Fill Your Employee Advance Form

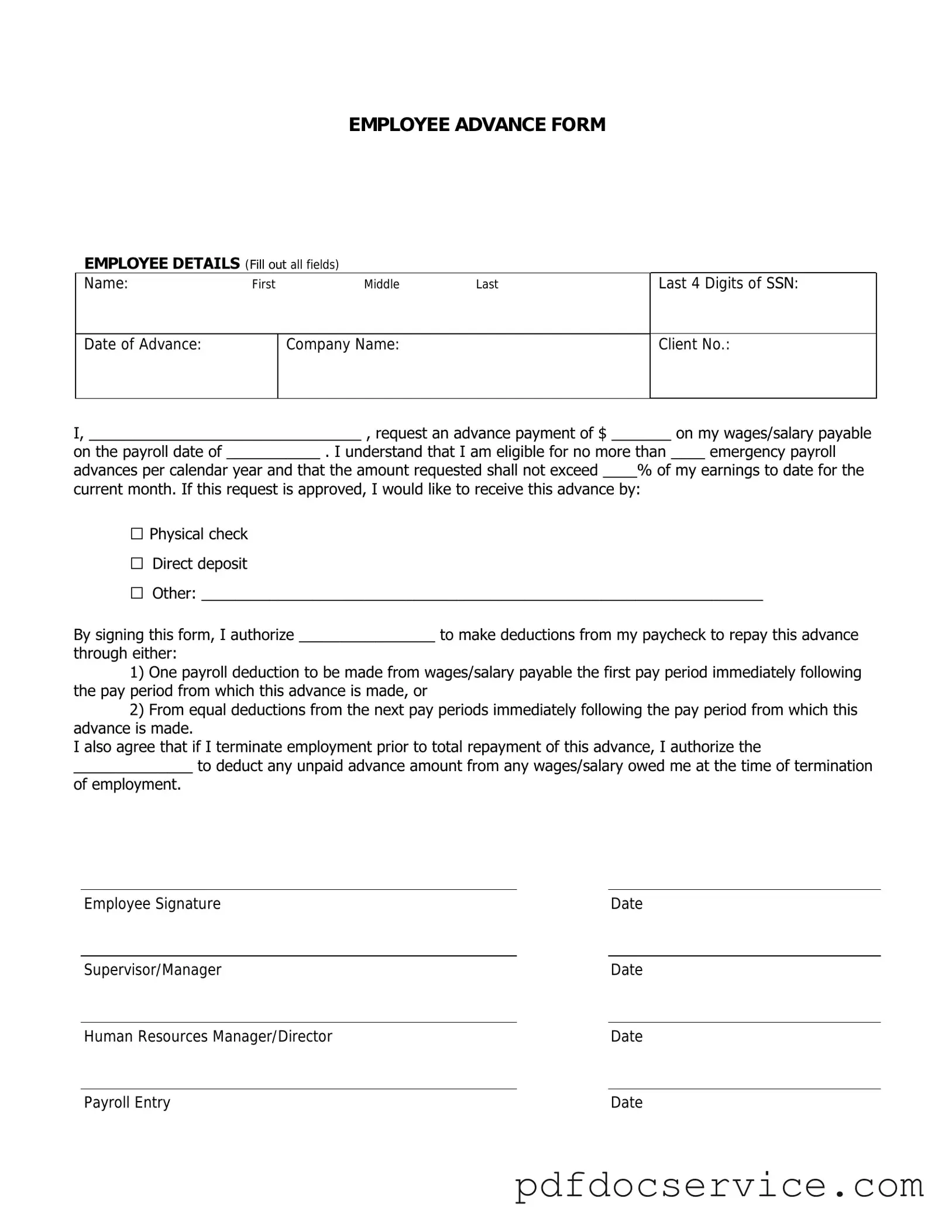

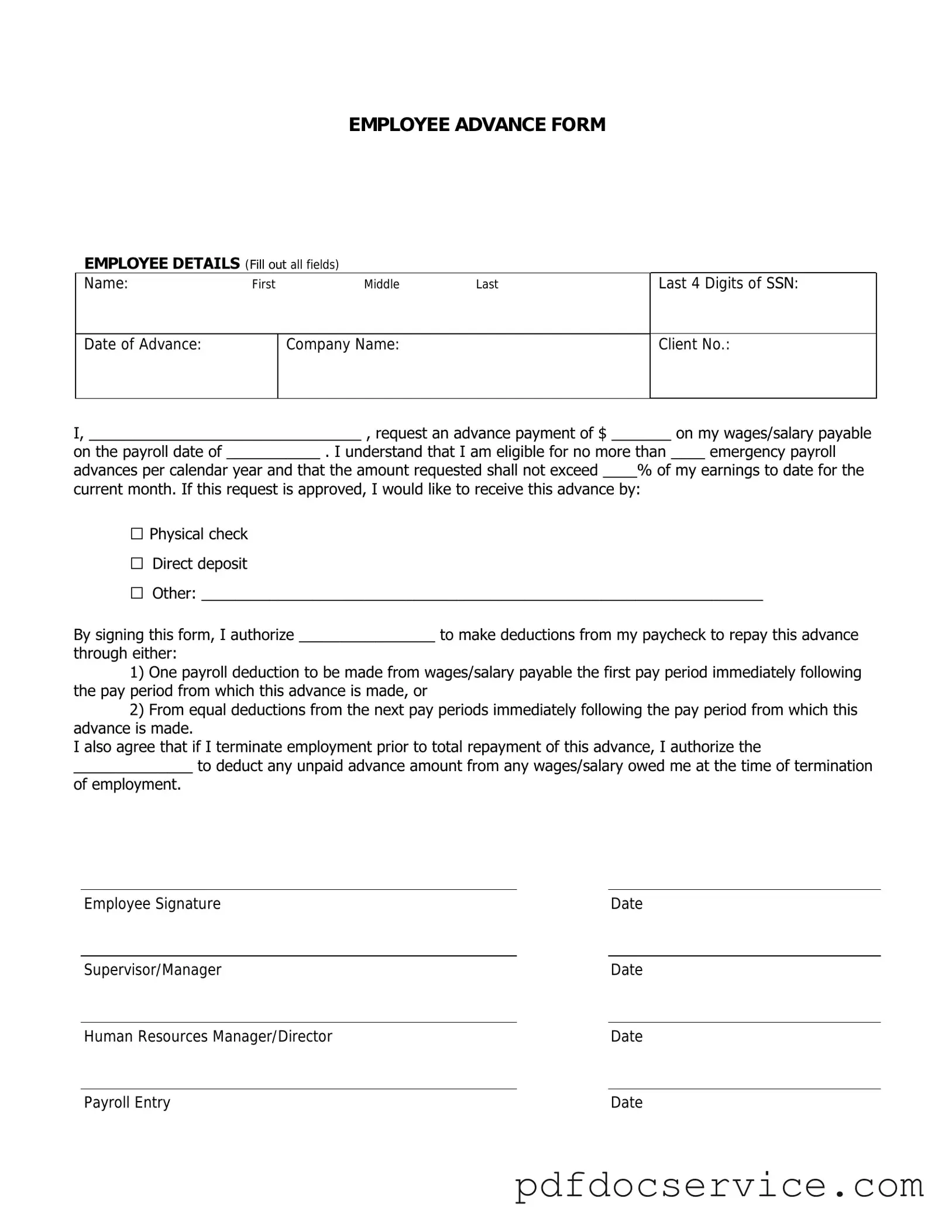

The Employee Advance form is a document that allows employees to request an advance on their salary for various reasons, such as unexpected expenses or emergencies. This form is essential for managing financial needs while ensuring that both the employee and employer are on the same page regarding repayment terms. Understanding how to properly fill out and submit this form can make a significant difference in accessing funds quickly and efficiently.

Open Employee Advance Editor

Fill Your Employee Advance Form

Open Employee Advance Editor

Open Employee Advance Editor

or

Get Employee Advance PDF

Finish the form now and be done

Finish Employee Advance online using simple edit, save, and download steps.