What are the Articles of Incorporation in Florida?

The Articles of Incorporation is a legal document that establishes a corporation in Florida. It serves as the foundation for your business entity and outlines key information, such as the corporation's name, purpose, and structure. Filing this document with the Florida Department of State is essential to legally form your corporation and gain the benefits associated with this business structure.

What information do I need to include in the Articles of Incorporation?

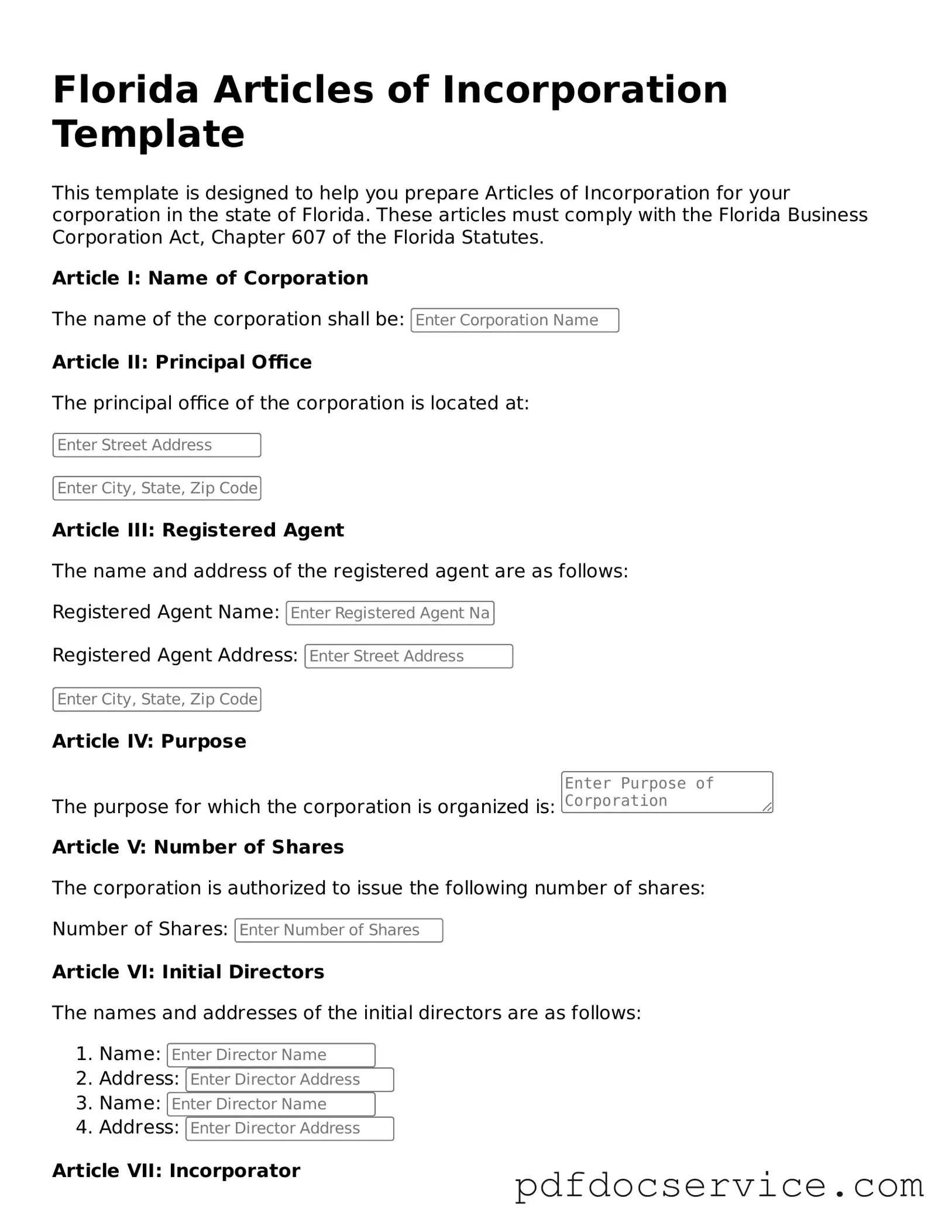

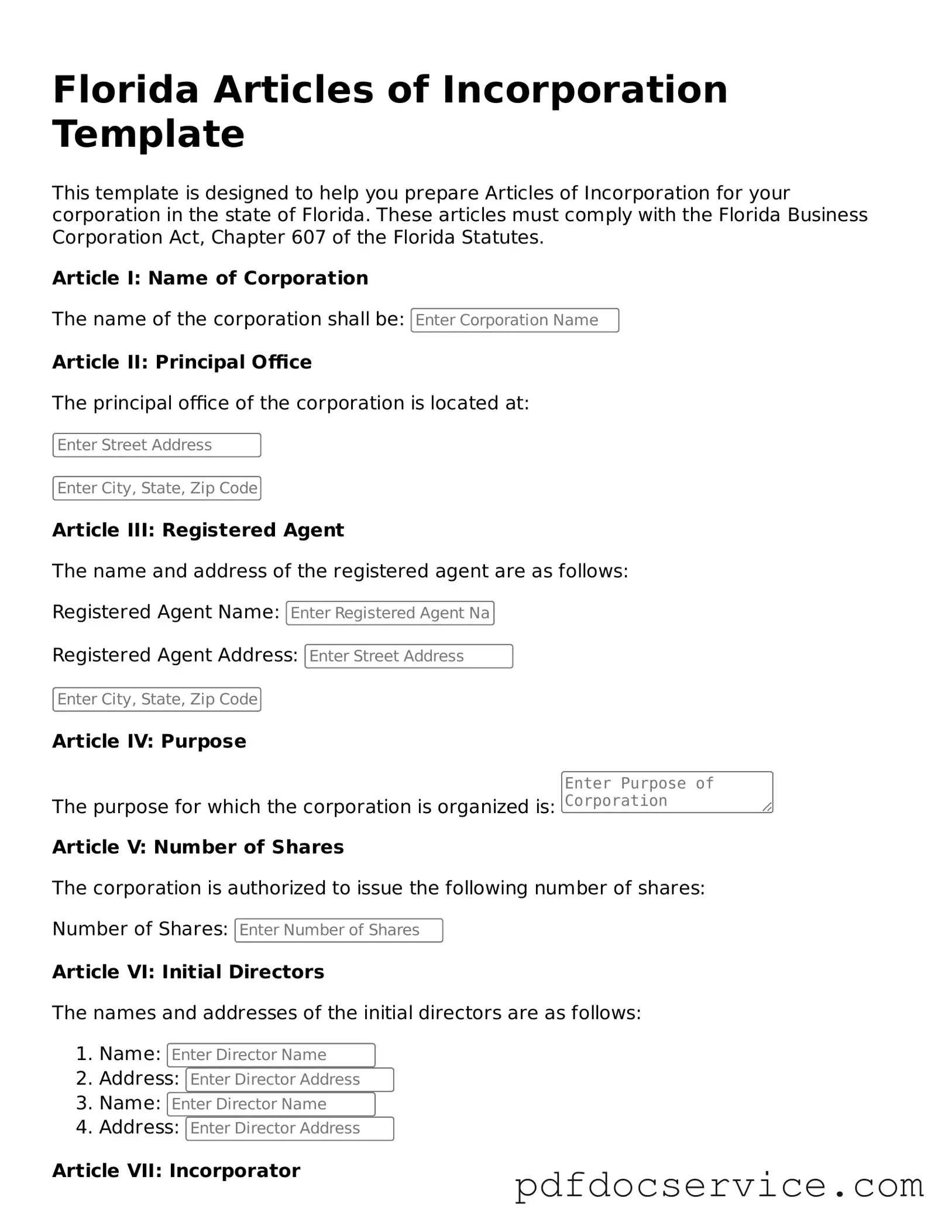

When completing the Articles of Incorporation form, you will need to provide the following information:

-

The name of your corporation, which must be unique and not already in use.

-

The principal office address.

-

The purpose of the corporation, which can be general or specific.

-

The names and addresses of the initial directors.

-

The registered agent's name and address, who will receive legal documents on behalf of the corporation.

-

The number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. If you choose to file online, you can visit the Florida Department of State's website and complete the form there. Alternatively, you can download the form, fill it out, and mail it to the appropriate address. Be sure to include the required filing fee, which varies depending on the type of corporation you are forming.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Florida typically ranges from $70 to $150, depending on the type of corporation (for-profit or non-profit) and the number of shares you plan to issue. It’s essential to check the Florida Department of State's website for the most current fee schedule, as fees may change.

How long does it take for my Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, online submissions are processed faster, often within a few business days. Mail submissions may take longer, sometimes up to two weeks or more. To expedite the process, consider filing online and ensuring all information is accurate and complete.

Do I need to create bylaws for my corporation?

Yes, while bylaws are not filed with the state, they are essential for the internal governance of your corporation. Bylaws outline how your corporation will operate, including rules for meetings, voting procedures, and the roles of directors and officers. Having clear bylaws helps prevent disputes and ensures that everyone involved understands their responsibilities.

Can I amend my Articles of Incorporation after filing?

Yes, you can amend your Articles of Incorporation if necessary. This might be needed for various reasons, such as changing the corporation's name, altering the number of authorized shares, or modifying the registered agent. To amend, you must file a specific form with the Florida Department of State and pay the required amendment fee. It's crucial to keep your Articles of Incorporation up to date to reflect the current status of your corporation.