A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof that a payment has been made and includes essential details such as the amount received, the date of the transaction, and the purpose of the payment.

The Cash Receipt form should be used by any individual or organization that receives cash payments. This includes businesses, non-profits, and educational institutions. It ensures proper tracking and accountability of cash transactions.

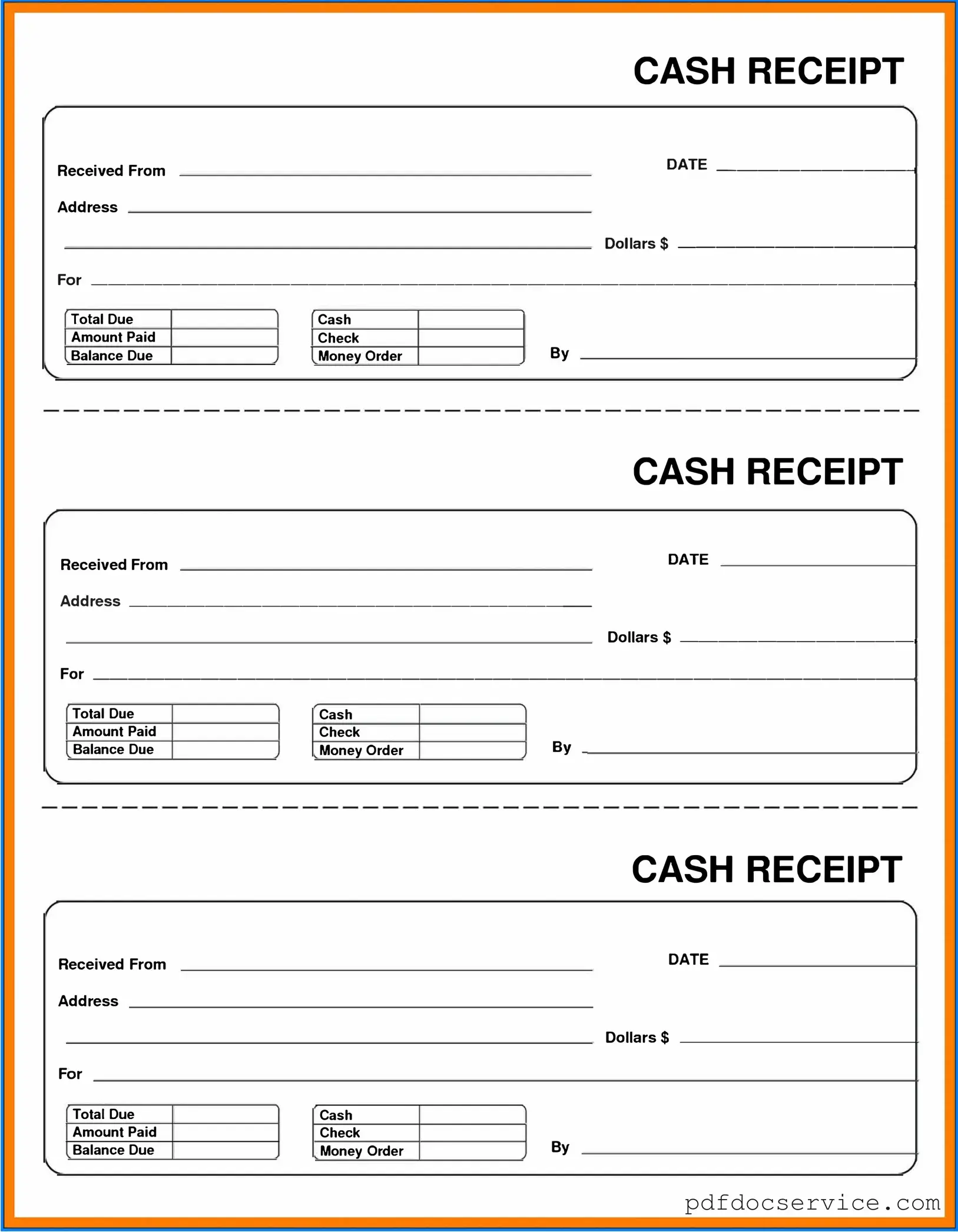

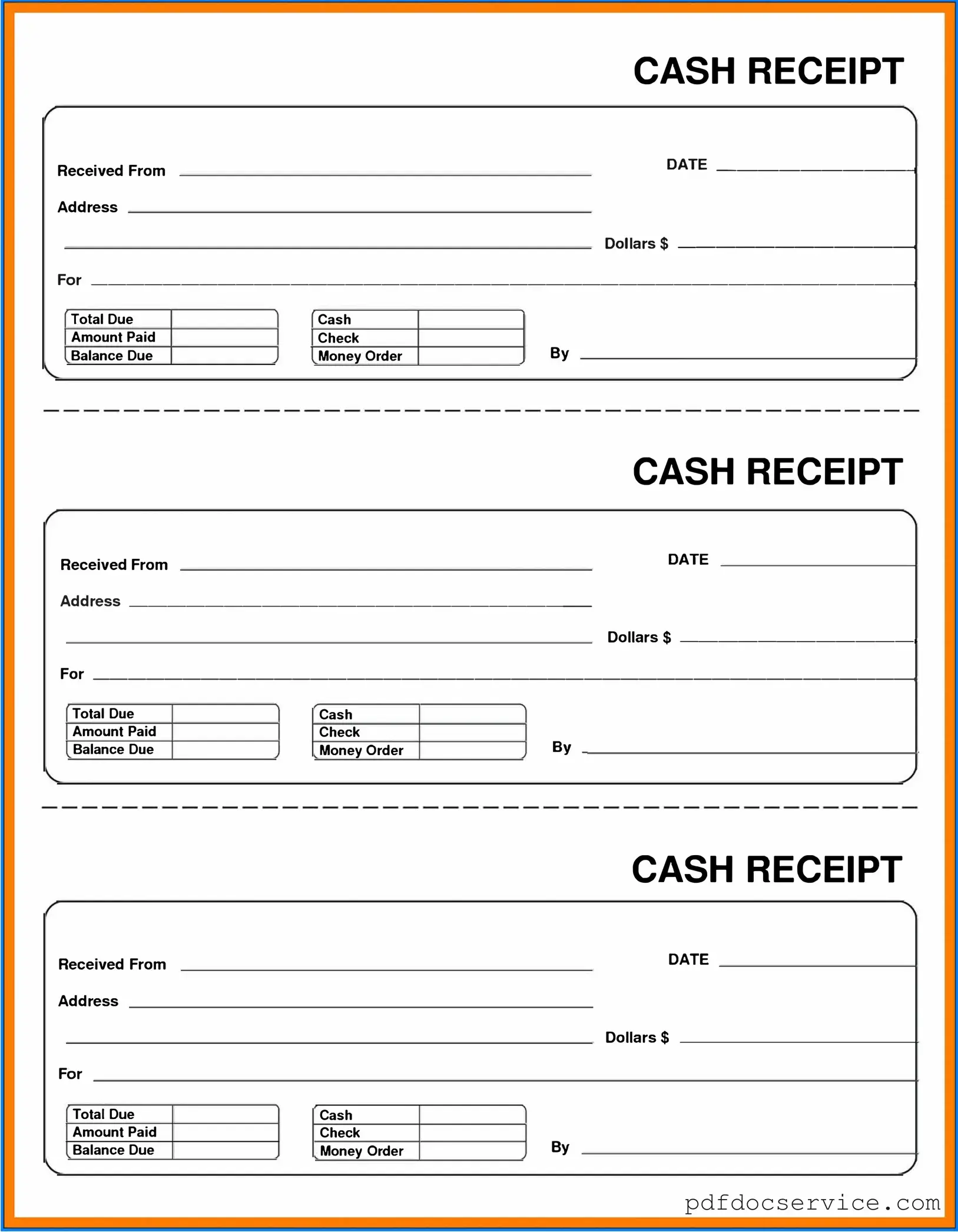

The Cash Receipt form typically requires the following information:

-

Date of the transaction

-

Name of the payer

-

Amount received

-

Payment method (cash, check, etc.)

-

Purpose of the payment

-

Signature of the person receiving the payment

To complete the Cash Receipt form, fill in all required fields accurately. Ensure that the information is legible. After filling out the form, have the payer sign it if necessary, and keep a copy for your records.

While it is not legally required for every cash transaction, using the Cash Receipt form is highly recommended. It provides a clear record for both the payer and the recipient, which can be crucial for financial tracking and audits.

No, the Cash Receipt form is specifically designed for cash transactions. For non-cash payments, such as checks or credit card transactions, different forms or receipts should be used to accurately document those payments.

Records of Cash Receipt forms should be kept for at least three to seven years, depending on your organization’s policies and any applicable legal requirements. This timeframe allows for adequate tracking and auditing of financial transactions.

If an error is discovered on the Cash Receipt form, it should be corrected immediately. Cross out the incorrect information, write the correct details, and initial the change. Ensure that both the payer and the recipient are aware of the correction.

Yes, the Cash Receipt form can be filled out electronically if your organization allows for digital documentation. Ensure that electronic signatures are acceptable and that the form is saved securely for record-keeping purposes.

A Cash Receipt form can typically be obtained from your organization's finance or accounting department. Additionally, many templates are available online for download and customization to meet your specific needs.