What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the state of California. They outline key information about the corporation, including its name, purpose, and structure. Filing these documents is a crucial step in forming a corporation.

Who needs to file Articles of Incorporation?

Any individual or group wishing to create a corporation in California must file Articles of Incorporation. This includes for-profit corporations, nonprofit organizations, and professional corporations. If you plan to operate your business as a corporation, this step is necessary.

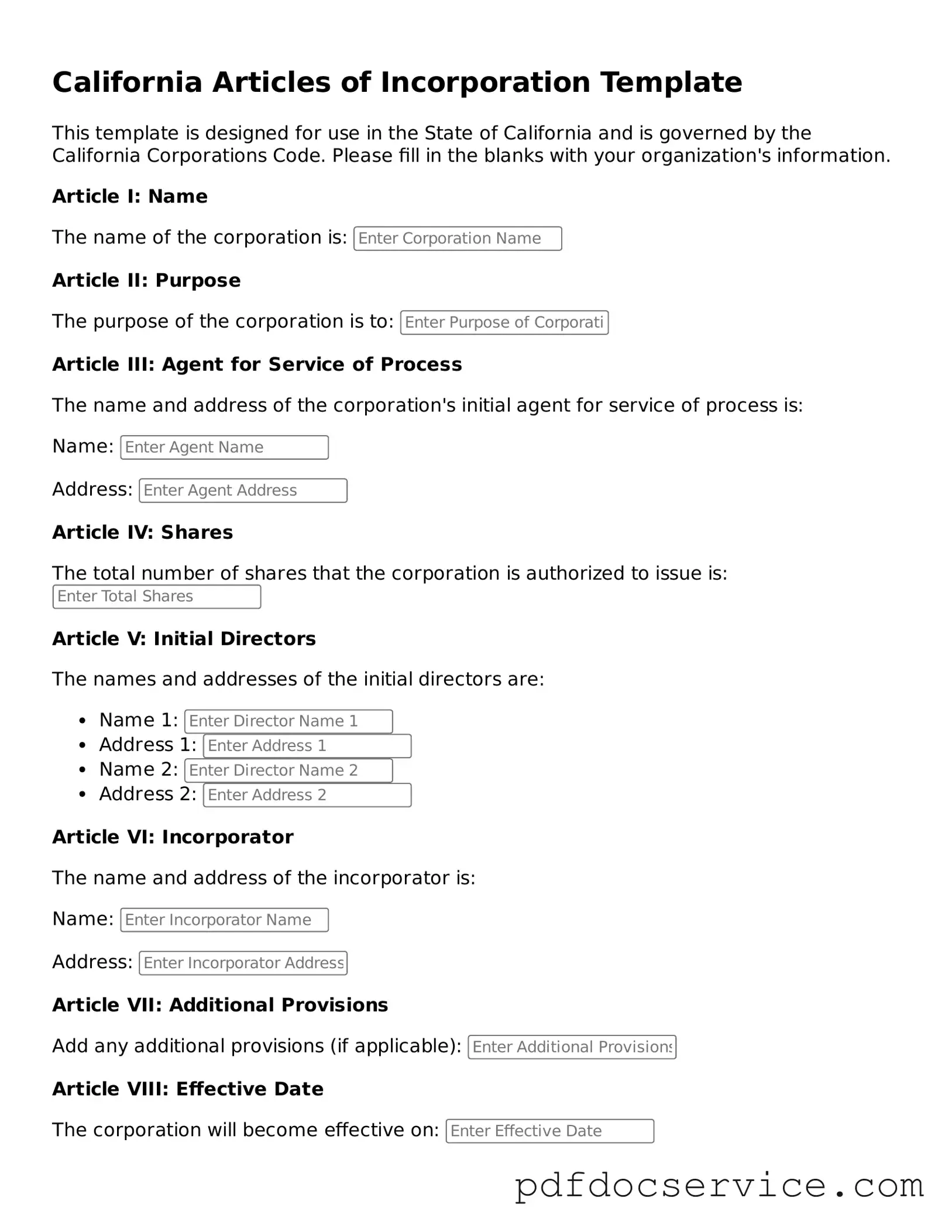

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require the following information:

-

The name of the corporation

-

The corporation's purpose

-

The address of the corporation's initial registered office

-

The name and address of the corporation's initial agent for service of process

-

The number of shares the corporation is authorized to issue

Additional information may be required depending on the specific type of corporation being formed.

How do I file Articles of Incorporation in California?

To file Articles of Incorporation in California, follow these steps:

-

Complete the Articles of Incorporation form, ensuring all required information is accurate.

-

Submit the completed form to the California Secretary of State, either online or by mail.

-

Pay the required filing fee, which varies based on the type of corporation.

Once the form is processed, you will receive confirmation of your corporation's formation.

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation can vary. Typically, it takes about 15 business days for the California Secretary of State to process the filing. However, expedited services are available for an additional fee, which can significantly reduce the processing time.

Can I amend my Articles of Incorporation after filing?

Yes, you can amend your Articles of Incorporation after they have been filed. To do this, you must file an amendment form with the California Secretary of State. This is necessary if you want to change the corporation's name, purpose, or other significant details. Ensure that you follow the proper procedures and pay any required fees.

What is the difference between Articles of Incorporation and Bylaws?

Articles of Incorporation and Bylaws serve different purposes. Articles of Incorporation are the foundational documents that establish the existence of a corporation. Bylaws, on the other hand, are internal rules that govern the management and operation of the corporation. While Articles of Incorporation are filed with the state, Bylaws are typically kept internally and do not need to be filed.

Are there any ongoing requirements after filing Articles of Incorporation?

Yes, after filing Articles of Incorporation, corporations must comply with ongoing requirements. These may include:

-

Filing annual statements with the Secretary of State

-

Paying annual franchise taxes

-

Holding regular meetings and keeping minutes

Failure to meet these requirements can result in penalties or the dissolution of the corporation.

Where can I find the Articles of Incorporation form?

The Articles of Incorporation form can be obtained from the California Secretary of State's website. You can download the form directly or access it through their online filing system. Ensure that you are using the most current version of the form to avoid any issues during the filing process.