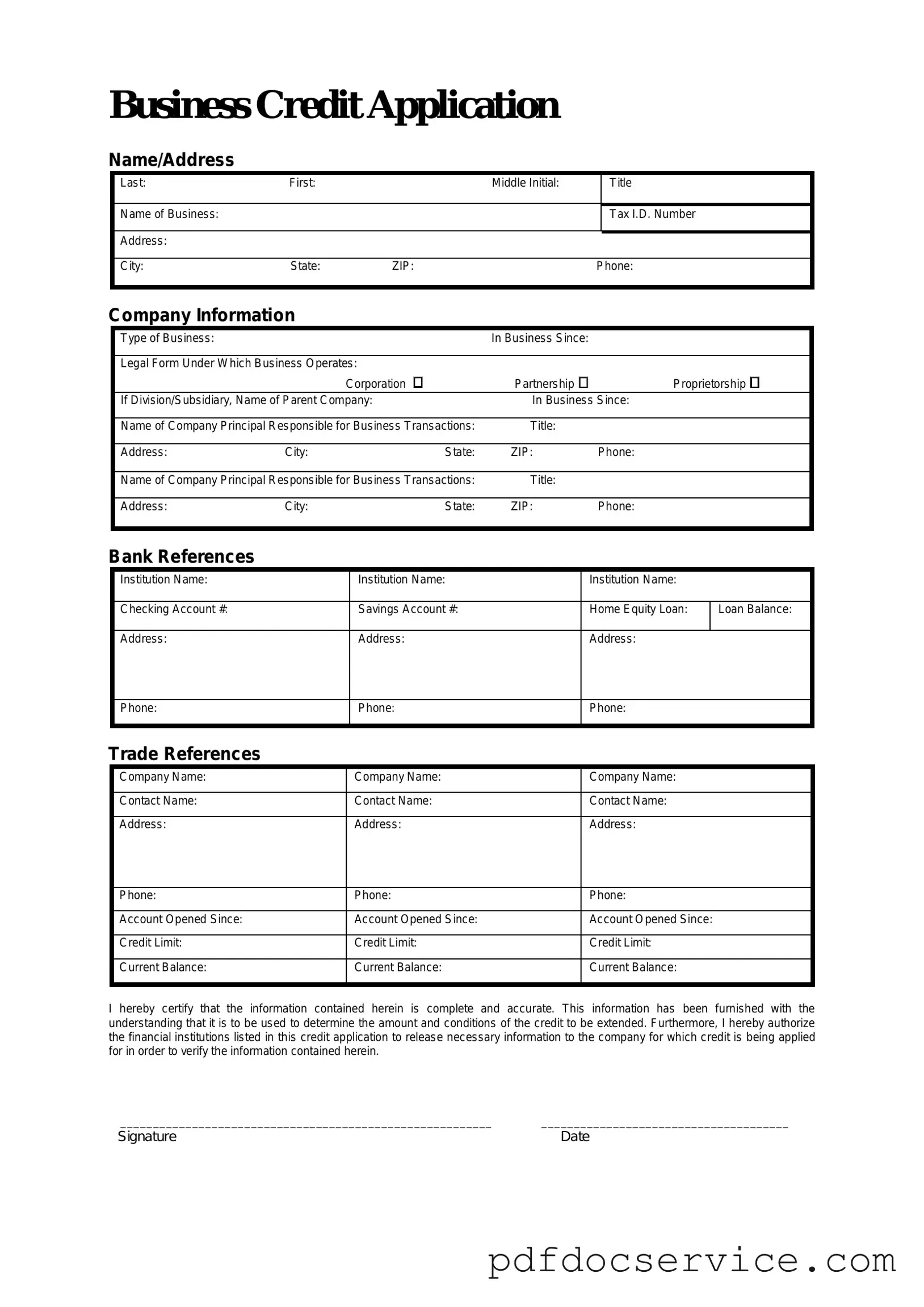

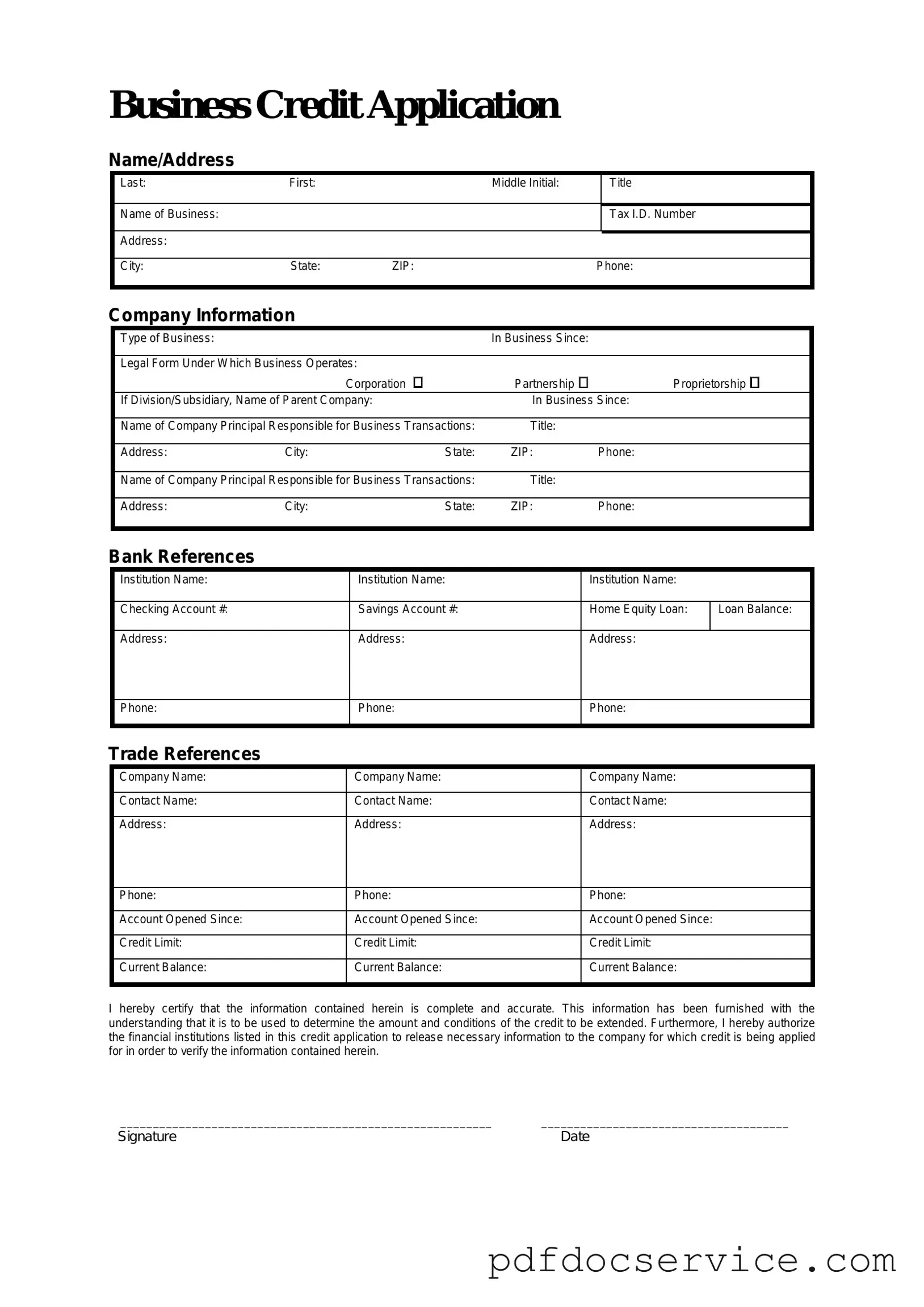

A Business Credit Application form is a document that businesses fill out to apply for credit from a lender or supplier. This form collects essential information about the business, including its financial history, ownership structure, and creditworthiness. By submitting this form, businesses seek to establish a line of credit to facilitate purchases or manage cash flow.

Why do I need to fill out a Business Credit Application?

Filling out a Business Credit Application is crucial for several reasons:

-

It helps lenders assess the risk of extending credit to your business.

-

It provides a formal record of your business's financial status and credit history.

-

It can lead to better terms and limits on credit, which can benefit your business operations.

The Business Credit Application usually requires the following information:

-

Business name and address.

-

Type of business entity (e.g., LLC, corporation, sole proprietorship).

-

Tax identification number (TIN) or Employer Identification Number (EIN).

-

Contact information for the owner(s) or principal(s).

-

Banking information, including the name of the bank and account details.

-

Financial statements or documents that demonstrate your business’s financial health.

How long does it take to process a Business Credit Application?

The processing time for a Business Credit Application can vary significantly. Generally, it may take anywhere from a few hours to several days. Factors influencing the timeline include the lender’s internal processes, the completeness of the application, and the complexity of your business’s financial situation. To expedite the process, ensure all required information is accurate and complete before submission.

What happens after I submit the application?

After submission, the lender will review your application. This review may involve checking your credit history, verifying the information provided, and assessing your business's financial stability. Once the evaluation is complete, the lender will communicate their decision. If approved, you will receive details about your credit limit and terms.

