What is a Quitclaim Deed in Colorado?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees. In Colorado, this means that the person transferring the property (the grantor) does not guarantee that they own the property free and clear or that they have the right to transfer it. The recipient (the grantee) receives whatever interest the grantor has, if any.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in specific situations, including:

-

Transferring property between family members, such as from parents to children.

-

Clearing up title issues, such as removing an ex-spouse from the title after a divorce.

-

Transferring property into a trust or business entity.

-

Gifting property without a sale.

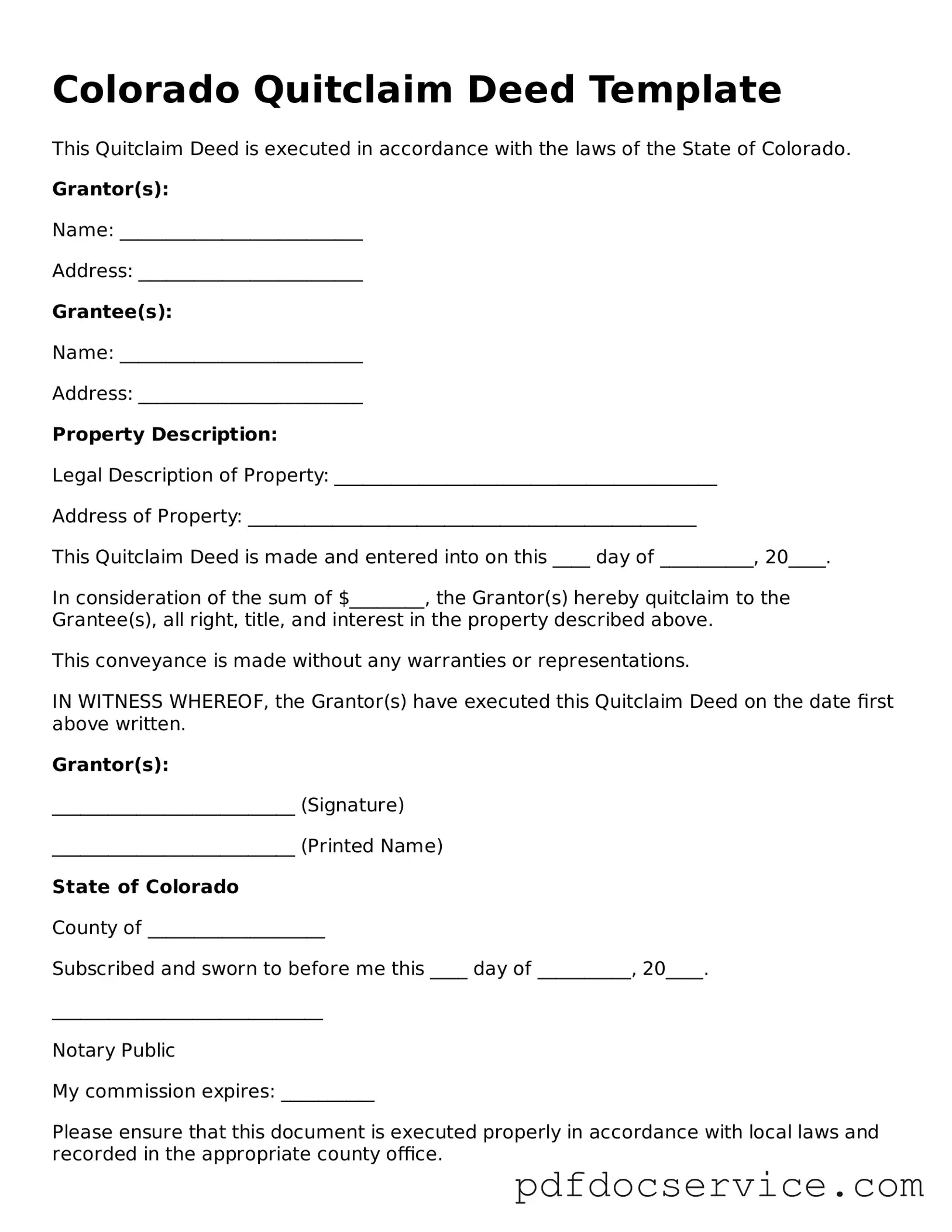

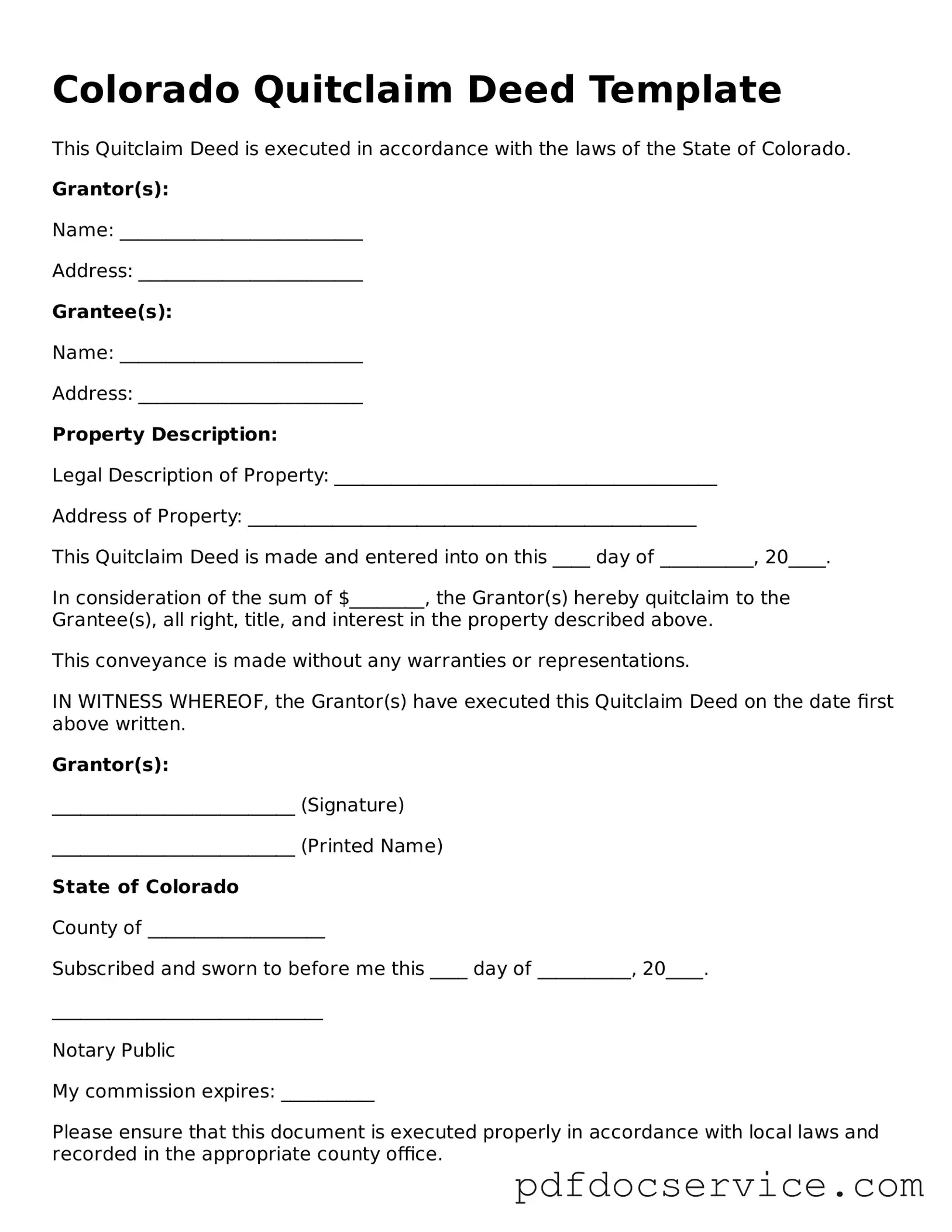

How do I complete a Quitclaim Deed in Colorado?

To complete a Quitclaim Deed, follow these steps:

-

Obtain a Quitclaim Deed form, which can be found online or at a local legal stationery store.

-

Fill out the form with the necessary information, including the names of the grantor and grantee, the property description, and the date of transfer.

-

Have the form signed by the grantor in front of a notary public.

-

File the completed deed with the appropriate county clerk and recorder's office to make the transfer official.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides guarantees about the property title, ensuring that the seller has a clear title and the right to sell the property. In contrast, a Quitclaim Deed transfers whatever interest the grantor has without any warranties, making it riskier for the grantee.

Are there any tax implications when using a Quitclaim Deed?

