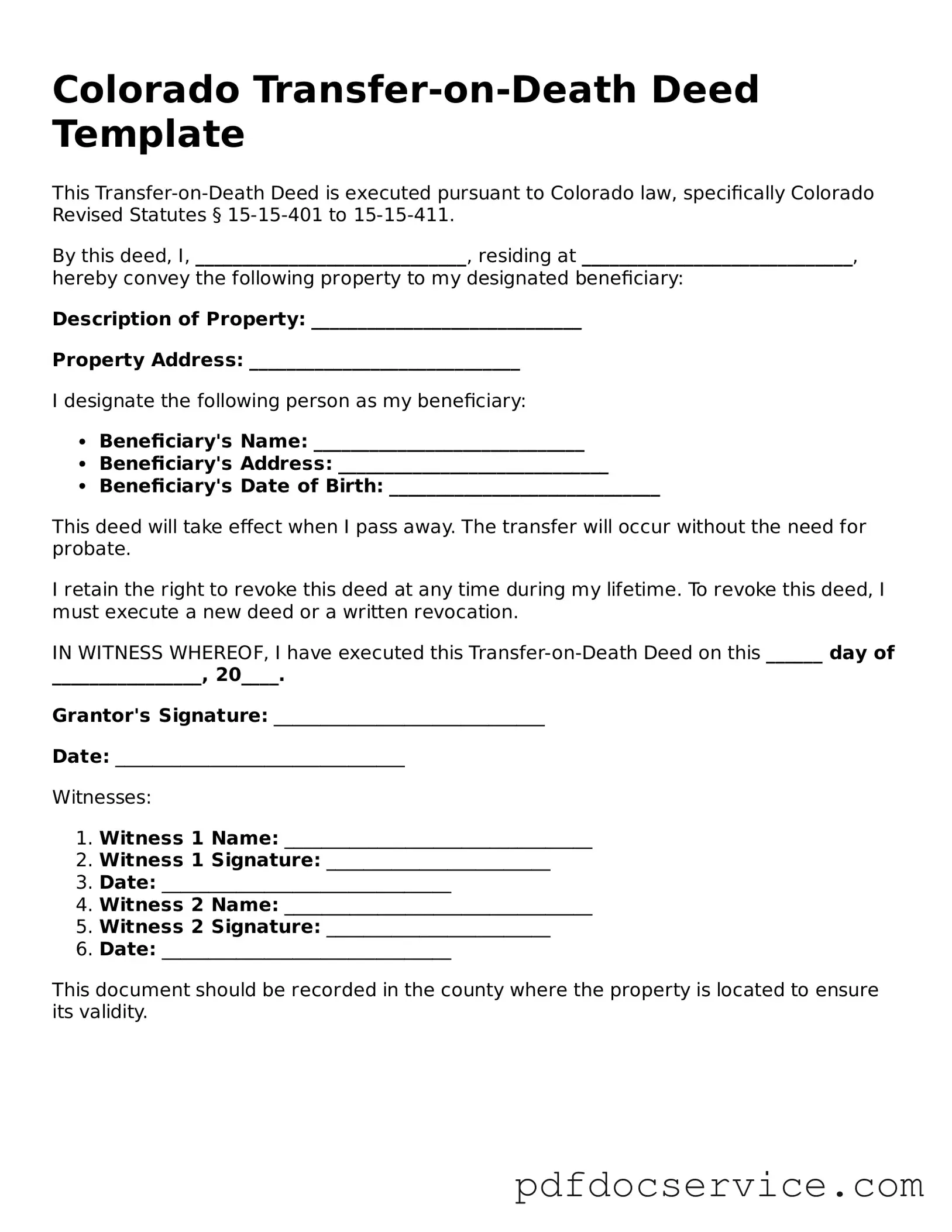

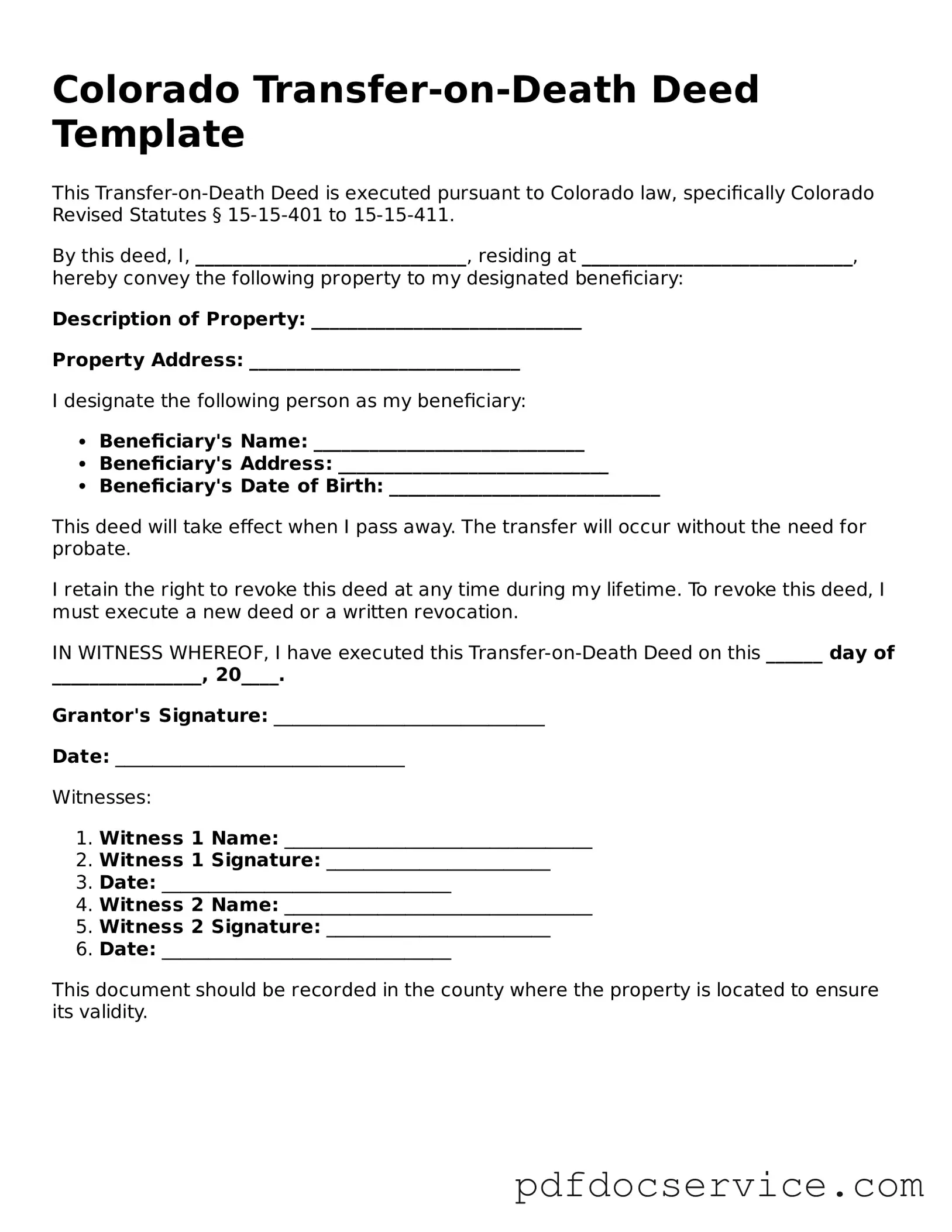

Printable Transfer-on-Death Deed Template for Colorado

A Transfer-on-Death Deed (TOD) is a legal document that allows an individual to transfer real property to a designated beneficiary upon their death, without the need for probate. This form provides a straightforward way to pass on property while retaining ownership during the grantor's lifetime. By utilizing a TOD deed, property owners can ensure a smooth transition of their assets to loved ones after their passing.

Open Transfer-on-Death Deed Editor

Printable Transfer-on-Death Deed Template for Colorado

Open Transfer-on-Death Deed Editor

Open Transfer-on-Death Deed Editor

or

Get Transfer-on-Death Deed PDF

Finish the form now and be done

Finish Transfer-on-Death Deed online using simple edit, save, and download steps.