Fill Your Cg 20 10 07 04 Liability Endorsement Form

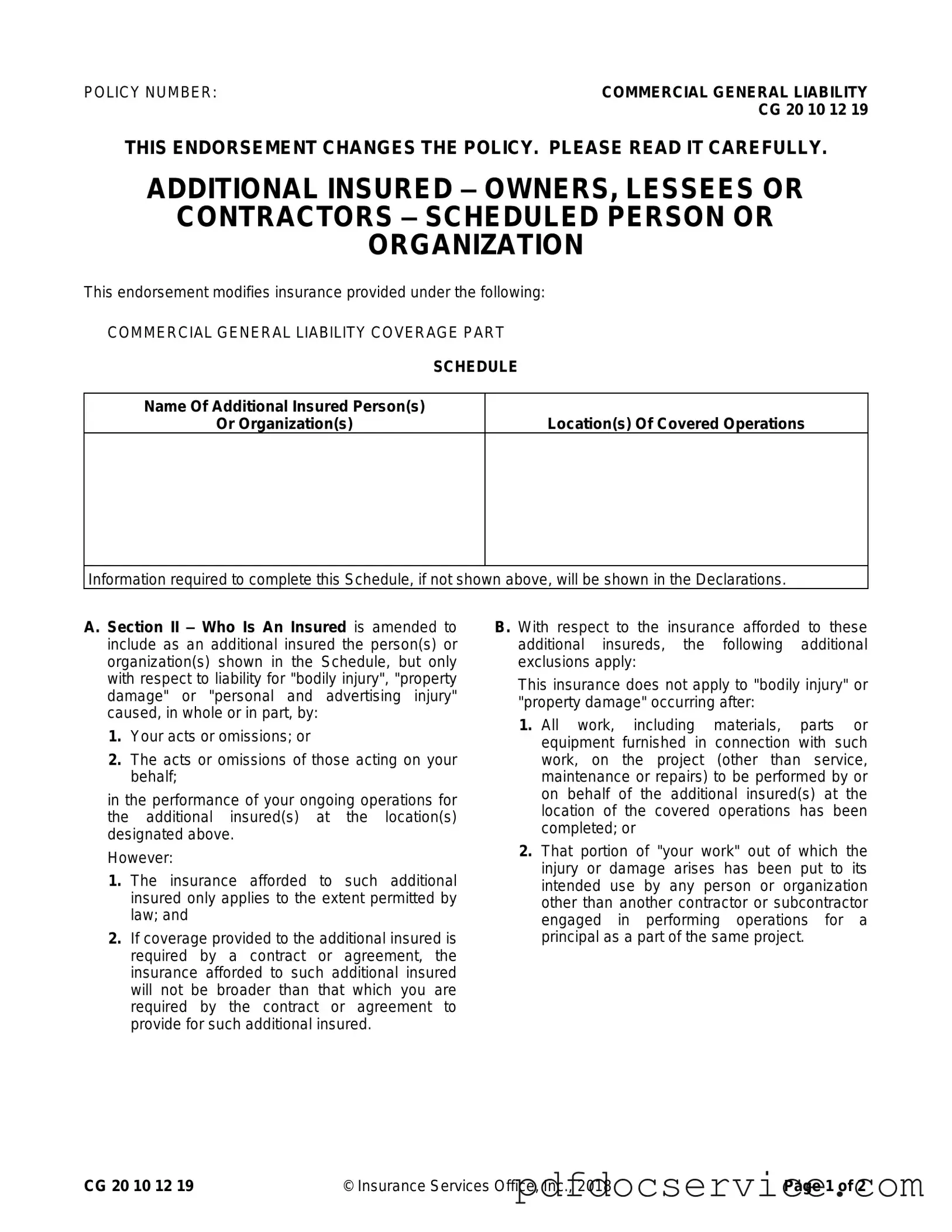

The CG 20 10 07 04 Liability Endorsement form serves as a critical modification to a Commercial General Liability policy, specifically addressing the inclusion of additional insured parties. This endorsement allows designated individuals or organizations to receive coverage for certain liabilities arising from ongoing operations performed on their behalf. Understanding the nuances of this endorsement is essential for both insurers and insureds, as it delineates the scope of coverage and the conditions under which it applies.

Open Cg 20 10 07 04 Liability Endorsement Editor

Fill Your Cg 20 10 07 04 Liability Endorsement Form

Open Cg 20 10 07 04 Liability Endorsement Editor

Open Cg 20 10 07 04 Liability Endorsement Editor

or

Get Cg 20 10 07 04 Liability Endorsement PDF

Finish the form now and be done

Finish Cg 20 10 07 04 Liability Endorsement online using simple edit, save, and download steps.