What is an Employee Loan Agreement?

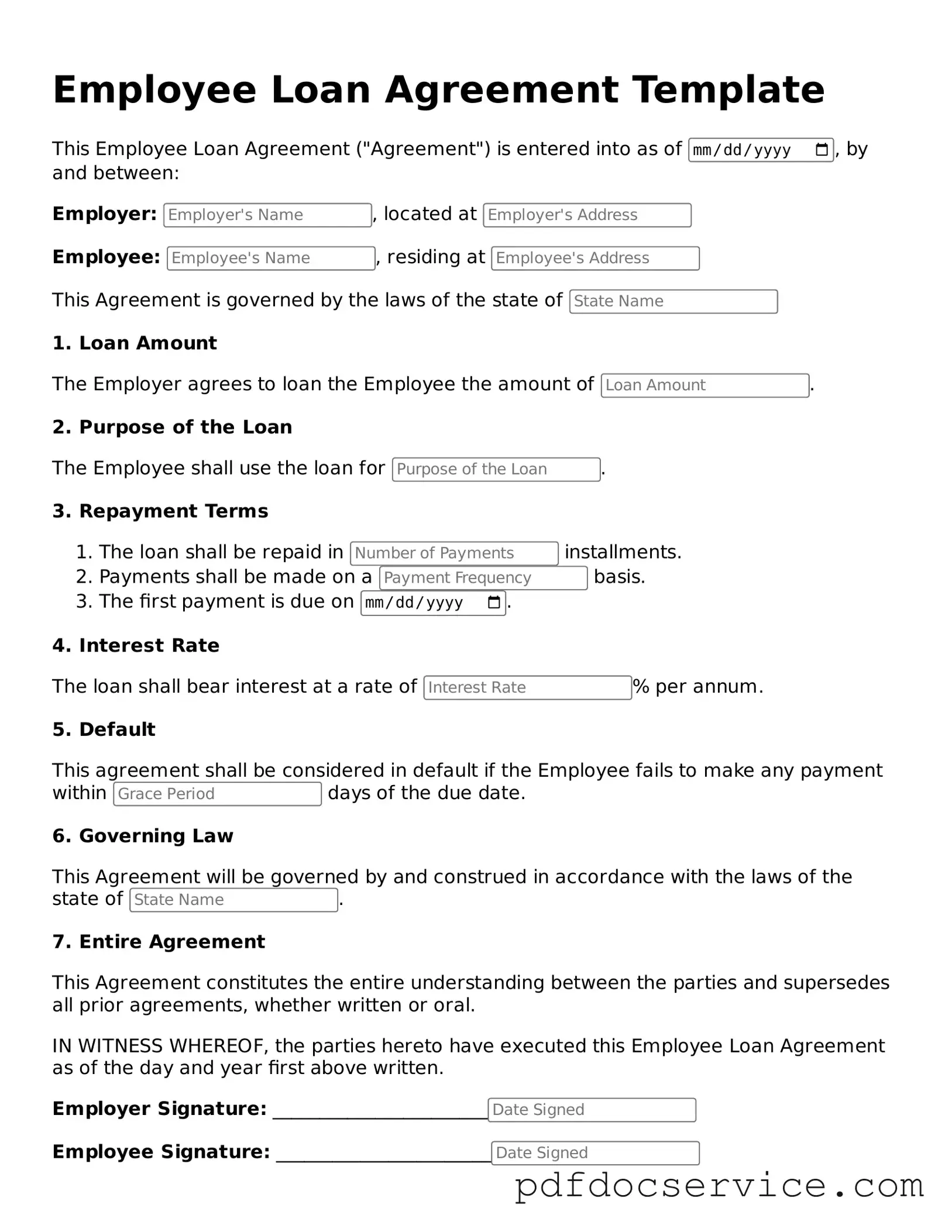

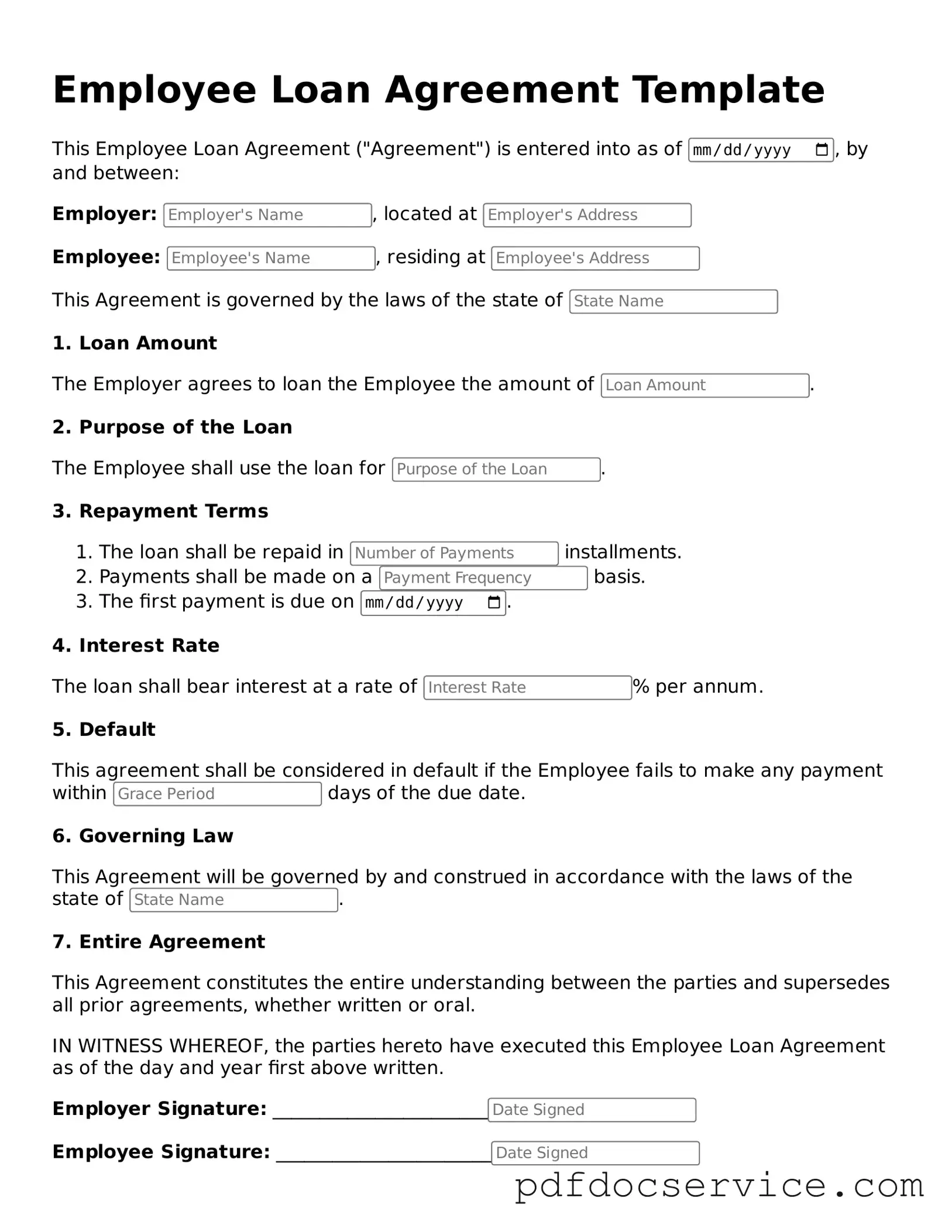

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement specifies the loan amount, repayment schedule, interest rates (if applicable), and any other relevant terms. It serves to protect both parties by clearly defining their rights and obligations.

Why would an employer offer a loan to an employee?

Employers may offer loans to employees for various reasons, including:

-

To assist employees during financial hardships.

-

To promote employee retention and loyalty.

-

To help employees manage unexpected expenses, such as medical bills or home repairs.

These loans can foster a supportive workplace culture and demonstrate the employer's commitment to employee well-being.

What should be included in an Employee Loan Agreement?

A comprehensive Employee Loan Agreement typically includes the following elements:

-

Loan amount: The total sum being lent to the employee.

-

Interest rate: If applicable, the rate at which interest will accrue on the loan.

-

Repayment schedule: Detailed information on how and when the employee will repay the loan.

-

Purpose of the loan: A brief explanation of why the loan is being provided.

-

Default terms: Conditions under which the loan may be considered in default and the actions that may follow.

-

Signatures: Both the employer and employee should sign the agreement to indicate their acceptance of the terms.

How does an employee repay the loan?

Repayment terms are outlined in the Employee Loan Agreement. Typically, repayments can be made through payroll deductions or direct payments. The agreement will specify the amount deducted from each paycheck and the frequency of these deductions. Employees should ensure they understand their repayment obligations to avoid defaulting on the loan.

What happens if an employee cannot repay the loan?

If an employee is unable to repay the loan, the terms of the agreement will dictate the next steps. This may include:

-

Negotiating a new repayment plan.

-

Assessing the possibility of loan forgiveness under certain circumstances.

-

Potential legal action if the loan is deemed in default.

Open communication between the employer and employee is crucial in these situations to find a mutually agreeable solution.

Are there tax implications for employee loans?

Yes, there can be tax implications associated with employee loans. If the loan is considered a gift or if the interest rate is below the market rate, the IRS may classify it differently for tax purposes. It’s advisable for both employers and employees to consult a tax professional to understand the potential tax consequences of the loan.

Can an Employee Loan Agreement be modified?

Yes, an Employee Loan Agreement can be modified if both parties agree to the changes. Any modifications should be documented in writing and signed by both the employer and the employee. This ensures that all parties have a clear understanding of the new terms and helps prevent misunderstandings in the future.

Is legal advice recommended when creating an Employee Loan Agreement?

While it is not mandatory, seeking legal advice when creating an Employee Loan Agreement is highly recommended. Legal professionals can help ensure that the agreement complies with applicable laws and regulations, protecting both the employer and employee. This step can help avoid potential disputes and ensure clarity in the agreement.