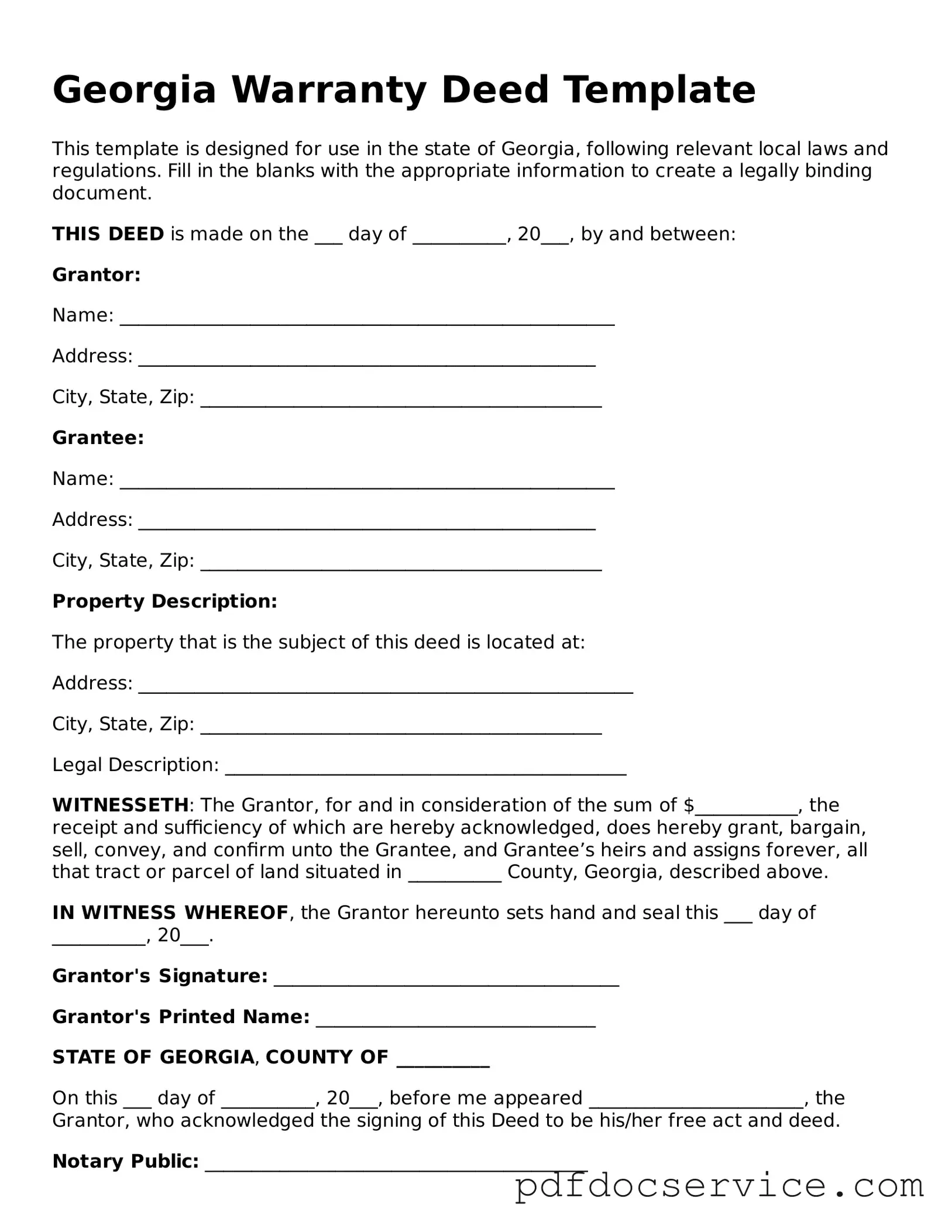

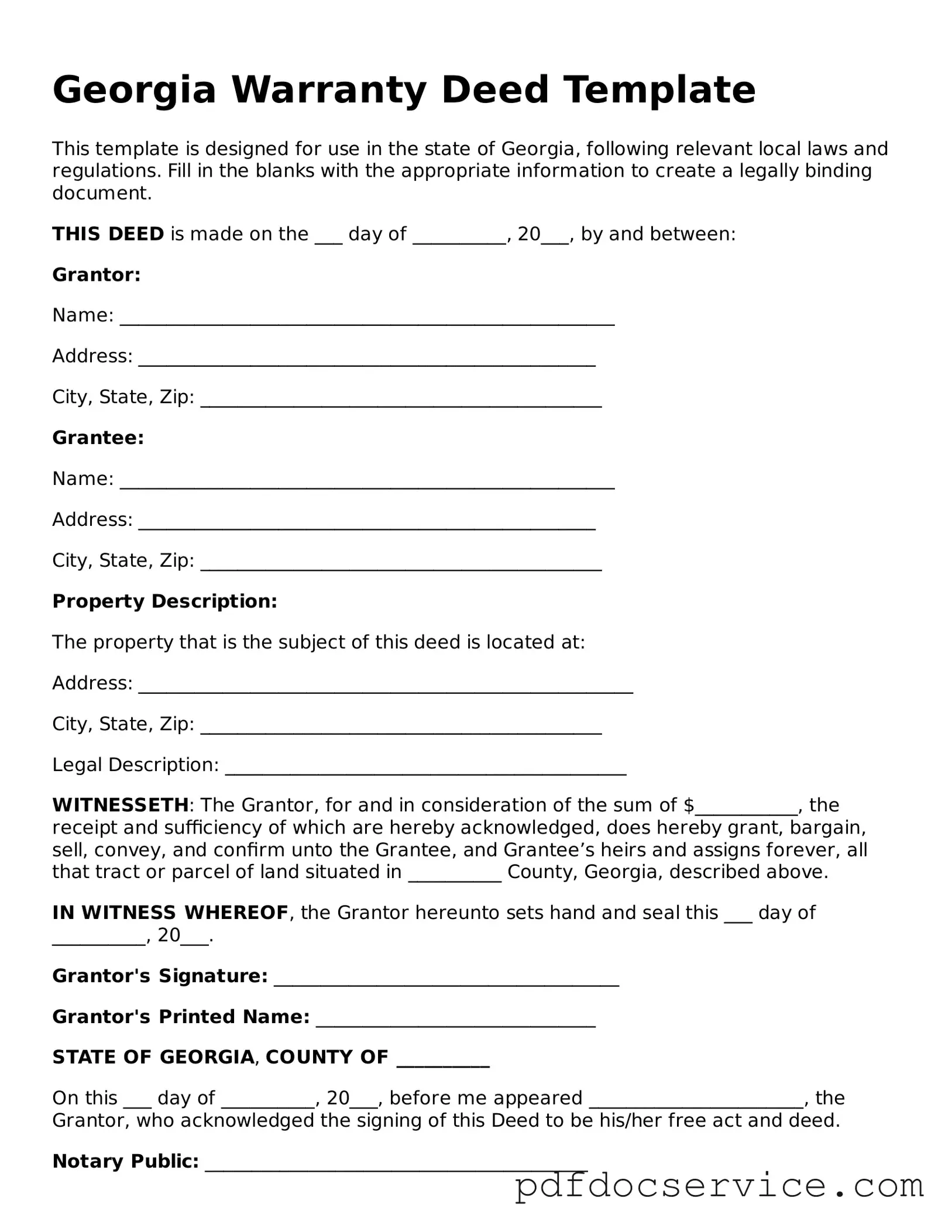

Blank Deed Form

A deed form is a legal document that formally transfers ownership of property from one party to another. This essential tool ensures that the transfer is recognized by law and provides a clear record of the transaction. Understanding the components and types of deeds can help you navigate property ownership effectively.

Open Deed Editor

Blank Deed Form

Open Deed Editor

Open Deed Editor

or

Get Deed PDF

Finish the form now and be done

Finish Deed online using simple edit, save, and download steps.