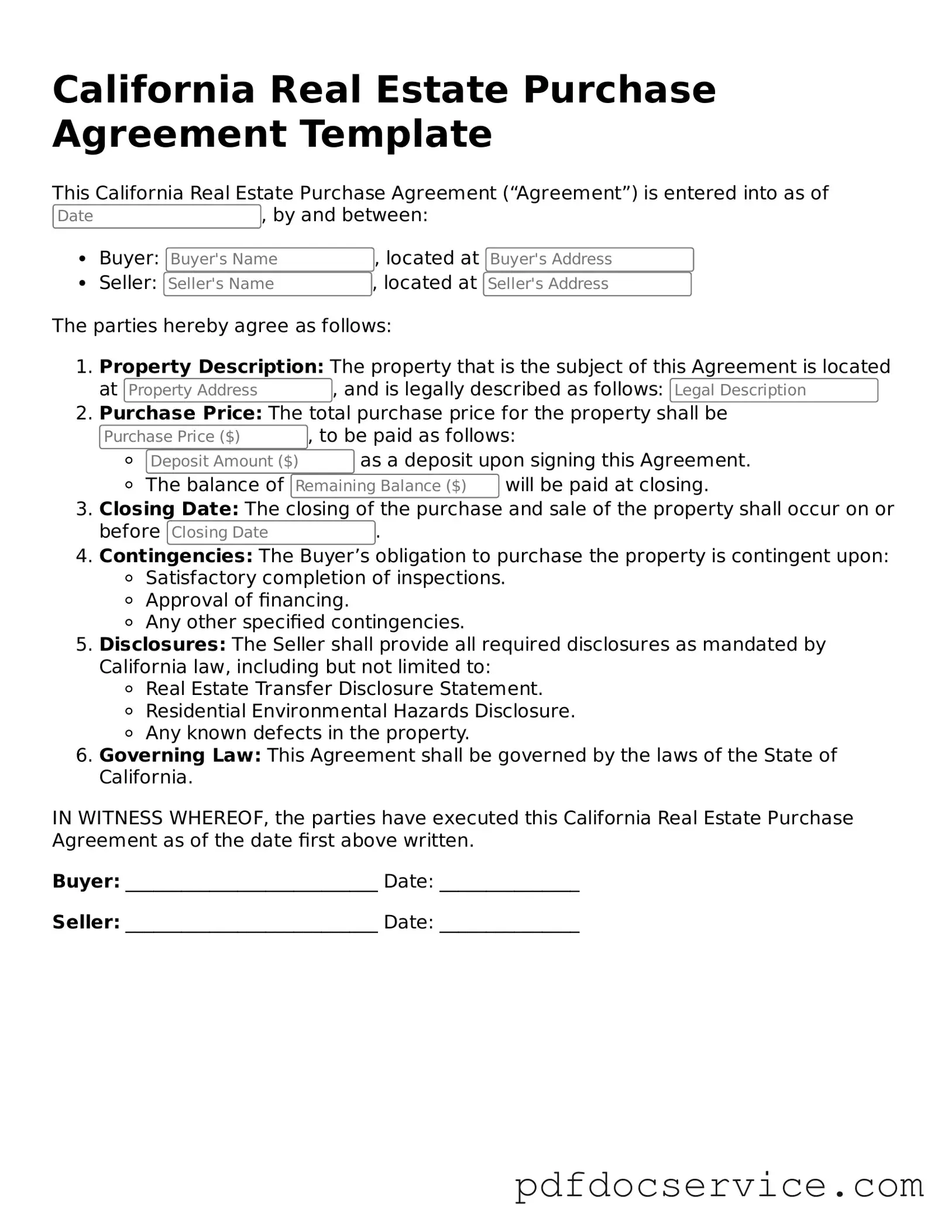

What is a California Real Estate Purchase Agreement?

The California Real Estate Purchase Agreement (REPA) is a legally binding document used when buying or selling real estate in California. It outlines the terms and conditions of the sale, including the purchase price, financing details, and any contingencies that must be met before the sale is finalized.

What are the key components of the agreement?

Several important elements are included in the REPA:

-

Parties Involved:

The names and contact information of the buyer and seller.

-

Property Description:

A detailed description of the property being sold, including the address and any relevant legal descriptions.

-

Purchase Price:

The agreed-upon amount for the property.

-

Contingencies:

Conditions that must be satisfied for the sale to proceed, such as inspections or financing approval.

-

Closing Date:

The date when the transaction will be finalized and ownership transferred.

Do I need a real estate agent to complete this agreement?

While it's not mandatory to have a real estate agent, it is highly recommended. Agents bring expertise in negotiations and can help ensure that all necessary terms are included. They also understand local market conditions, which can be beneficial during the transaction.

What contingencies should I consider including?

Common contingencies in a California Real Estate Purchase Agreement include:

-

Home inspection contingency

-

Financing contingency

-

Appraisal contingency

-

Sale of current home contingency

These contingencies protect the buyer by allowing them to back out of the agreement if certain conditions are not met.

Can I modify the agreement after it's signed?

Yes, modifications can be made after the agreement is signed, but both parties must agree to the changes. It's advisable to document any amendments in writing to avoid misunderstandings later on.

What happens if one party breaches the agreement?

If one party fails to meet their obligations, the other party may have several options, including:

-

Seeking damages for losses incurred

-

Requesting specific performance, which requires the breaching party to fulfill their obligations

-

Terminating the agreement

Consulting with a legal professional is wise to understand the best course of action.

Is the agreement legally binding?

Yes, once both parties sign the California Real Estate Purchase Agreement, it becomes a legally binding contract. Each party is obligated to adhere to the terms outlined in the agreement.

How do I submit the agreement after it's completed?

After completing the REPA, submit it to the appropriate parties involved in the transaction. This typically includes the seller, buyer, and their respective agents. Ensure that all parties have signed the document before proceeding with any further steps in the transaction.

Where can I find a California Real Estate Purchase Agreement template?

Templates for the California Real Estate Purchase Agreement can be found through various sources, including:

-

Real estate websites

-

Local real estate offices

-

Legal document services

Ensure that any template you use complies with California laws and regulations.