What is a Durable Power of Attorney in California?

A Durable Power of Attorney (DPOA) is a legal document that allows one person, known as the "principal," to appoint another person, called the "agent," to manage their financial or medical affairs. The key feature of a DPOA is that it remains effective even if the principal becomes incapacitated. This means that the agent can make decisions on behalf of the principal when they are unable to do so themselves, ensuring that their wishes are honored and their affairs are managed without interruption.

How do I create a Durable Power of Attorney in California?

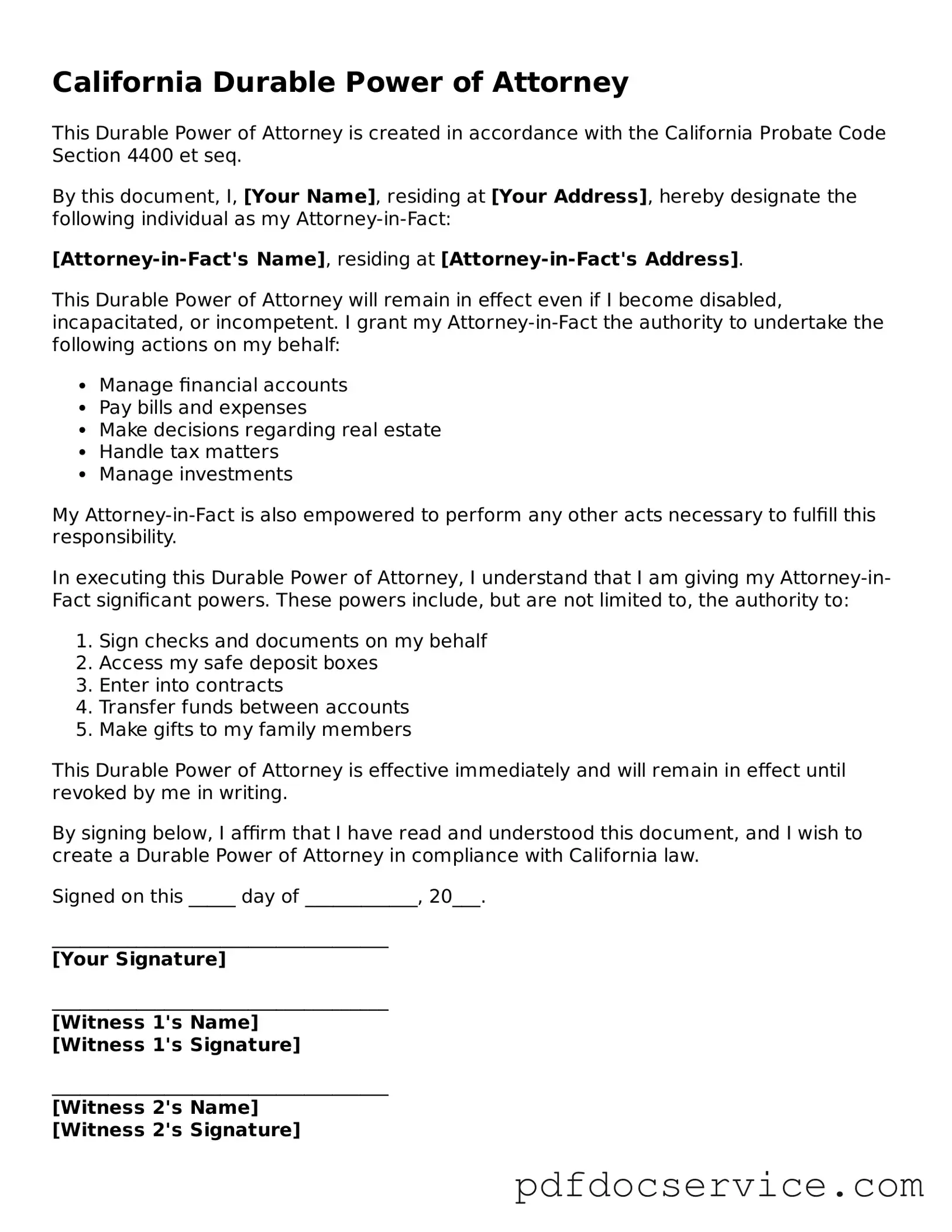

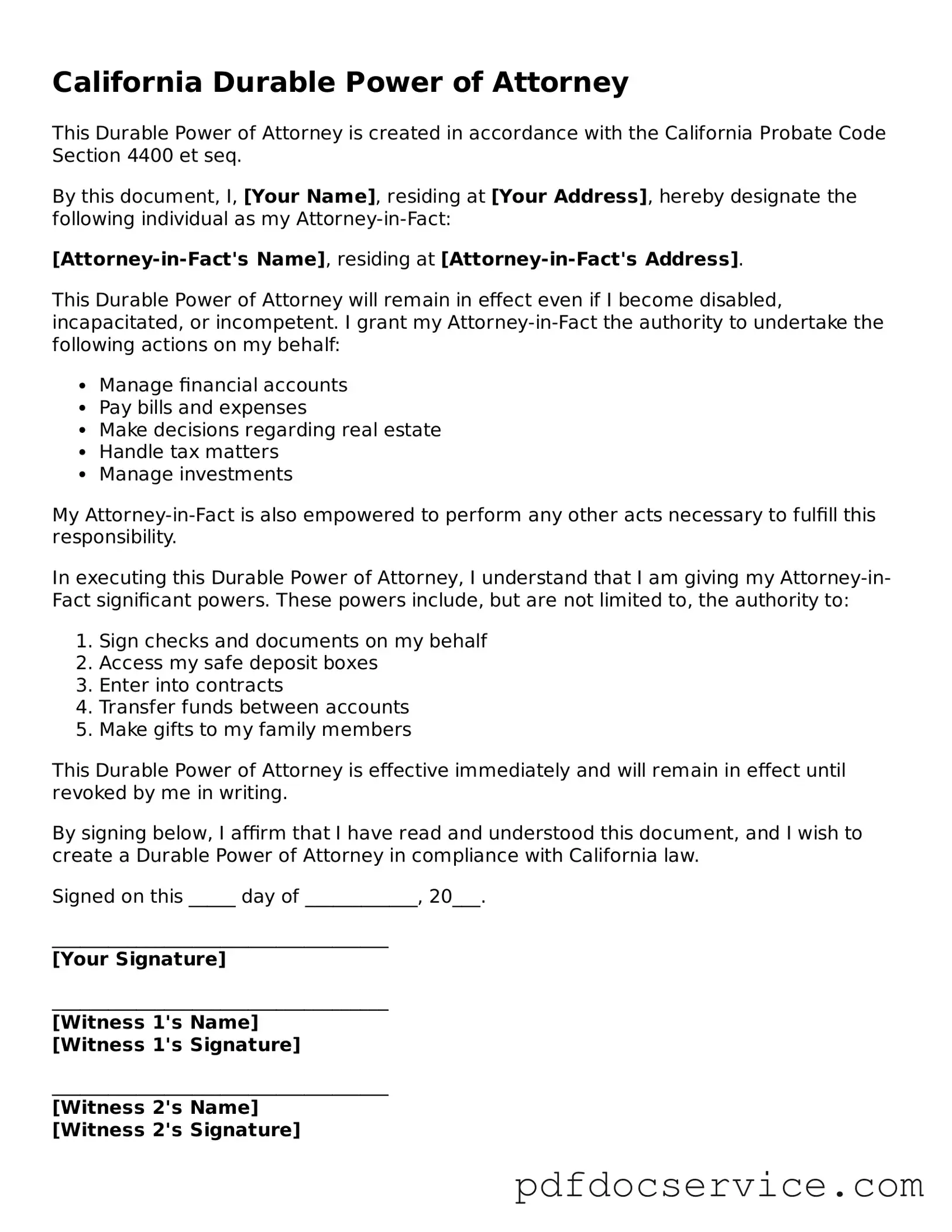

Creating a Durable Power of Attorney in California involves several steps:

-

Choose a trusted individual to act as your agent. This person should be someone you trust to handle your affairs responsibly.

-

Obtain the appropriate Durable Power of Attorney form. California provides a statutory form that you can use, but you can also create a customized document if it meets legal requirements.

-

Fill out the form carefully. Clearly specify the powers you are granting to your agent, and consider including any limitations or specific instructions.

-

Sign the document in front of a notary public or two witnesses. California law requires that the signing process be witnessed to ensure its validity.

What powers can I grant to my agent?

In a Durable Power of Attorney, you can grant a wide range of powers to your agent. Common powers include:

-

Managing bank accounts and financial transactions.

-

Buying or selling real estate.

-

Handling investments.

-

Paying bills and managing debts.

-

Making healthcare decisions if you become incapacitated.

It's important to be clear about the specific powers you want to grant, as this will help prevent any misunderstandings in the future.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are still mentally competent. To do so, you should create a written revocation document, clearly stating your intention to revoke the DPOA. It’s also wise to notify your agent and any institutions or individuals who may have relied on the original document. This helps ensure that your wishes are respected and that the agent no longer has authority to act on your behalf.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may need to go through a court process to obtain guardianship or conservatorship. This can be time-consuming, expensive, and emotionally challenging for your family. By establishing a DPOA in advance, you can avoid this situation and ensure that someone you trust can manage your affairs seamlessly.

Is it necessary to have a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer to create a Durable Power of Attorney in California, seeking legal advice can be beneficial. A lawyer can help you understand the implications of the powers you are granting and ensure that the document is properly drafted and executed. If your situation is complex or if you have specific concerns, consulting with an attorney can provide peace of mind and clarity.