What is a California Promissory Note?

A California Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It includes the amount borrowed, interest rate, repayment schedule, and other terms of the loan. This document serves as evidence of the debt and can be enforced in court if necessary.

Who can use a Promissory Note in California?

Any individual or business can use a Promissory Note in California. It is commonly used in personal loans, business loans, and real estate transactions. Both the borrower and lender should understand the terms before signing.

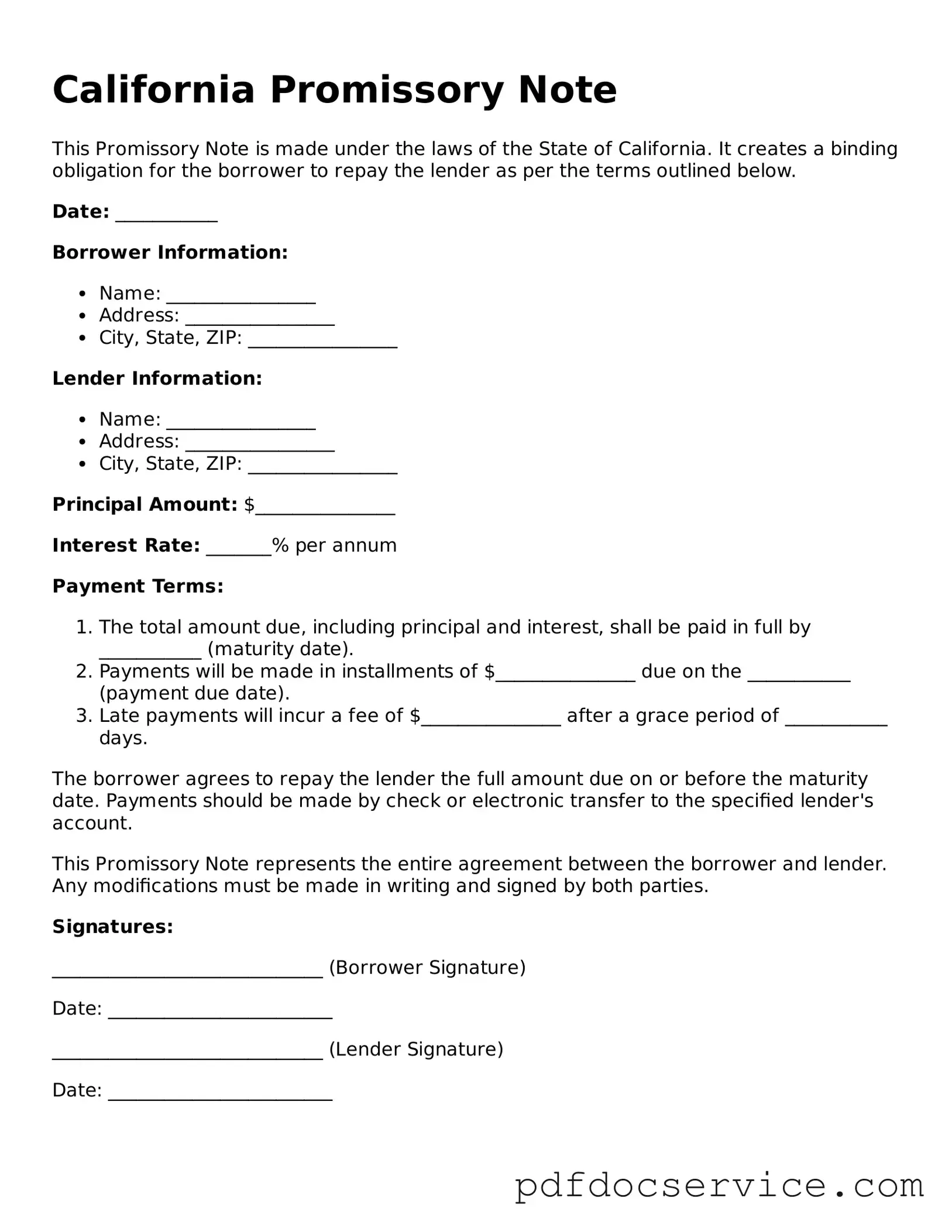

A typical California Promissory Note includes the following information:

-

The names and addresses of the borrower and lender

-

The principal amount of the loan

-

The interest rate

-

The repayment schedule

-

Any late fees or penalties

-

Conditions for default

-

Governing law

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is often advisable. A lawyer can ensure that the document meets legal standards and protects both parties' interests. If you choose to create one without legal assistance, ensure that it is clear and comprehensive.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the revised terms to avoid misunderstandings in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or seeking a judgment against the borrower. The specific actions available depend on the terms outlined in the Promissory Note and California law.

Is a Promissory Note the same as a loan agreement?

While both documents serve similar purposes, they are not the same. A Promissory Note focuses primarily on the borrower's promise to repay the loan, while a loan agreement is more comprehensive. A loan agreement typically includes additional terms such as covenants, warranties, and conditions that govern the loan.

Can a Promissory Note be secured or unsecured?

A Promissory Note can be either secured or unsecured. A secured note is backed by collateral, such as property or assets, which the lender can claim if the borrower defaults. An unsecured note does not have collateral backing it, making it riskier for the lender.

How long is a Promissory Note valid in California?

The validity of a Promissory Note in California does not have a specific expiration date, but it is subject to the statute of limitations for collecting debts. Generally, the statute of limitations for written contracts, including Promissory Notes, is four years from the date of default.

Where can I find a California Promissory Note template?

California Promissory Note templates can be found online through legal websites, law libraries, or by consulting with a legal professional. It is important to choose a template that complies with California laws and suits your specific needs.