Can I apply for business credit if I have bad credit?

Yes, it is possible to apply for business credit even if you have bad credit. However, the chances of approval may be lower, and the terms might not be as favorable. Some lenders specialize in working with businesses that have poor credit histories. Be prepared to provide additional documentation that demonstrates your ability to repay the credit, such as cash flow statements or a business plan.

Is there a fee associated with submitting the application?

Most lenders do not charge a fee for submitting a Business Credit Application. However, some may require a fee for processing or for conducting a credit check. It’s essential to read the terms and conditions provided by the lender to understand any potential costs involved.

What should I do if my application is denied?

If your application is denied, don’t be discouraged. First, request feedback from the lender to understand the reasons for the denial. Common reasons include insufficient credit history, low credit scores, or incomplete information. Use this feedback to improve your application or consider applying with a different lender that may have more flexible criteria.

Can I apply for business credit without a personal guarantee?

It is possible to apply for business credit without a personal guarantee, but it may be challenging. Many lenders require a personal guarantee, especially for new or small businesses, as it reduces their risk. If you want to avoid a personal guarantee, consider building your business credit profile first by establishing trade lines with suppliers that report to credit bureaus.

How can I improve my chances of getting approved?

To enhance your chances of approval for a Business Credit Application, consider the following tips:

-

Maintain a strong credit score for both your business and personal finances.

-

Keep your financial statements organized and up-to-date.

-

Provide accurate and complete information on the application.

-

Establish a relationship with the lender before applying.

-

Consider applying for smaller amounts initially to build trust.