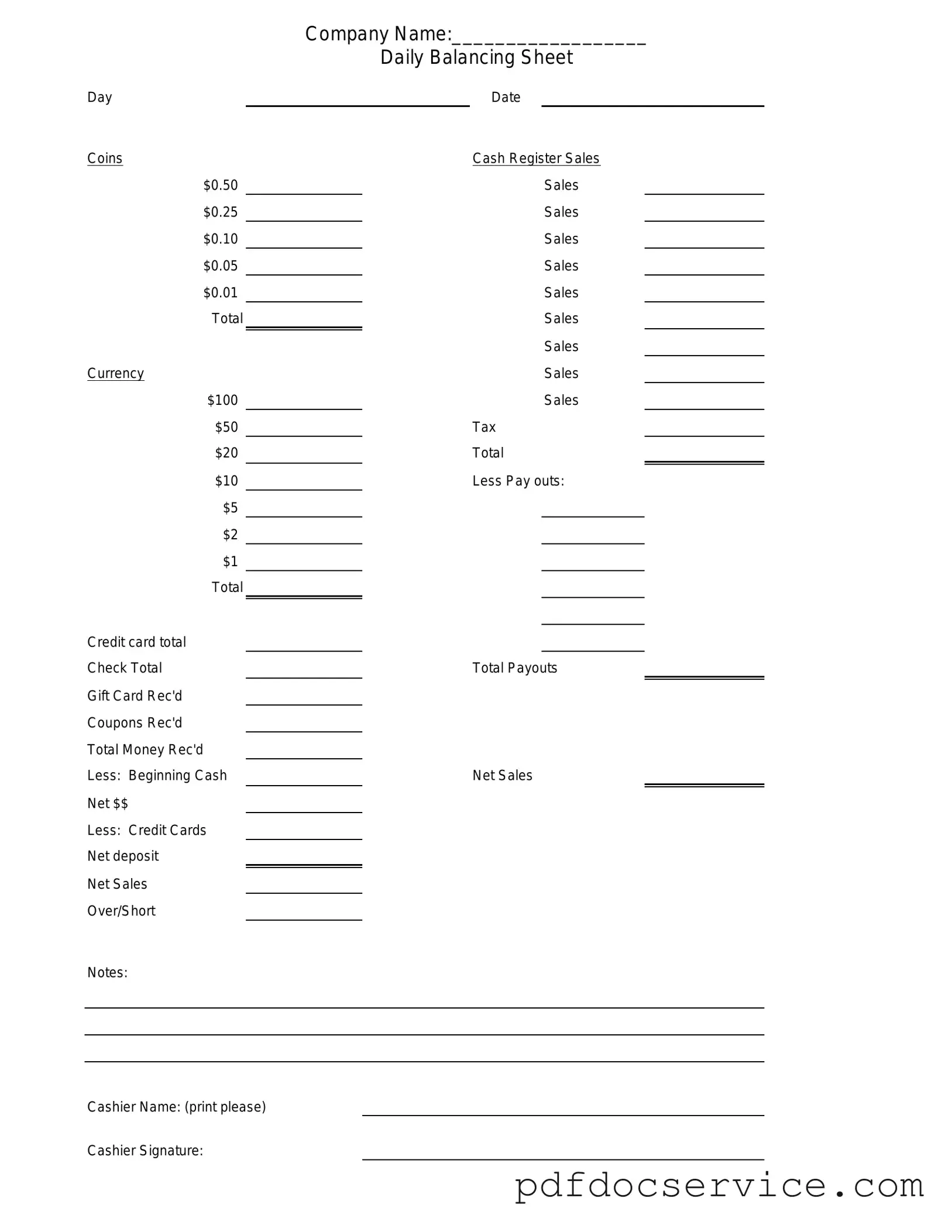

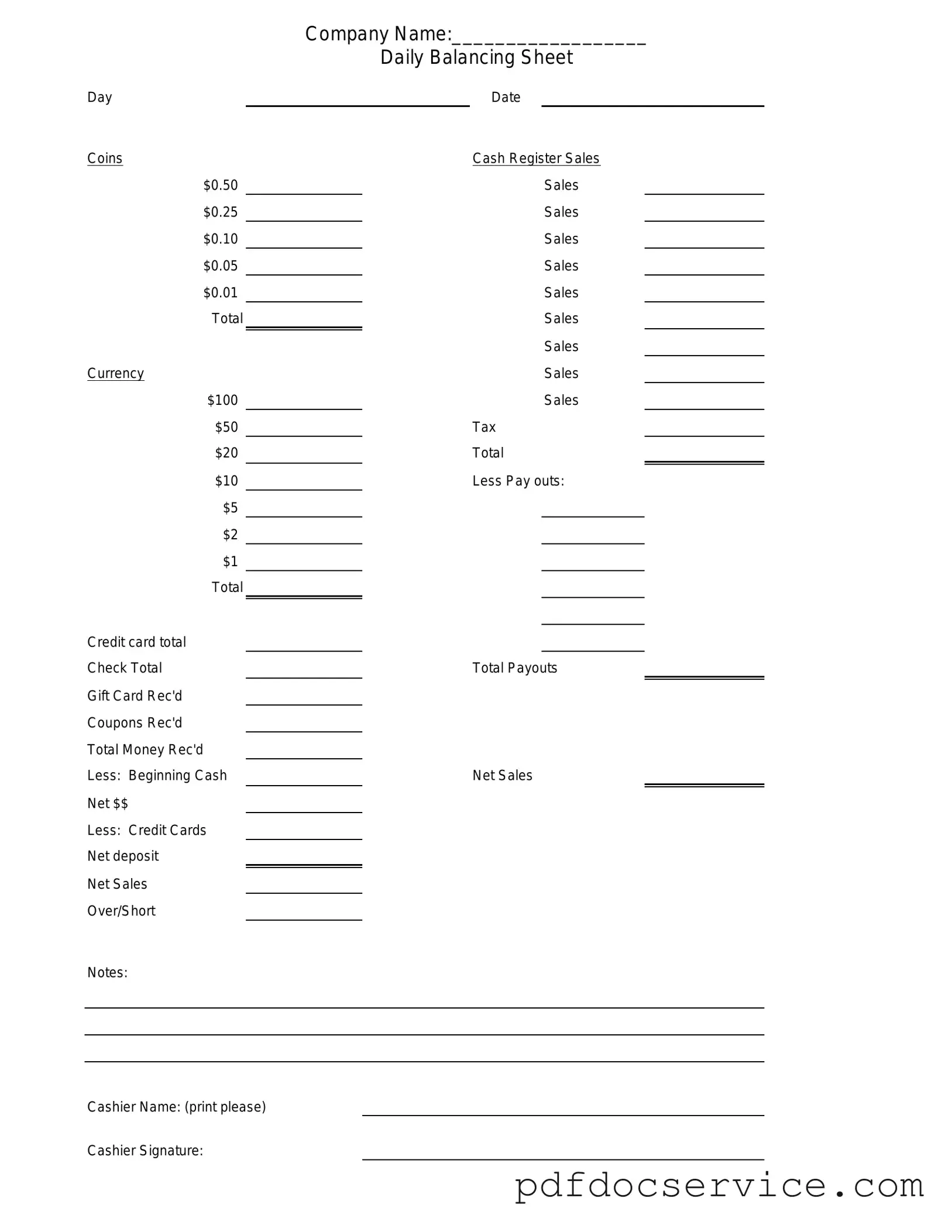

Fill Your Cash Drawer Count Sheet Form

The Cash Drawer Count Sheet is a tool used by businesses to track and verify the amount of cash in a cash drawer at the end of a shift or business day. This form helps ensure accuracy in cash handling and provides a clear record for financial accountability. By documenting the cash count, businesses can identify discrepancies and maintain proper financial controls.

Open Cash Drawer Count Sheet Editor

Fill Your Cash Drawer Count Sheet Form

Open Cash Drawer Count Sheet Editor

Open Cash Drawer Count Sheet Editor

or

Get Cash Drawer Count Sheet PDF

Finish the form now and be done

Finish Cash Drawer Count Sheet online using simple edit, save, and download steps.