What is a Power of Attorney in California?

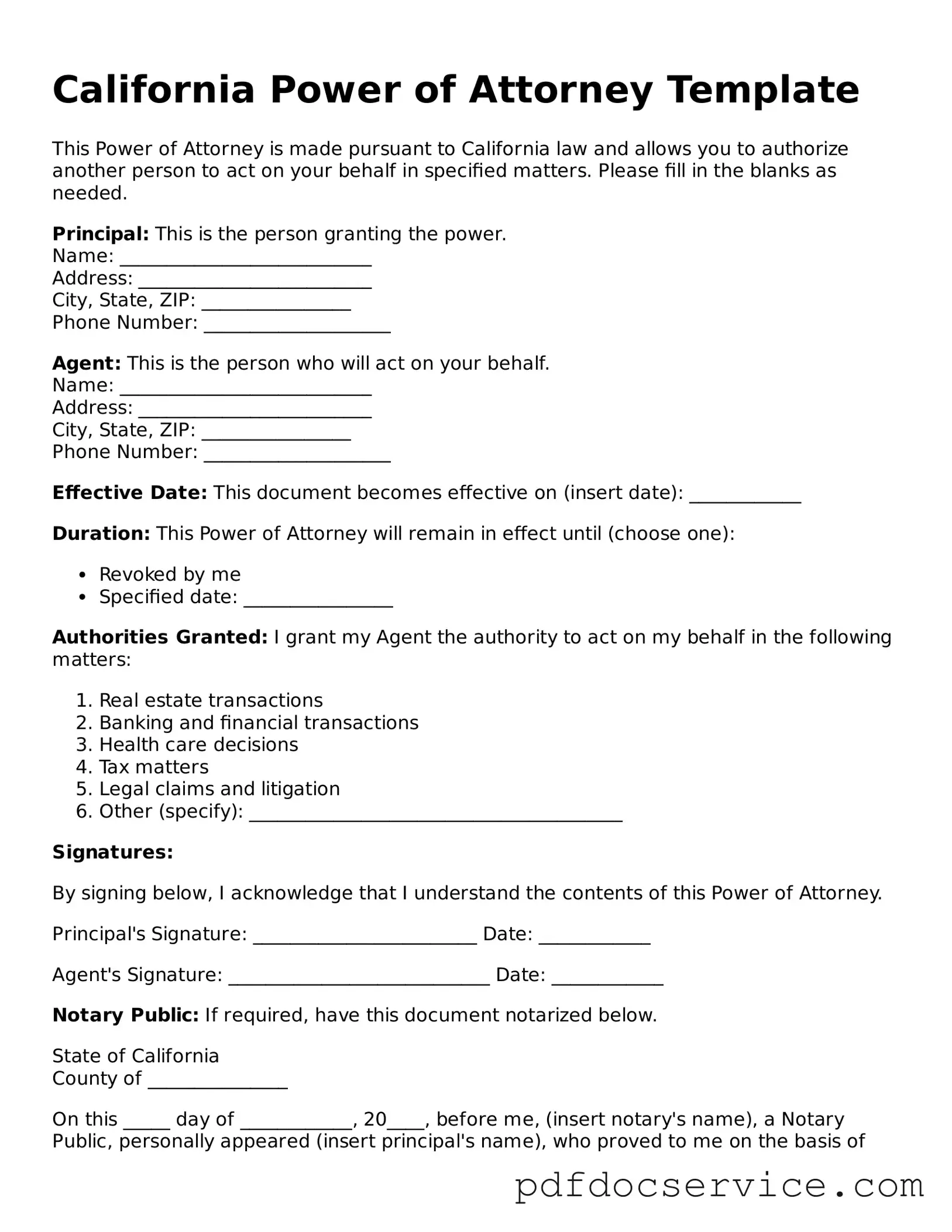

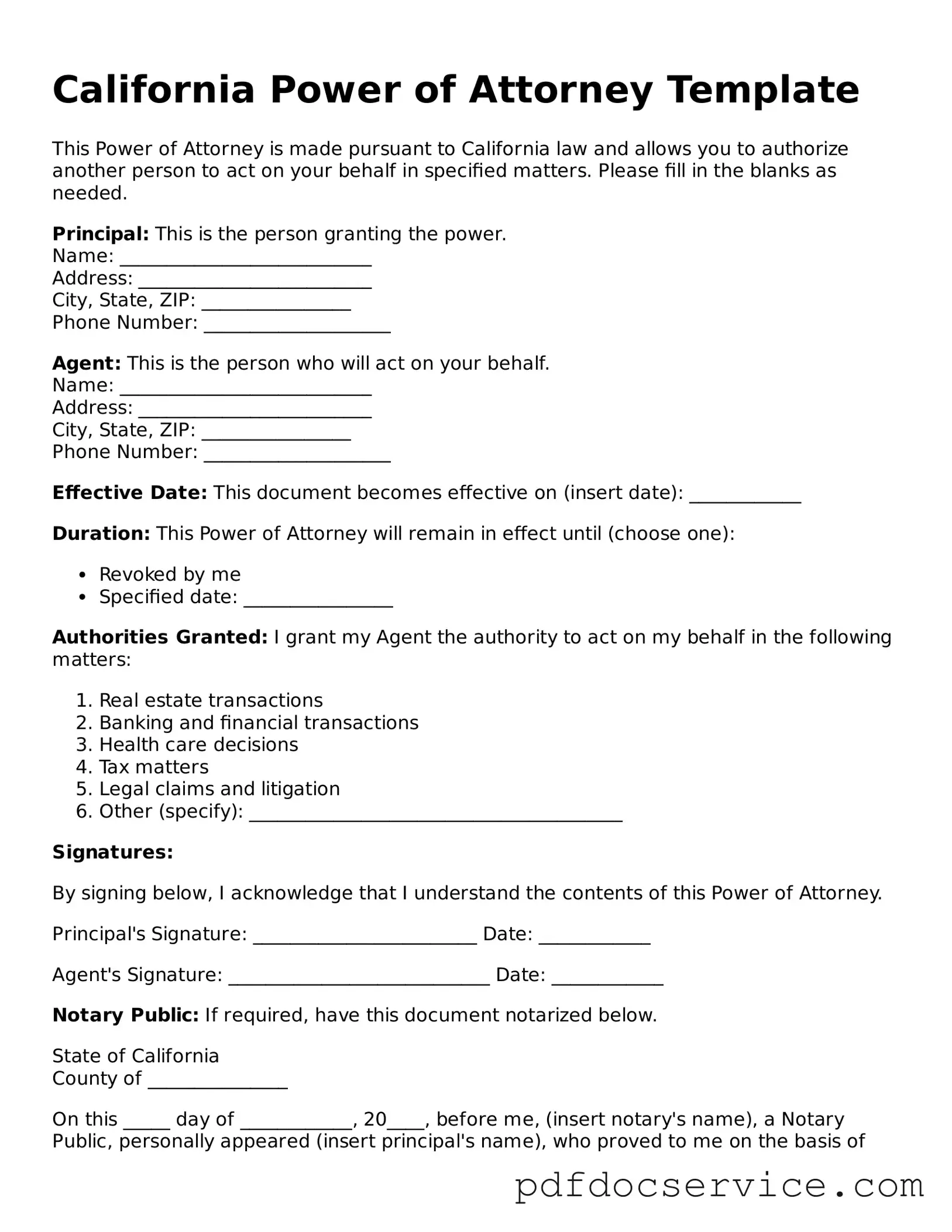

A Power of Attorney (POA) is a legal document that allows one person, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This can include financial matters, medical decisions, or other specific tasks. In California, the POA must be in writing and signed by the principal to be valid.

What are the different types of Power of Attorney in California?

California recognizes several types of Power of Attorney, including:

-

Durable Power of Attorney:

Remains in effect even if the principal becomes incapacitated.

-

Springing Power of Attorney:

Becomes effective only upon a specific event, such as the principal’s incapacity.

-

Healthcare Power of Attorney:

Specifically allows the agent to make medical decisions for the principal.

-

Financial Power of Attorney:

Grants authority to manage financial matters, such as paying bills or handling investments.

Who can be an agent in a Power of Attorney?

In California, anyone over the age of 18 can serve as an agent, provided they are competent to act. It is advisable to choose someone trustworthy, as the agent will have significant authority over the principal's affairs. Family members, friends, or professionals such as attorneys can serve in this role.

Do I need to notarize my Power of Attorney?

Yes, in California, a Power of Attorney must be signed by the principal in the presence of a notary public or two witnesses. Notarization adds an extra layer of authenticity and can help avoid disputes regarding the document's validity later on.

Can I revoke a Power of Attorney once it is created?

