Fill Your Citibank Direct Deposit Form

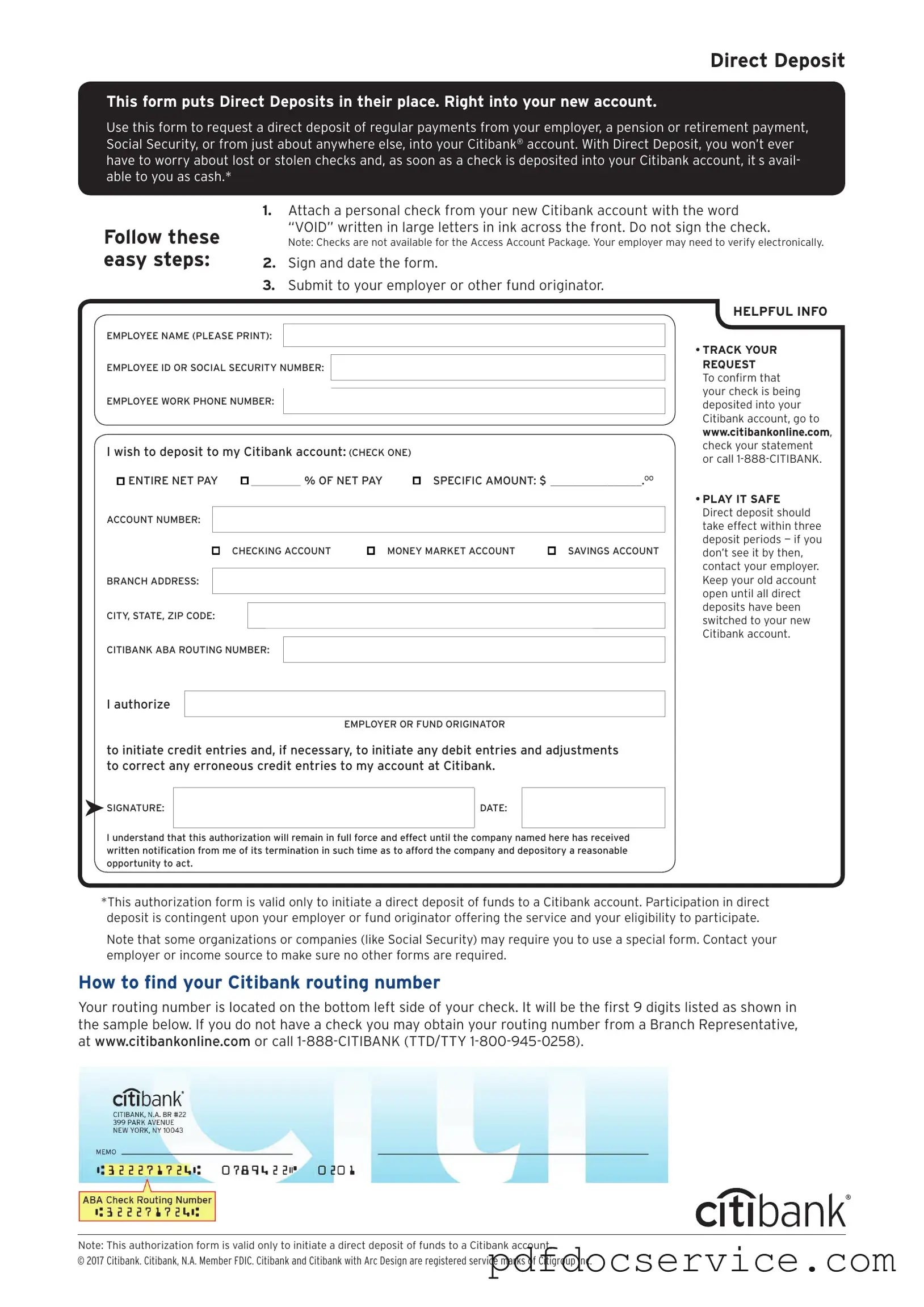

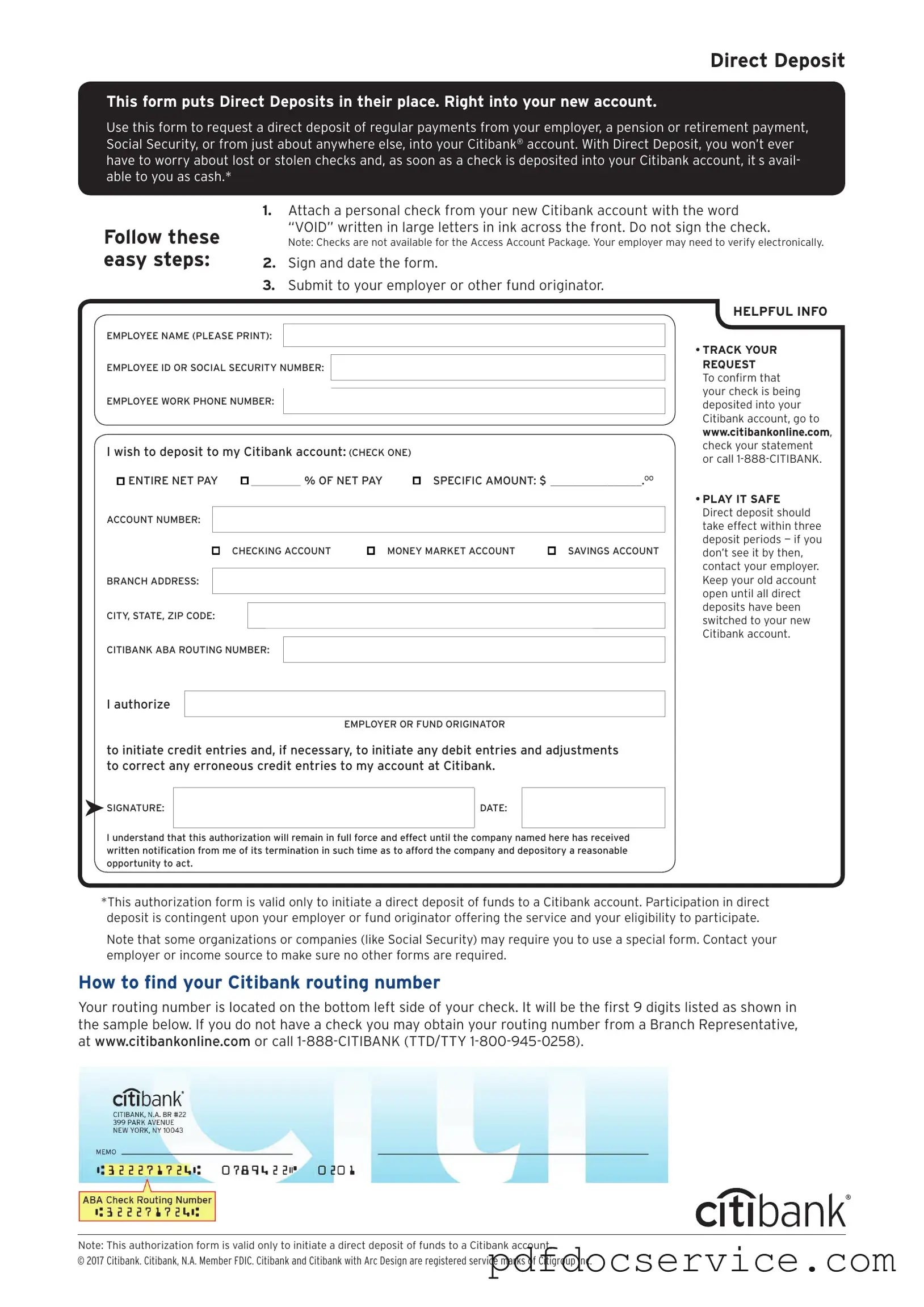

The Citibank Direct Deposit form is a document that allows individuals to authorize the automatic deposit of their paychecks or government benefits directly into their Citibank accounts. This convenient process eliminates the need for physical checks, ensuring timely access to funds. Completing this form is essential for setting up direct deposit with Citibank.

Open Citibank Direct Deposit Editor

Fill Your Citibank Direct Deposit Form

Open Citibank Direct Deposit Editor

Open Citibank Direct Deposit Editor

or

Get Citibank Direct Deposit PDF

Finish the form now and be done

Finish Citibank Direct Deposit online using simple edit, save, and download steps.