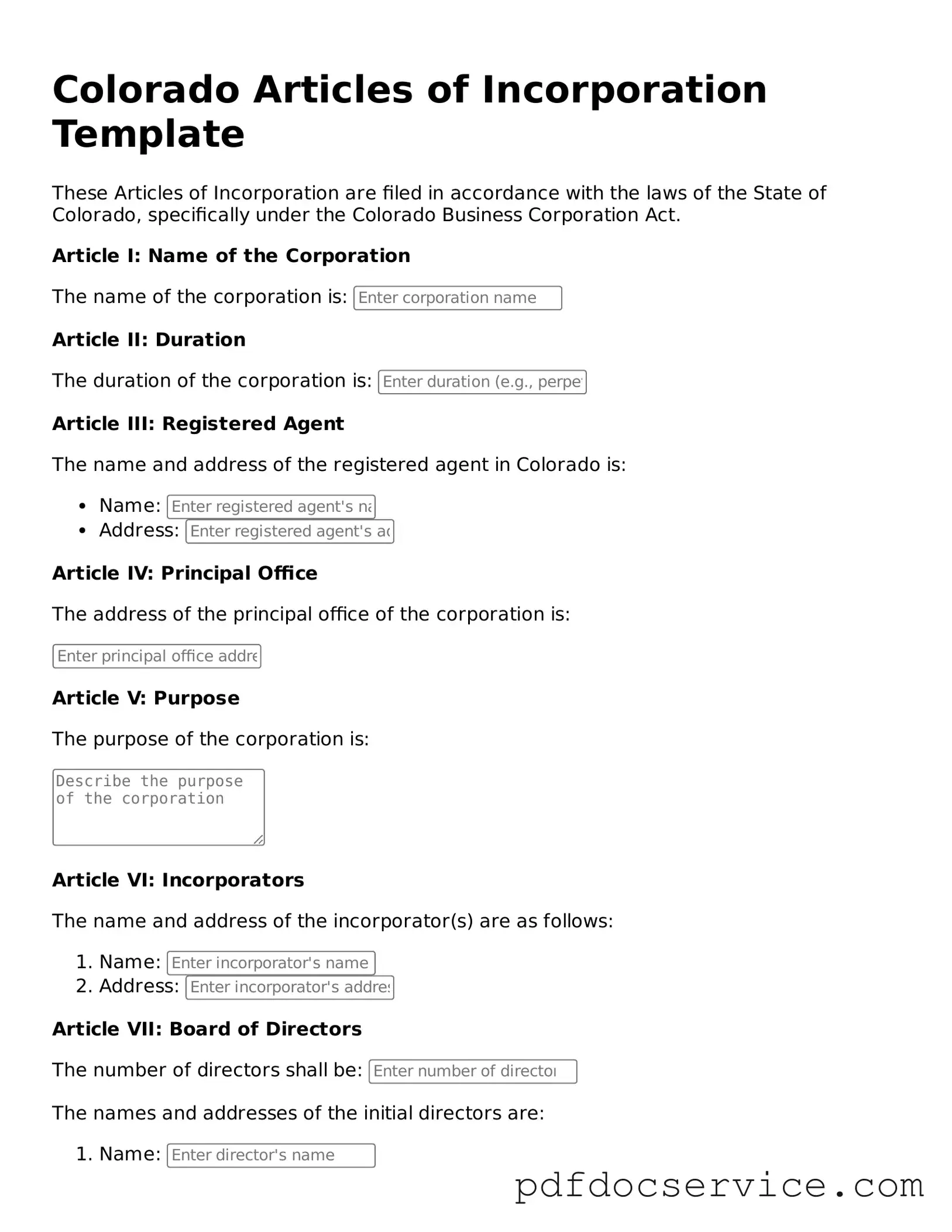

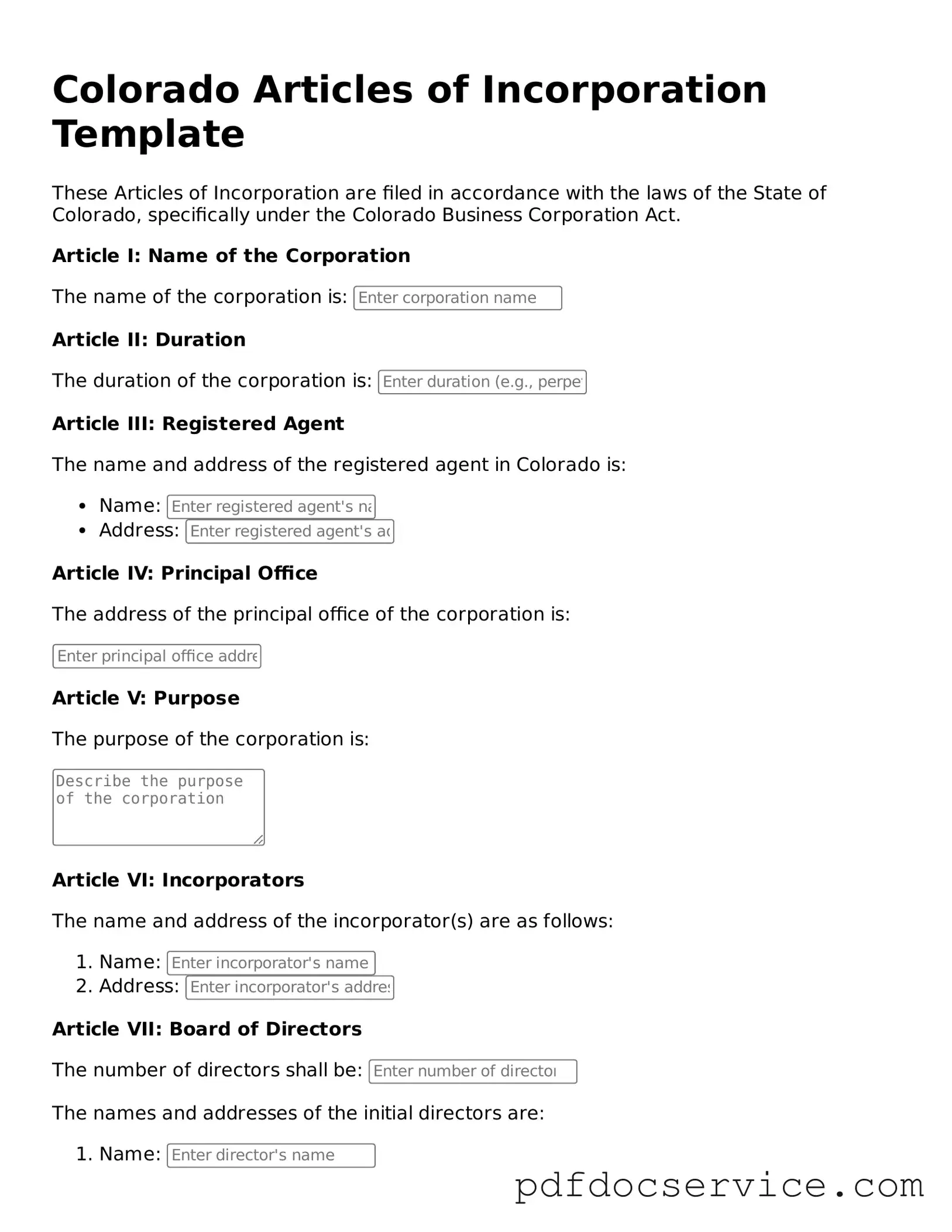

Printable Articles of Incorporation Template for Colorado

The Colorado Articles of Incorporation form is a legal document that establishes a corporation in the state of Colorado. This form outlines essential information about the corporation, including its name, purpose, and registered agent. Completing this form is a crucial step for anyone looking to create a legally recognized business entity in Colorado.

Open Articles of Incorporation Editor

Printable Articles of Incorporation Template for Colorado

Open Articles of Incorporation Editor

Open Articles of Incorporation Editor

or

Get Articles of Incorporation PDF

Finish the form now and be done

Finish Articles of Incorporation online using simple edit, save, and download steps.