What is a Durable Power of Attorney?

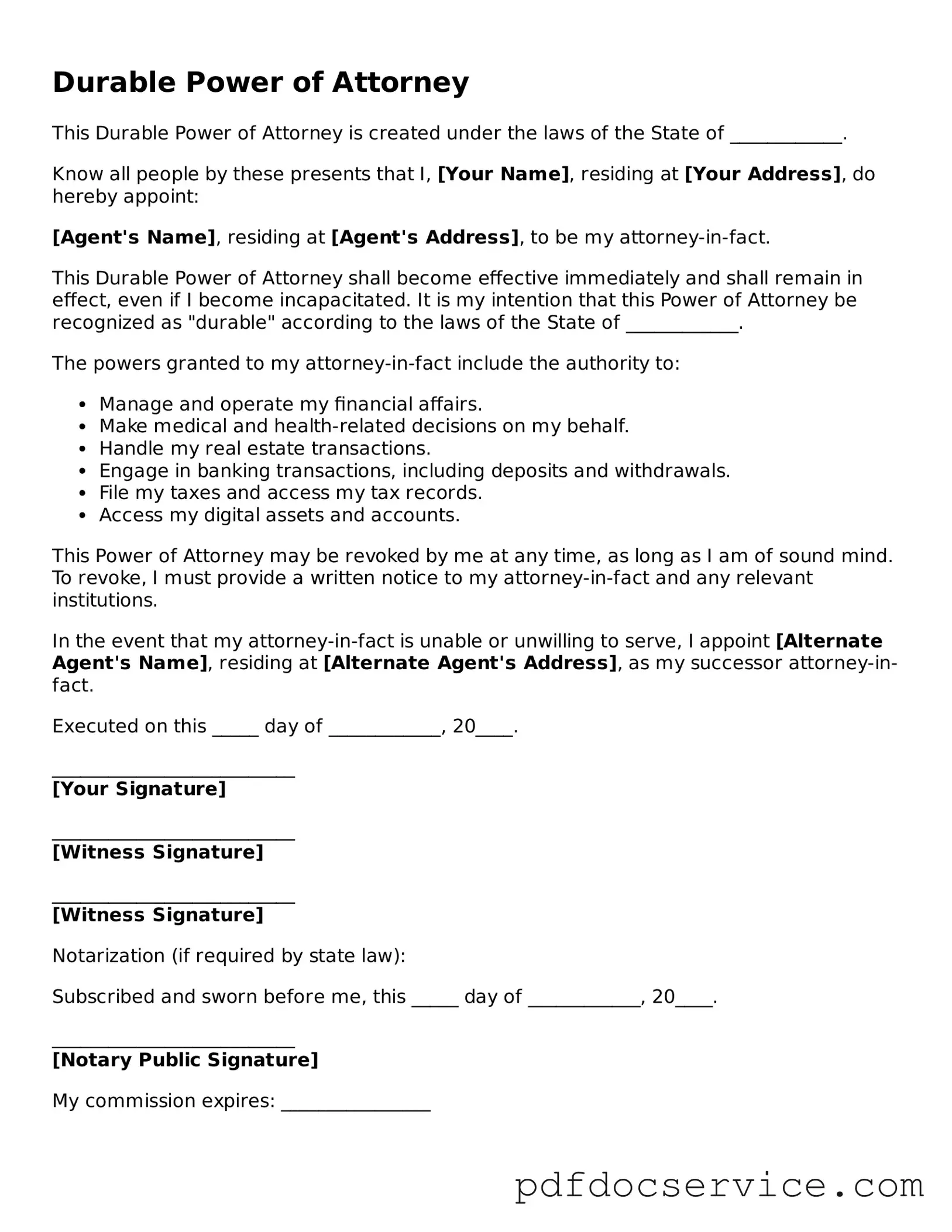

A Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney can provide peace of mind. It ensures that someone you trust can manage your financial and legal affairs if you are unable to do so. This can prevent potential disputes among family members and avoid the need for court intervention.

What decisions can my agent make on my behalf?

Your agent can make a variety of decisions, including:

-

Managing bank accounts and investments

-

Paying bills and expenses

-

Handling real estate transactions

-

Making decisions regarding your healthcare (if specified)

However, the specific powers granted can be tailored to your preferences in the document.

Can I limit the powers of my agent?

Yes, you can limit the powers of your agent by specifying the scope of authority in the Durable Power of Attorney document. For example, you can allow them to manage only certain financial accounts or make healthcare decisions only under specific circumstances.

How do I choose an agent?

Choosing an agent is a crucial decision. Consider someone who is trustworthy, responsible, and familiar with your financial and personal affairs. It is also beneficial to choose someone who is willing to take on the responsibilities involved.

A Durable Power of Attorney can be effective immediately upon signing or can be set to activate only upon your incapacity. This depends on the language used in the document. Be sure to clarify this when drafting the form.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer draft a Durable Power of Attorney, consulting with one can be beneficial. A lawyer can ensure that the document complies with state laws and accurately reflects your wishes.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To revoke it, you should notify your agent and any institutions or individuals that have a copy of the document. It is advisable to create a written revocation for clarity.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may appoint a guardian or conservator to manage your affairs. This process can be lengthy and may not align with your personal wishes.

How often should I review my Durable Power of Attorney?

It is wise to review your Durable Power of Attorney periodically, especially after major life events such as marriage, divorce, or the birth of a child. Changes in your health or financial situation may also necessitate updates to the document.