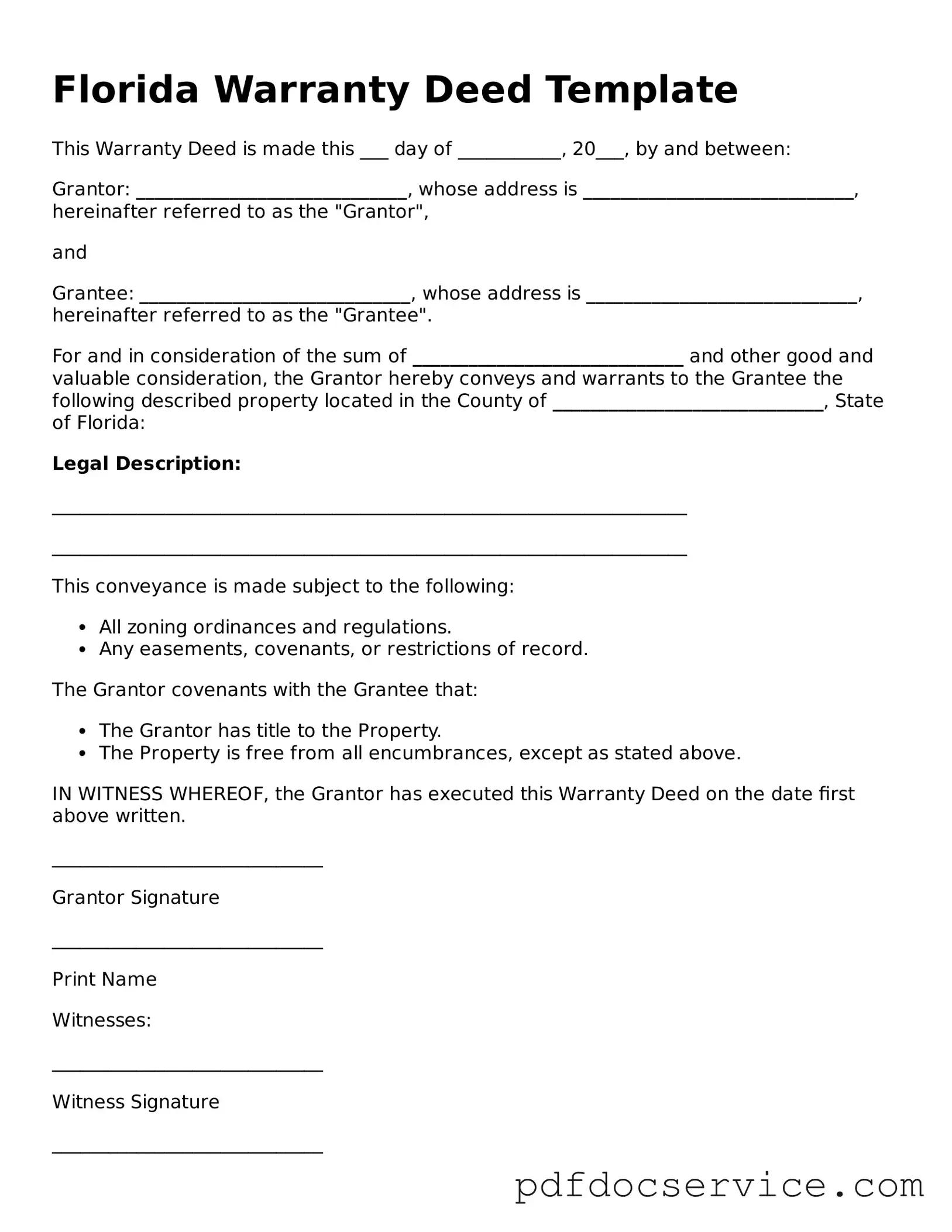

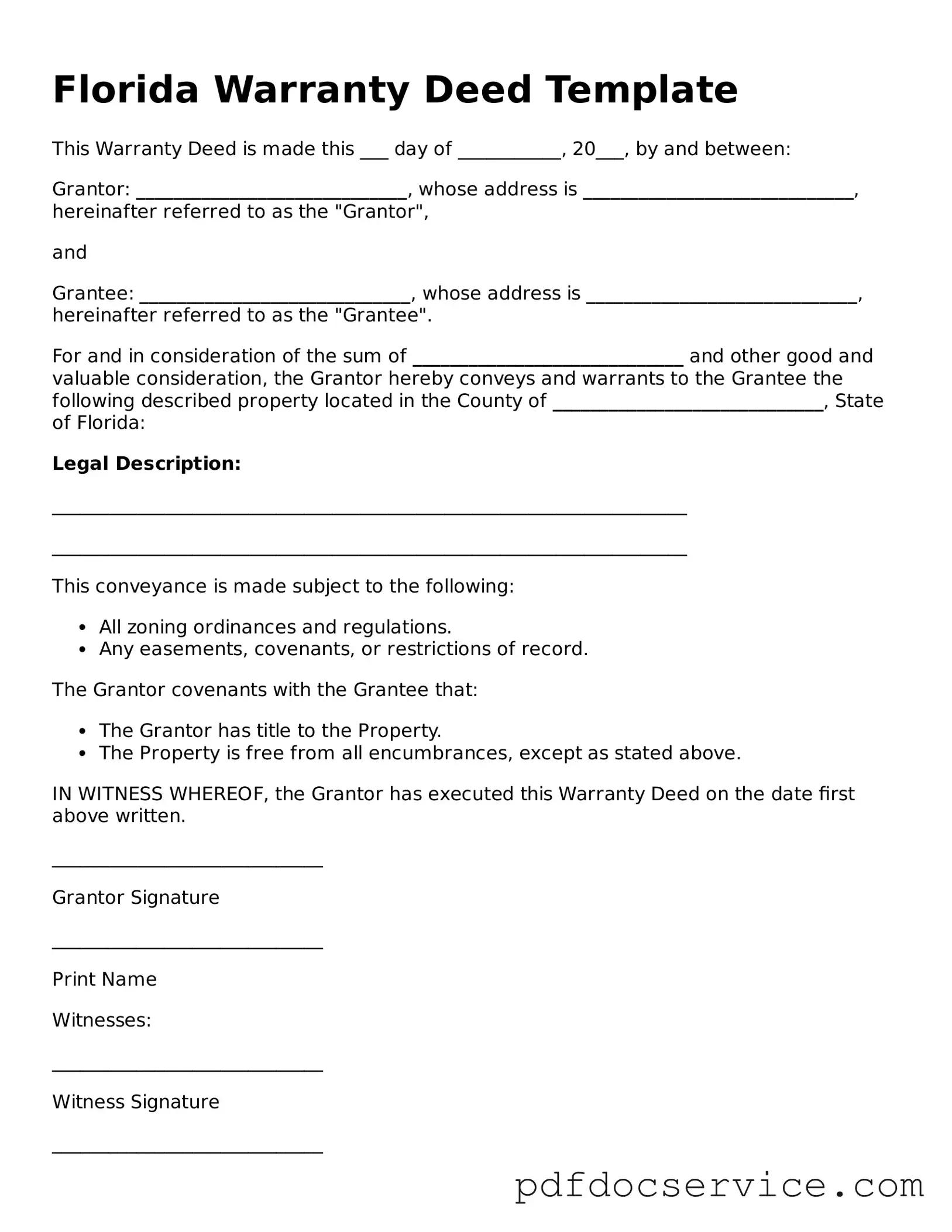

A Florida Deed form is a legal document used to transfer ownership of real estate in the state of Florida. It serves as proof of the transfer and outlines the details of the property, including the names of the buyer and seller, the legal description of the property, and any conditions of the transfer.

What types of deeds are available in Florida?

Florida offers several types of deeds, including:

-

Warranty Deed:

Guarantees that the seller holds clear title to the property and has the right to sell it.

-

Quitclaim Deed:

Transfers any interest the seller has in the property without guaranteeing clear title.

-

Special Warranty Deed:

Offers limited warranties, only covering the time the seller owned the property.

-

Personal Representative's Deed:

Used by an executor to transfer property from an estate.

To fill out a Florida Deed form, follow these steps:

-

Begin with the names and addresses of the grantor (seller) and grantee (buyer).

-

Include a legal description of the property. This can usually be found on the current deed or property tax statement.

-

State the consideration (the amount paid for the property).

-

Sign the deed in front of a notary public.

Do I need a lawyer to create a Florida Deed?

While it's not required to have a lawyer to create a Florida Deed, it can be helpful, especially if you're unfamiliar with the process. A lawyer can ensure that the deed is filled out correctly and meets all legal requirements.

How do I record a Florida Deed?

To record a Florida Deed, take the signed and notarized document to the county clerk's office in the county where the property is located. There may be a small fee for recording. Once recorded, the deed becomes part of the public record.

What happens after I record the Deed?

After you record the deed, it serves as official proof of ownership. The county clerk will provide you with a stamped copy of the recorded deed. Keep this copy for your records, as it may be needed for future transactions or legal matters.

Are there any taxes associated with transferring property in Florida?

Yes, there may be documentary stamp taxes and other fees associated with transferring property in Florida. The amount can vary based on the property's sale price and location. It's wise to check with the local tax collector's office for specific rates.

Can I change a Florida Deed after it has been recorded?

To change a Florida Deed after it has been recorded, you typically need to create a new deed that reflects the changes. This new deed must also be signed, notarized, and recorded with the county clerk. Simple corrections can sometimes be made through a corrective deed.