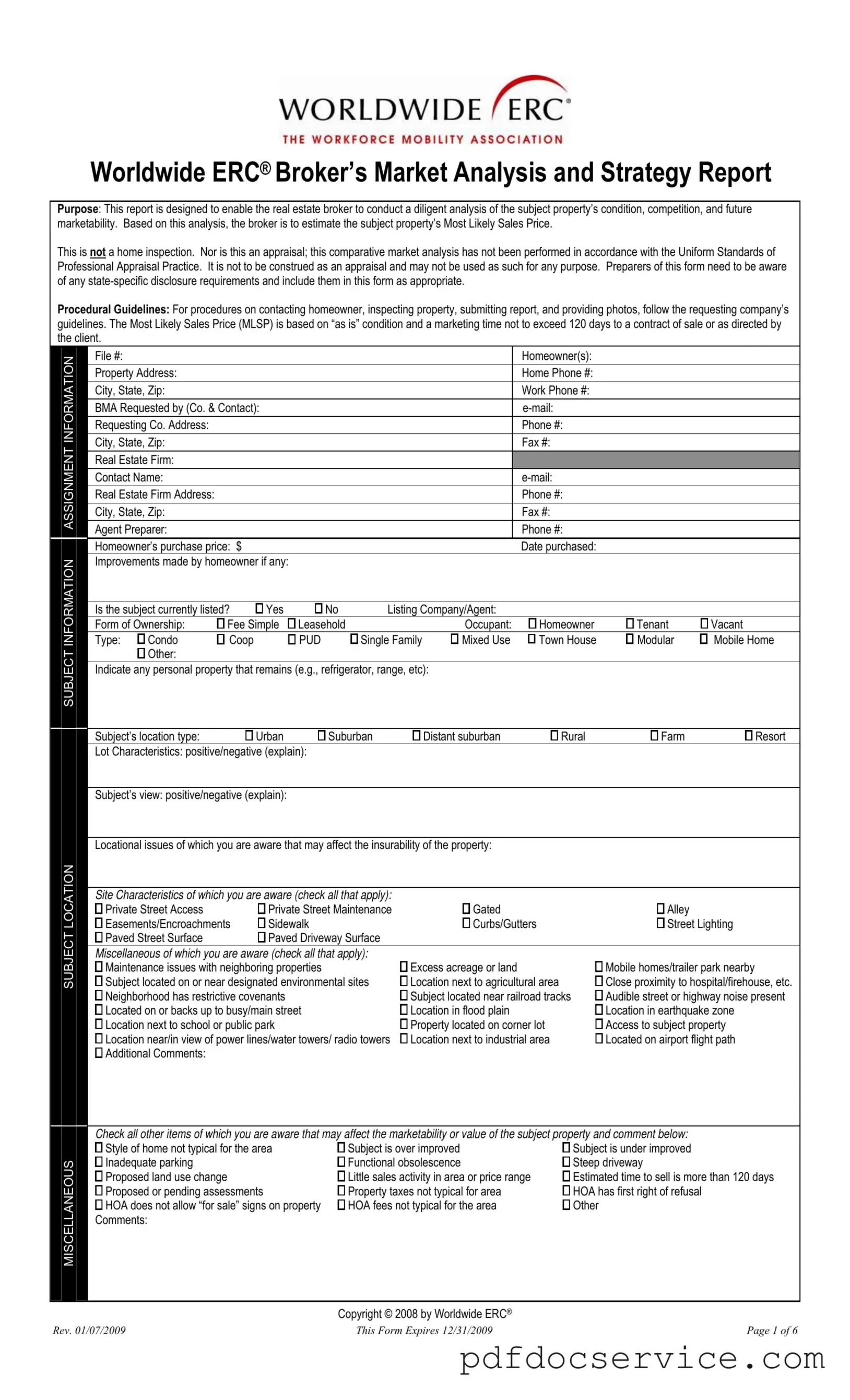

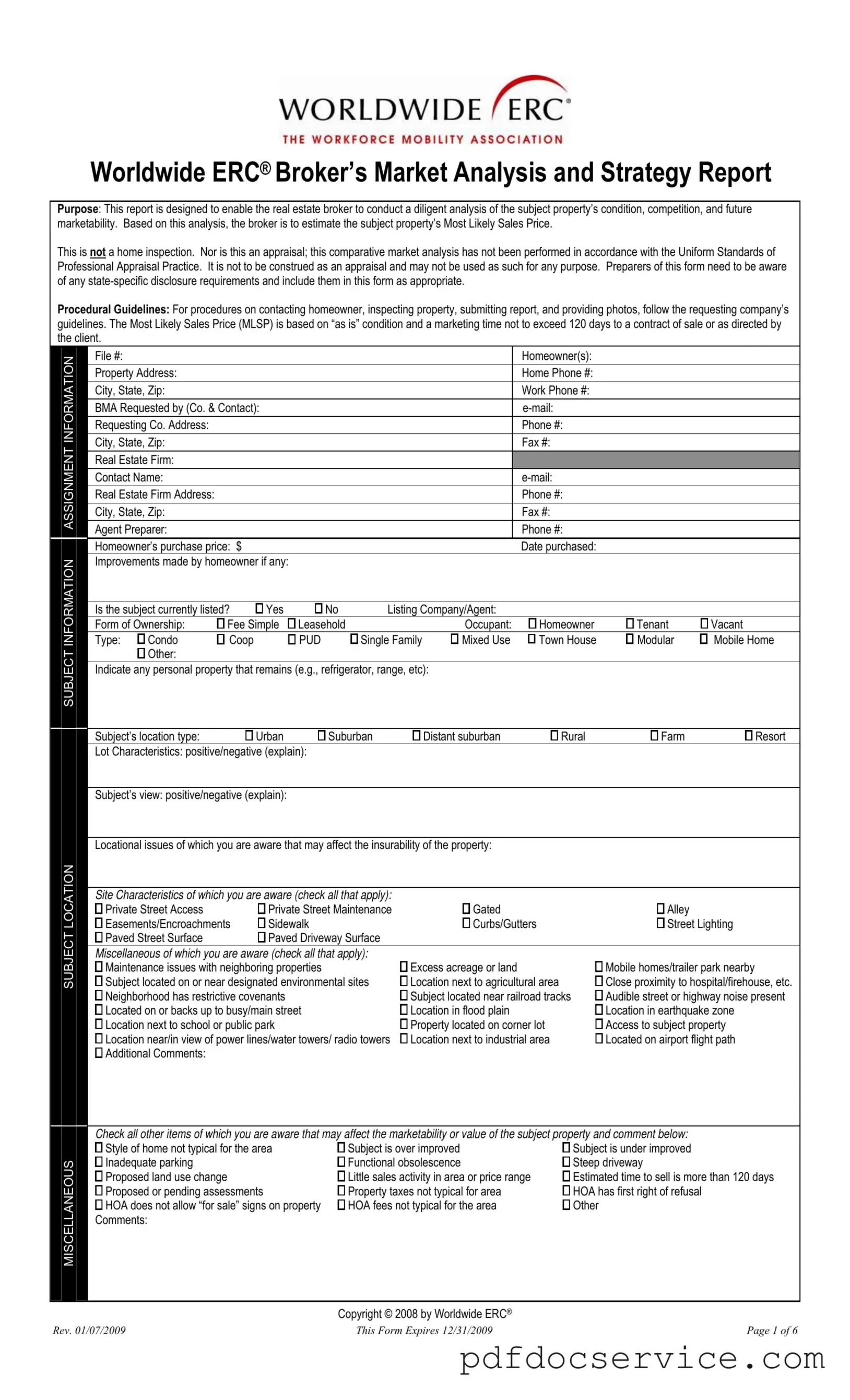

The ERC Broker Market Analysis form is designed to help real estate brokers assess a property's condition, competition, and future marketability. It allows brokers to estimate the Most Likely Sales Price (MLSP) based on their analysis. This report is not a home inspection or appraisal and should not be used as such.

This form should be completed by licensed real estate brokers who are familiar with the property and its market. They need to conduct a thorough analysis and provide detailed information about the property and its surroundings.

The form requires various details, including:

-

Property address and owner information

-

Real estate firm details

-

Property characteristics (e.g., type, condition, improvements)

-

Neighborhood and market conditions

-

Comparable sales and listings

What is the Most Likely Sales Price (MLSP)?

The MLSP is an estimate of the price at which the property is likely to sell, based on its current condition and market conditions. This estimate assumes a marketing time not exceeding 120 days unless otherwise directed by the client.

Yes, brokers should follow the requesting company's guidelines for contacting homeowners, inspecting properties, submitting reports, and providing photos. Additionally, brokers must be aware of any state-specific disclosure requirements.

This form can be used for various property types, including single-family homes, condos, townhouses, and mixed-use properties. It is adaptable to different property characteristics and market conditions.

What should be included in the property condition section?

The property condition section should include observations about the home's decor, any signs of damage, maintenance issues, and any required repairs. Brokers should check relevant boxes and provide comments to explain their findings.

How should brokers handle financing considerations in the analysis?

Brokers should identify the most probable means of financing for the property, describe any necessary financing concessions, and note any potential issues that may affect financing, such as property condition or zoning restrictions.

What are the benefits of completing this analysis?

Completing the ERC Broker Market Analysis helps brokers provide clients with a comprehensive understanding of the property’s value and market position. It aids in setting realistic expectations for pricing and selling strategies.

The ERC Broker Market Analysis form is periodically reviewed and updated to ensure it reflects current market practices and legal requirements. The version mentioned in the document expires on December 31, 2009, indicating the need for users to check for the latest version.