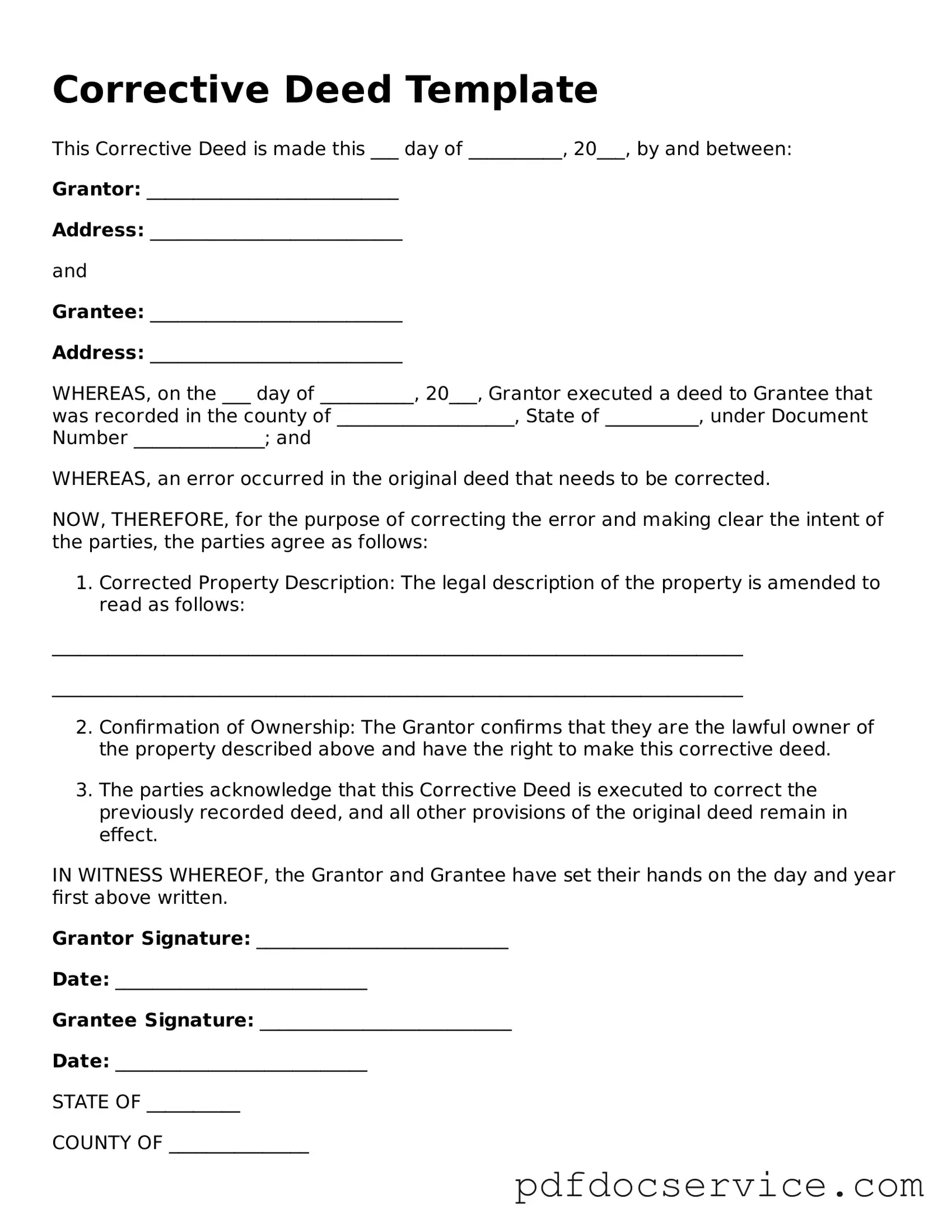

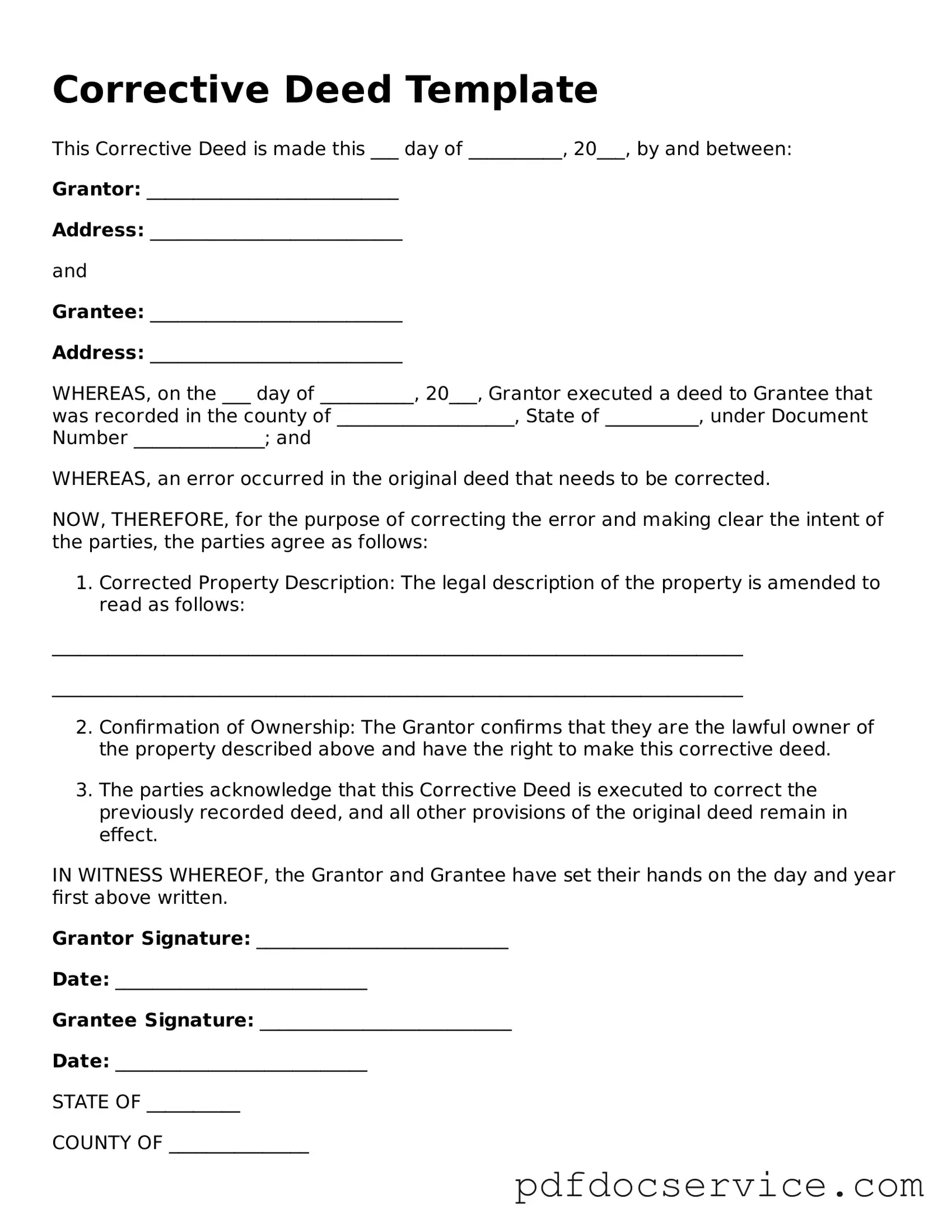

Blank Corrective Deed Form

A Corrective Deed is a legal document used to correct errors or omissions in a previously executed deed. This form ensures that the intent of the parties involved is accurately reflected in the property records. By addressing discrepancies, a Corrective Deed helps to maintain clarity and prevent future disputes regarding property ownership.

Open Corrective Deed Editor

Blank Corrective Deed Form

Open Corrective Deed Editor

Open Corrective Deed Editor

or

Get Corrective Deed PDF

Finish the form now and be done

Finish Corrective Deed online using simple edit, save, and download steps.