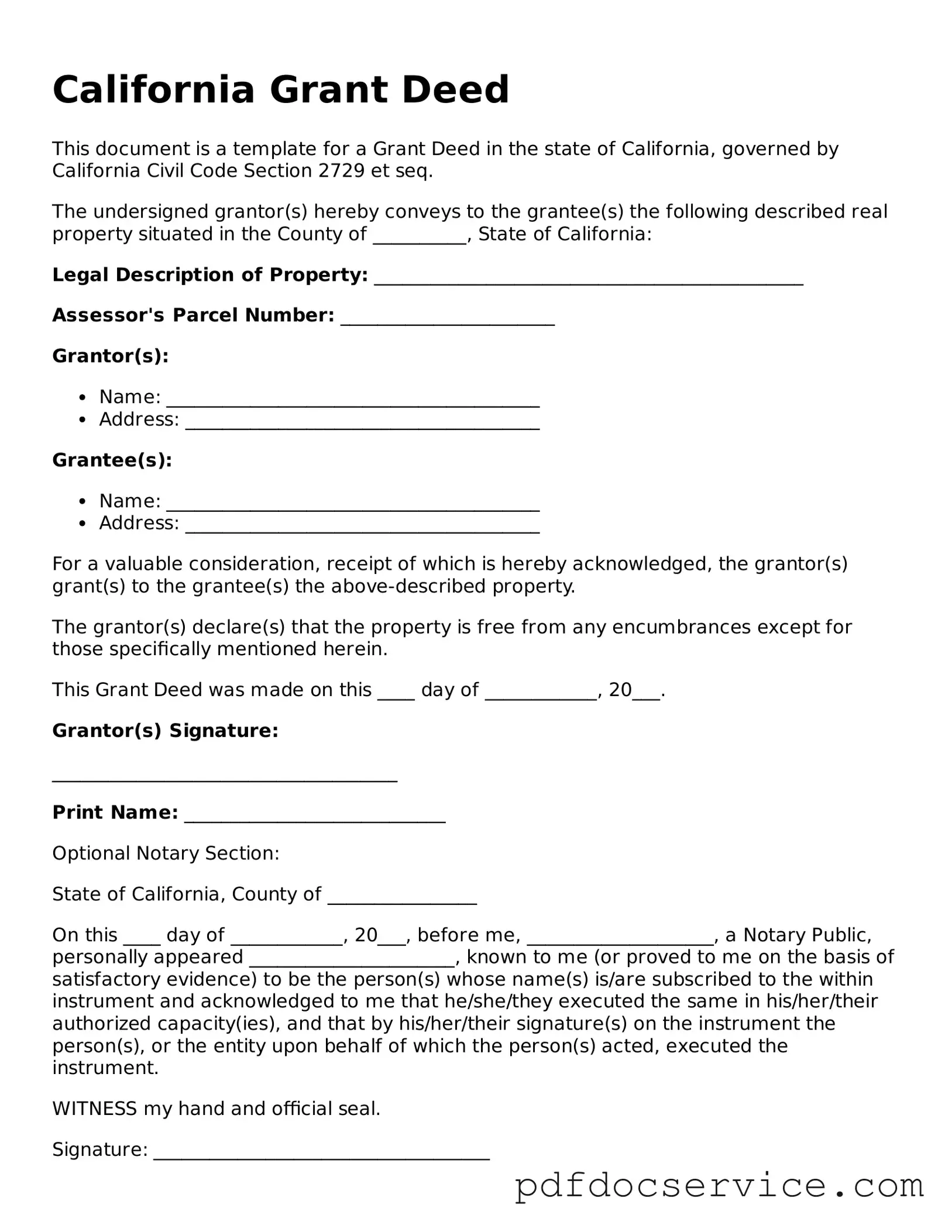

A California Deed form is a legal document used to transfer ownership of real property from one party to another within the state of California. This form serves as evidence of the transfer and includes essential information such as the names of the parties involved, a description of the property, and the signatures of the parties. Various types of deeds exist, including grant deeds and quitclaim deeds, each serving different purposes in property transfer.

What types of deeds are commonly used in California?

In California, several types of deeds can be utilized, including:

-

Grant Deed:

This is the most common type of deed used for property transfers. It guarantees that the seller has not sold the property to anyone else and that there are no undisclosed encumbrances.

-

Quitclaim Deed:

This deed transfers whatever interest the seller has in the property, without making any guarantees about the title. It is often used between family members or in divorce settlements.

-

Warranty Deed:

Less common in California, this type offers a higher level of protection to the buyer, ensuring that the title is clear of any claims.

Filling out a California Deed form involves several key steps:

-

Begin by entering the names of the grantor (seller) and grantee (buyer).

-

Provide a clear and accurate description of the property being transferred. This should include the property's address and legal description.

-

Include any necessary information about the consideration (the payment or value exchanged for the property).

-

Sign the deed in the presence of a notary public to ensure its validity.

It is advisable to consult with a legal professional to ensure that all details are correctly filled out and that the deed complies with California law.

Do I need to have the deed notarized?

Yes, in California, a deed must be notarized to be legally valid. Notarization helps verify the identities of the parties involved and confirms that they are signing the document willingly. After notarization, the deed should be recorded with the county recorder’s office where the property is located to provide public notice of the ownership transfer.

What is the process for recording a deed in California?

Recording a deed in California involves a few straightforward steps:

-

After the deed is completed and notarized, take it to the local county recorder’s office.

-

Pay any applicable recording fees. These fees can vary by county.

-

Submit the deed for recording. Once recorded, the county will provide a copy of the deed with a recording stamp, which serves as proof of the transfer.

Recording the deed is essential as it protects the grantee’s ownership rights and provides public notice of the property transfer.

Are there any taxes associated with transferring property in California?

Yes, transferring property in California may involve several taxes and fees. The most common is the documentary transfer tax, which is typically based on the sale price of the property. Additionally, there may be other fees related to recording the deed. It’s important to check with local authorities or a tax professional to understand the specific taxes applicable to your situation.

While it is possible to create your own deed form, it is generally recommended to seek legal advice or use a professionally prepared form. A legal professional can ensure that the deed complies with California laws and meets all necessary requirements. This can help prevent potential issues or disputes in the future regarding property ownership.