What is a Durable Power of Attorney in Florida?

A Durable Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. It is important for individuals to choose a trusted person as their agent, as this person will have significant authority over financial and legal matters.

Why is a Durable Power of Attorney important?

This document is crucial because it ensures that someone can manage your affairs if you are unable to do so yourself. Without a Durable Power of Attorney, your loved ones may face legal hurdles and delays in accessing your finances or making decisions on your behalf. This can lead to stress and complications during difficult times.

What types of decisions can an agent make under a Durable Power of Attorney?

An agent can make a variety of decisions, including:

-

Managing bank accounts and investments

-

Paying bills and expenses

-

Buying or selling property

-

Handling tax matters

-

Making healthcare decisions, if specified

The extent of the agent's authority can be tailored to the principal's preferences, allowing for specific limitations or broad powers.

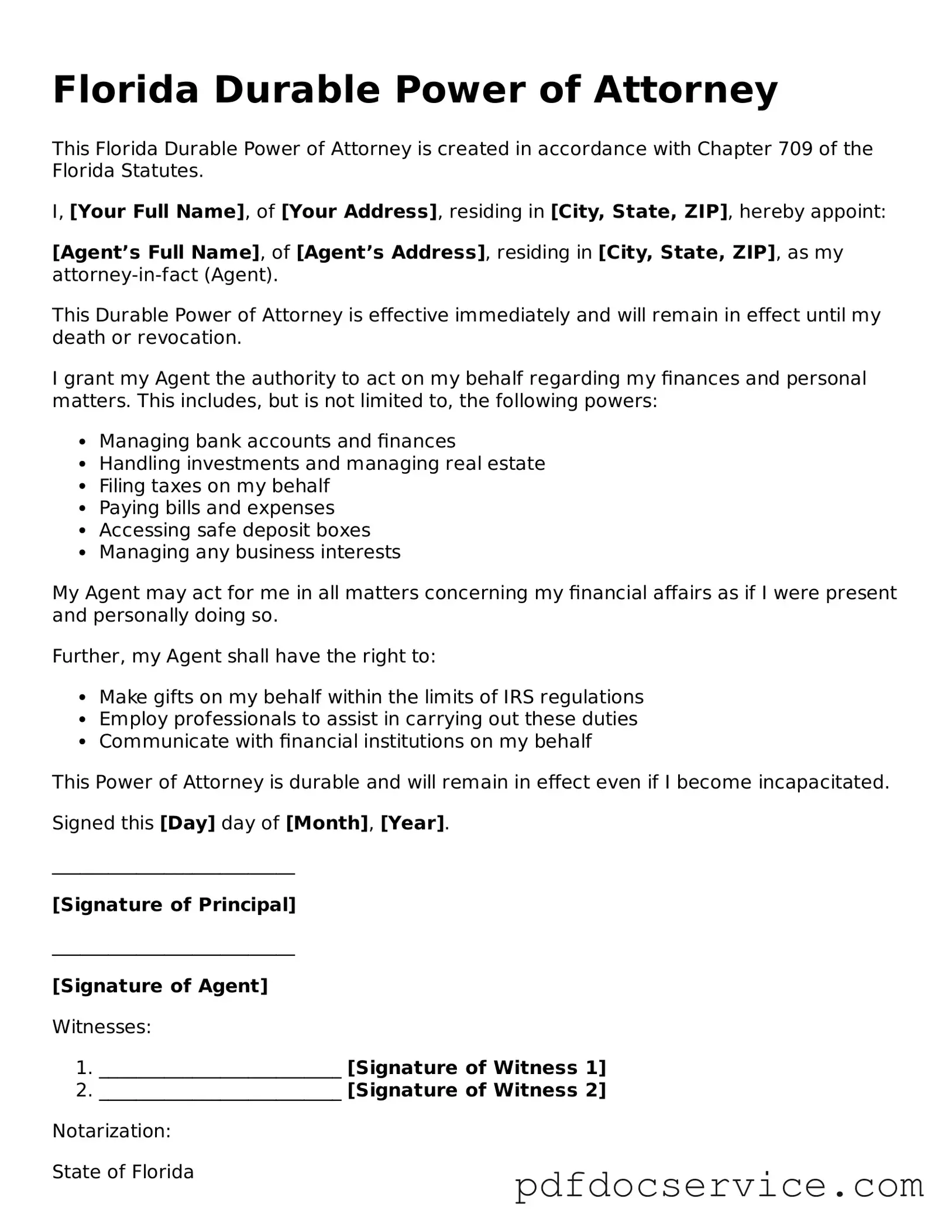

How do I create a Durable Power of Attorney in Florida?

To create a Durable Power of Attorney in Florida, follow these steps:

-

Choose a trusted agent who will act in your best interest.

-

Obtain the Durable Power of Attorney form, which can be found online or through legal resources.

-

Fill out the form, specifying the powers granted to the agent.

-

Sign the document in the presence of a notary public and two witnesses.

It is advisable to keep the original document in a safe place and provide copies to your agent and relevant family members.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any institutions that may have a copy of the original document. This ensures that your wishes are clear and that the previous agent no longer has authority.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your family may need to go through a court process to obtain guardianship. This can be time-consuming, costly, and emotionally taxing for your loved ones. Having a Durable Power of Attorney in place can help avoid these challenges.

Is a Durable Power of Attorney the same as a Healthcare Proxy?

No, a Durable Power of Attorney primarily deals with financial and legal matters, while a Healthcare Proxy specifically allows someone to make medical decisions on your behalf. However, both documents can be important for comprehensive planning. It is often recommended to have both in place to ensure all aspects of your care and affairs are managed according to your wishes.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer to create a Durable Power of Attorney in Florida, consulting with one can provide valuable guidance. A lawyer can help ensure that the document meets all legal requirements and reflects your intentions clearly. This can prevent potential disputes or misunderstandings in the future.