What is a Colorado Motor Vehicle Bill of Sale?

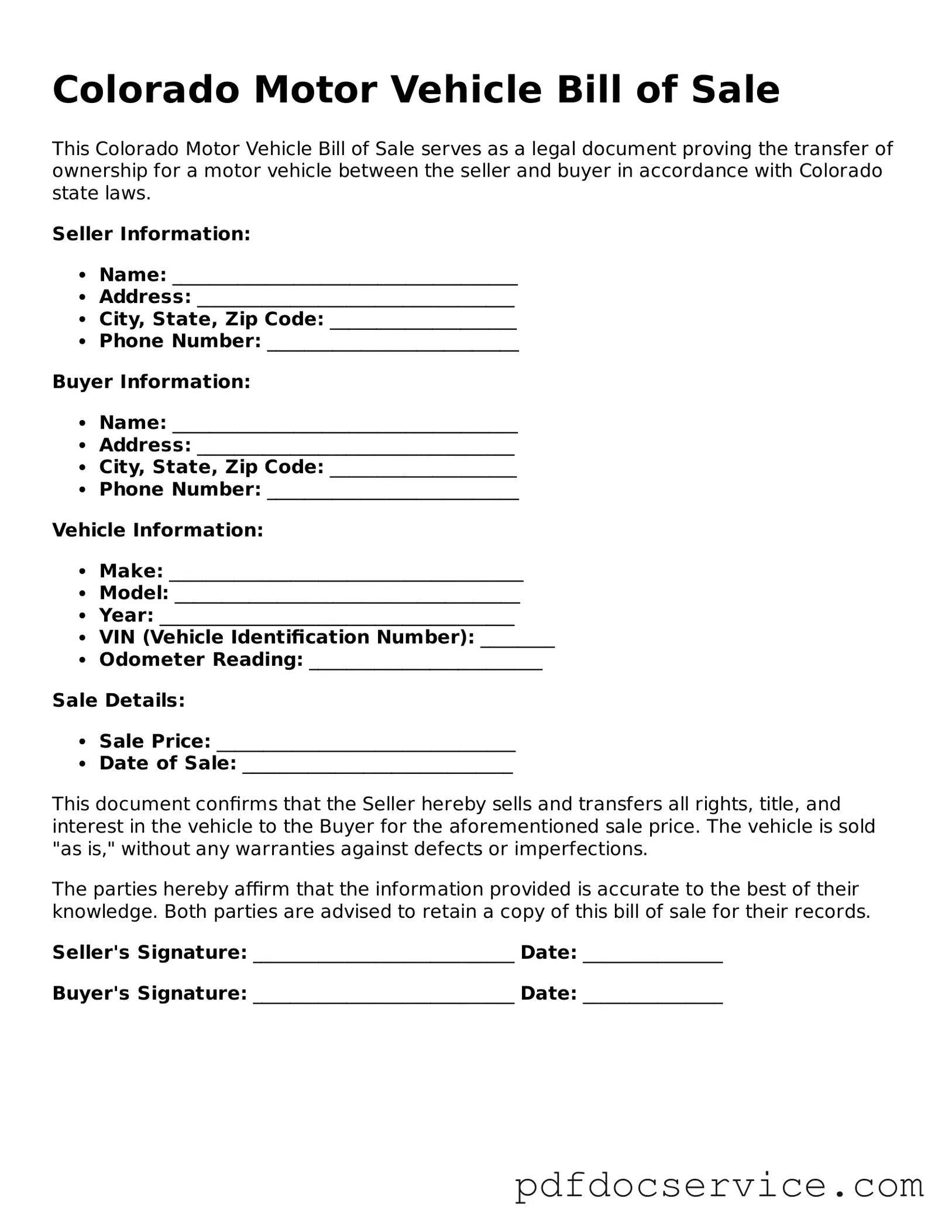

A Colorado Motor Vehicle Bill of Sale is a legal document that serves as a record of the sale of a vehicle between a buyer and a seller. It includes important details such as the vehicle's make, model, year, Vehicle Identification Number (VIN), and the sale price. This document is crucial for transferring ownership and is often required for registering the vehicle with the state.

Why is a Bill of Sale important?

The Bill of Sale provides proof of the transaction between the buyer and the seller. It helps protect both parties by documenting the details of the sale, including the condition of the vehicle at the time of sale. In addition, it can be useful for tax purposes and may be required by the Department of Motor Vehicles (DMV) when registering the vehicle in the new owner's name.

When completing a Colorado Motor Vehicle Bill of Sale, the following information is typically required:

-

Names and addresses of both the buyer and the seller

-

Vehicle details, including make, model, year, and VIN

-

Sale price of the vehicle

-

Date of the sale

-

Odometer reading at the time of sale

Including all this information ensures that the document is complete and legally valid.

Do I need to have the Bill of Sale notarized?

No, in Colorado, it is not mandatory to have the Bill of Sale notarized. However, having it notarized can add an extra layer of security and authenticity to the document. It may also help prevent disputes in the future regarding the sale.

Can I use a generic Bill of Sale template?

Yes, you can use a generic Bill of Sale template, but it is recommended to use the official Colorado Motor Vehicle Bill of Sale form. This ensures that you include all necessary information and comply with state requirements. Official forms are often available online through the Colorado DMV website or at local DMV offices.

Is there a fee associated with the Bill of Sale?

There is no fee for creating a Bill of Sale itself, as it is a document that you can fill out and sign without cost. However, when registering the vehicle with the DMV, there may be fees associated with title transfers, registration, and taxes based on the sale price.

What should I do with the Bill of Sale after the sale?

After the sale is completed, both the buyer and the seller should keep a copy of the Bill of Sale for their records. The buyer will need to present it when registering the vehicle with the DMV, while the seller should keep it as proof of the transaction in case any issues arise in the future.

What if the vehicle has a lien on it?

If the vehicle has a lien, it is important to address this before completing the sale. The seller should ensure that the lien is paid off and released before transferring ownership. The Bill of Sale should clearly indicate whether the vehicle is sold free of any liens or if the buyer is assuming responsibility for the lien. This helps avoid complications during the registration process.