Fill Your Childcare Receipt Form

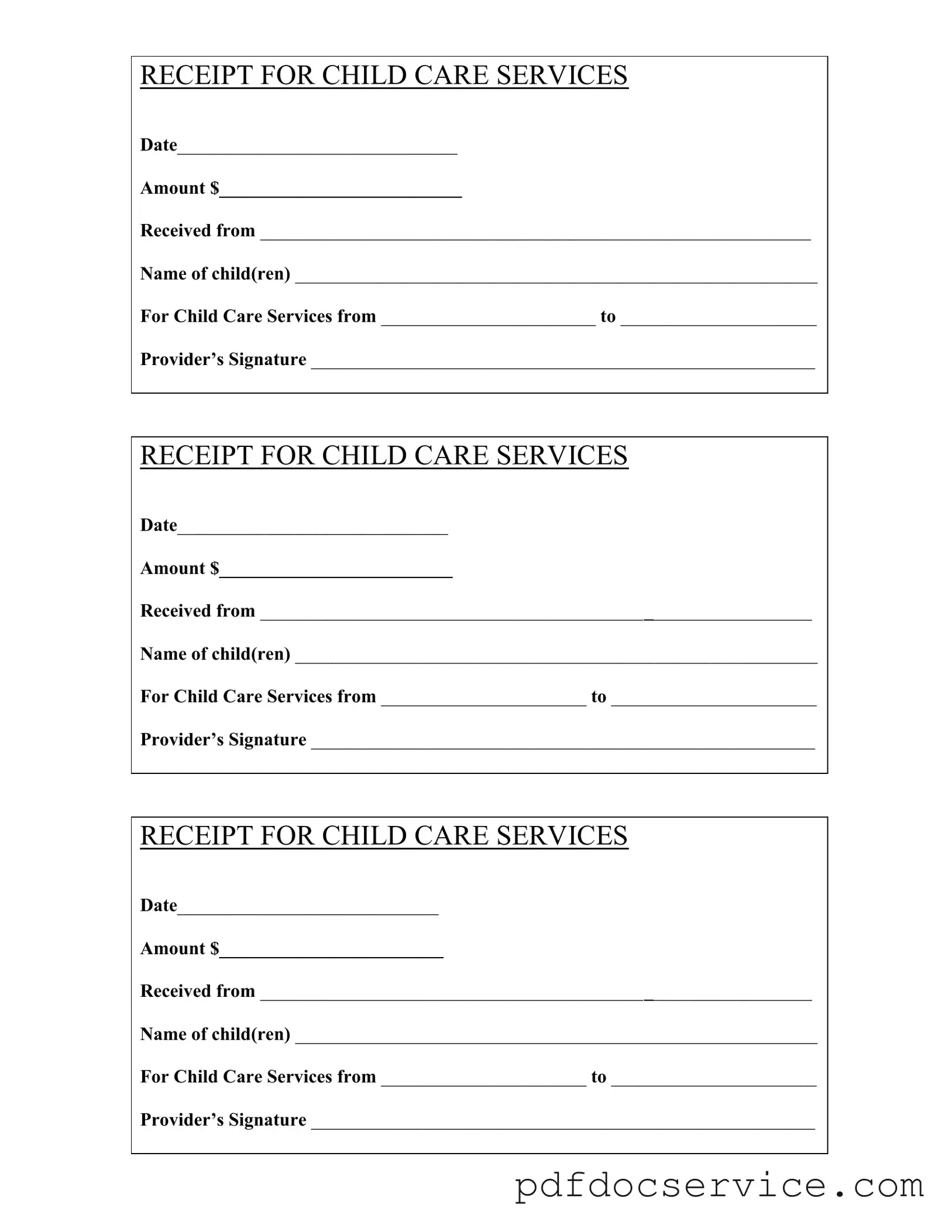

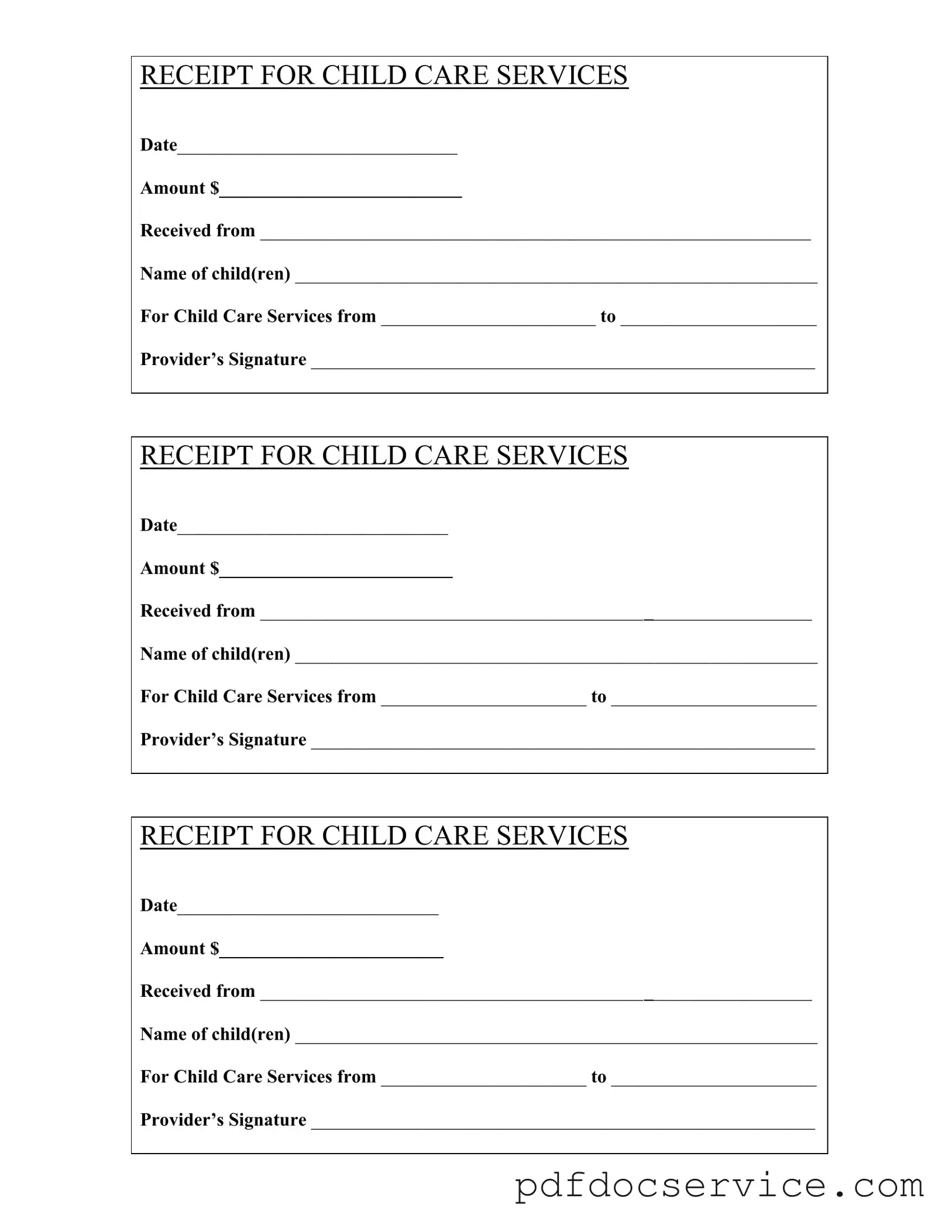

The Childcare Receipt form serves as an essential document that records the payment made for childcare services. This form typically includes details such as the date of service, the amount paid, and the names of the children receiving care. By providing a clear record of transactions, it ensures transparency and accountability for both parents and childcare providers.

Open Childcare Receipt Editor

Fill Your Childcare Receipt Form

Open Childcare Receipt Editor

Open Childcare Receipt Editor

or

Get Childcare Receipt PDF

Finish the form now and be done

Finish Childcare Receipt online using simple edit, save, and download steps.