Absolutely. The principal has the right to revoke a Power of Attorney at any time, as long as they are competent to do so. To revoke, the principal should create a written revocation document and notify the agent and any relevant third parties. This ensures that everyone is aware of the change.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated and has executed a Durable Power of Attorney, the agent can continue to act on their behalf without interruption. However, if the Power of Attorney is not durable, it will become invalid upon the principal's incapacity, which can lead to complications in decision-making.

Can I use a Power of Attorney for real estate transactions?

Yes, a Power of Attorney can be used for real estate transactions in California. The agent can sign documents related to buying, selling, or managing property on behalf of the principal. It is essential that the document specifically grants authority for real estate matters to avoid any legal issues.

Is a Power of Attorney the same as a Living Will?

No, a Power of Attorney and a Living Will serve different purposes. A Living Will, also known as an Advance Healthcare Directive, outlines the principal's wishes regarding medical treatment in case they become unable to communicate their preferences. In contrast, a Power of Attorney designates someone to make decisions on the principal’s behalf, which can include healthcare decisions if it is specifically stated.

Power of Attorney forms can be obtained from various sources, including:

-

Legal stationery stores

-

Online legal service providers

-

California state government websites

-

Attorneys who specialize in estate planning

It’s important to ensure that the form you choose complies with California law and fits your specific needs.