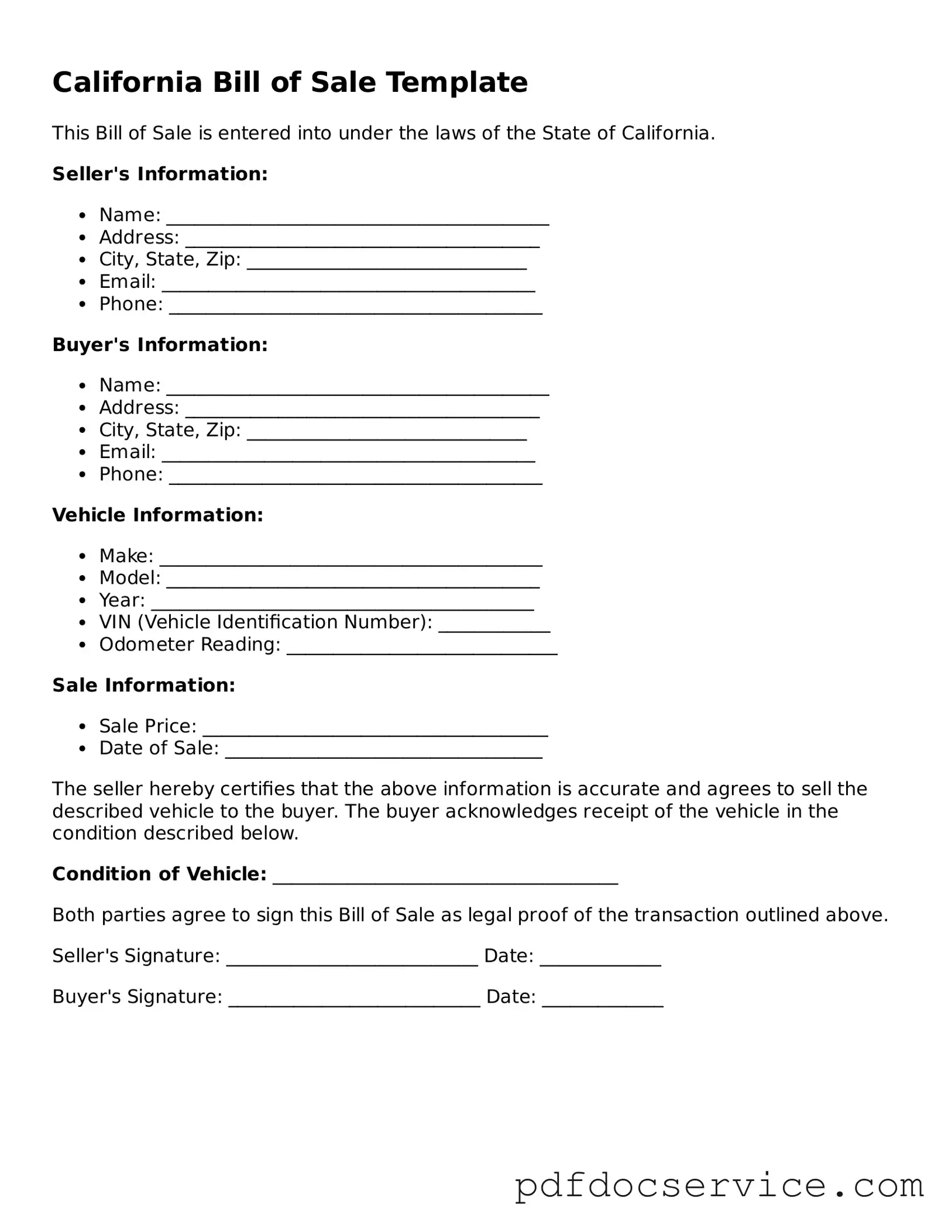

What is a California Bill of Sale?

A California Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This form is commonly used for transactions involving vehicles, boats, and other valuable items. It serves as proof of the sale and includes important details about the buyer, seller, and the item being sold.

When do I need a Bill of Sale in California?

You typically need a Bill of Sale when you sell or purchase personal property. While it is not always legally required for every transaction, having one is highly recommended. It provides a record of the transaction and can be useful for tax purposes or in case of disputes. For vehicle sales, a Bill of Sale is often required to complete the registration process with the Department of Motor Vehicles (DMV).

A comprehensive Bill of Sale should include the following information:

-

The names and addresses of both the buyer and seller

-

A description of the item being sold, including make, model, year, and VIN (for vehicles)

-

The purchase price

-

The date of the transaction

-

Signatures of both parties

Including additional details, such as payment method and any warranties, can also be beneficial.

Is a Bill of Sale legally binding?

Yes, a Bill of Sale is legally binding once both parties have signed it. It serves as a contract between the buyer and seller, outlining the terms of the sale. To ensure its enforceability, both parties should keep a copy of the signed document for their records.

Do I need to have the Bill of Sale notarized?

In California, notarization is not required for a Bill of Sale to be valid. However, having the document notarized can add an extra layer of authenticity and may be beneficial in case of disputes. It is especially useful for high-value items or when dealing with buyers or sellers who are not personally known to you.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. There are templates available online that can guide you through the process. Just ensure that you include all necessary information and that both parties sign the document. Alternatively, you can also purchase pre-printed forms that comply with California laws.

What should I do with the Bill of Sale after the transaction?

After the transaction is complete, both the buyer and seller should keep their copies of the Bill of Sale in a safe place. The buyer may need it for registration purposes or to prove ownership, while the seller should retain it for their records, especially for tax reporting. If the item sold is a vehicle, the seller should also notify the DMV of the sale.