Generally, transferring property via a Quitclaim Deed may not trigger significant tax implications, especially if the transfer is between family members or as a gift. However, it is essential to consider potential capital gains taxes if the property appreciates in value. Consulting a tax professional is advisable to understand any specific tax obligations.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot be revoked unilaterally. The grantor may attempt to create a new deed to transfer the property back, but this requires the cooperation of both parties. If the grantor wishes to reclaim the property, they must negotiate with the grantee.

What happens if the grantor has outstanding debts?

If the grantor has outstanding debts, the property transferred through a Quitclaim Deed may still be subject to those debts. Creditors can potentially place liens on the property, even after the transfer. It is wise to conduct a title search before proceeding with a Quitclaim Deed to ensure there are no existing claims against the property.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is often advisable. An attorney can help ensure that the deed is completed correctly and that all necessary legal requirements are met. This can prevent potential issues or disputes in the future.

Quitclaim Deed forms for Colorado can be found online through various legal websites, or you can obtain one from a local office supply store that sells legal forms. Additionally, some county clerk and recorder offices may provide forms on their websites or in person.

How much does it cost to file a Quitclaim Deed in Colorado?

The cost to file a Quitclaim Deed in Colorado varies by county. Typically, there is a recording fee, which can range from $10 to $30 or more. It is essential to check with your local county clerk and recorder's office for the exact fee and any additional requirements they may have.