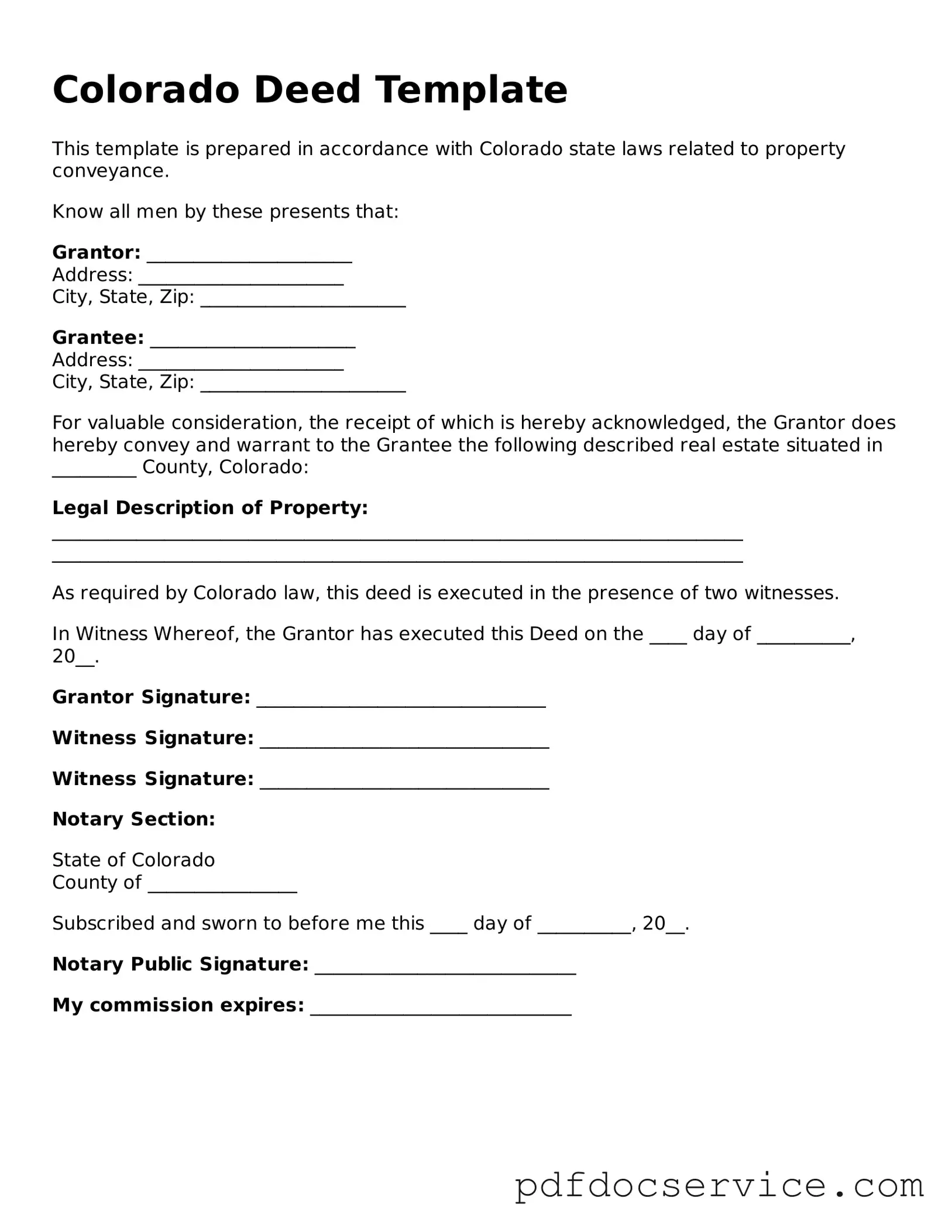

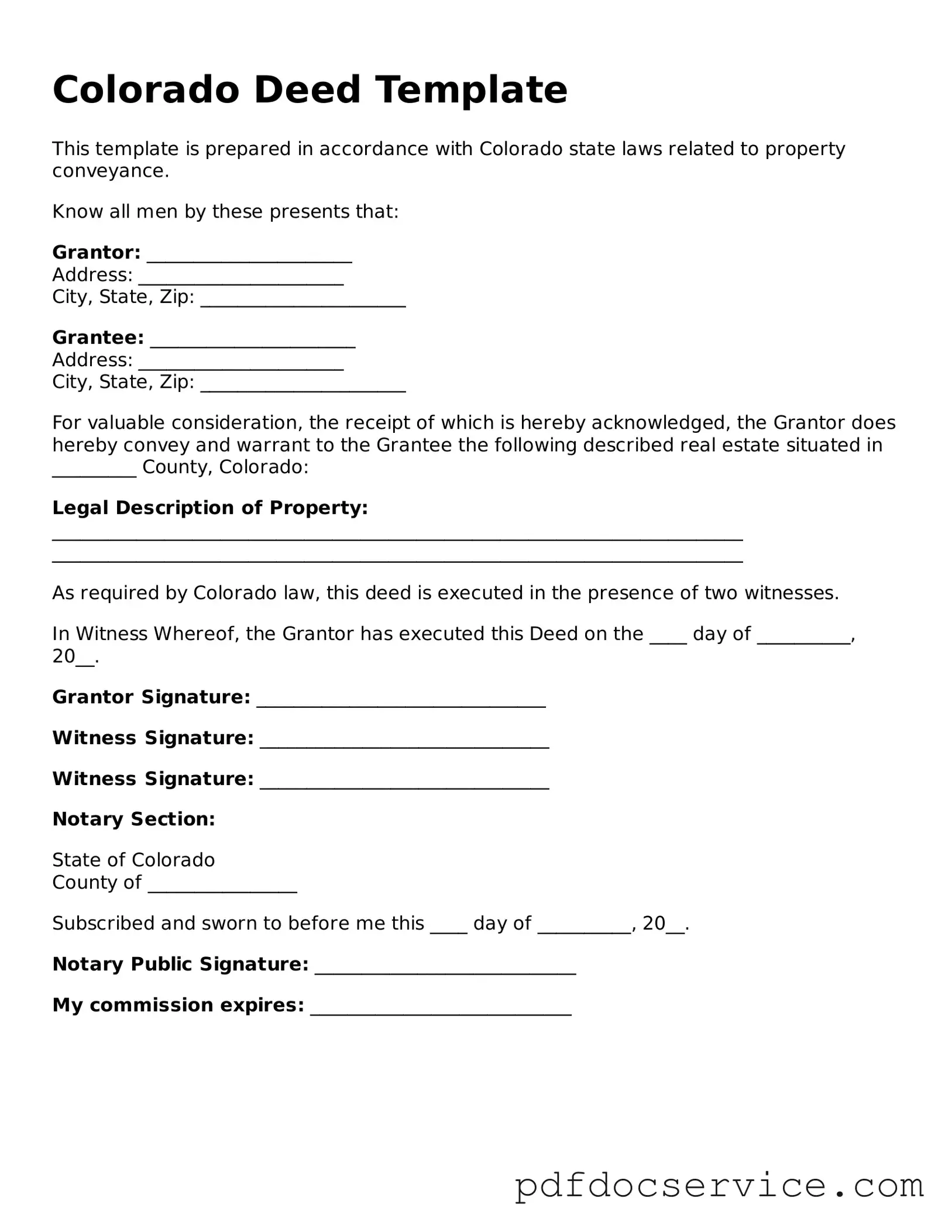

Printable Deed Template for Colorado

A Colorado Deed form is a legal document used to transfer ownership of real property in the state of Colorado. This form outlines the details of the transaction, including the parties involved and the property being conveyed. Understanding the nuances of this form is essential for anyone engaged in real estate transactions in Colorado.

Open Deed Editor

Printable Deed Template for Colorado

Open Deed Editor

Open Deed Editor

or

Get Deed PDF

Finish the form now and be done

Finish Deed online using simple edit, save, and download steps.