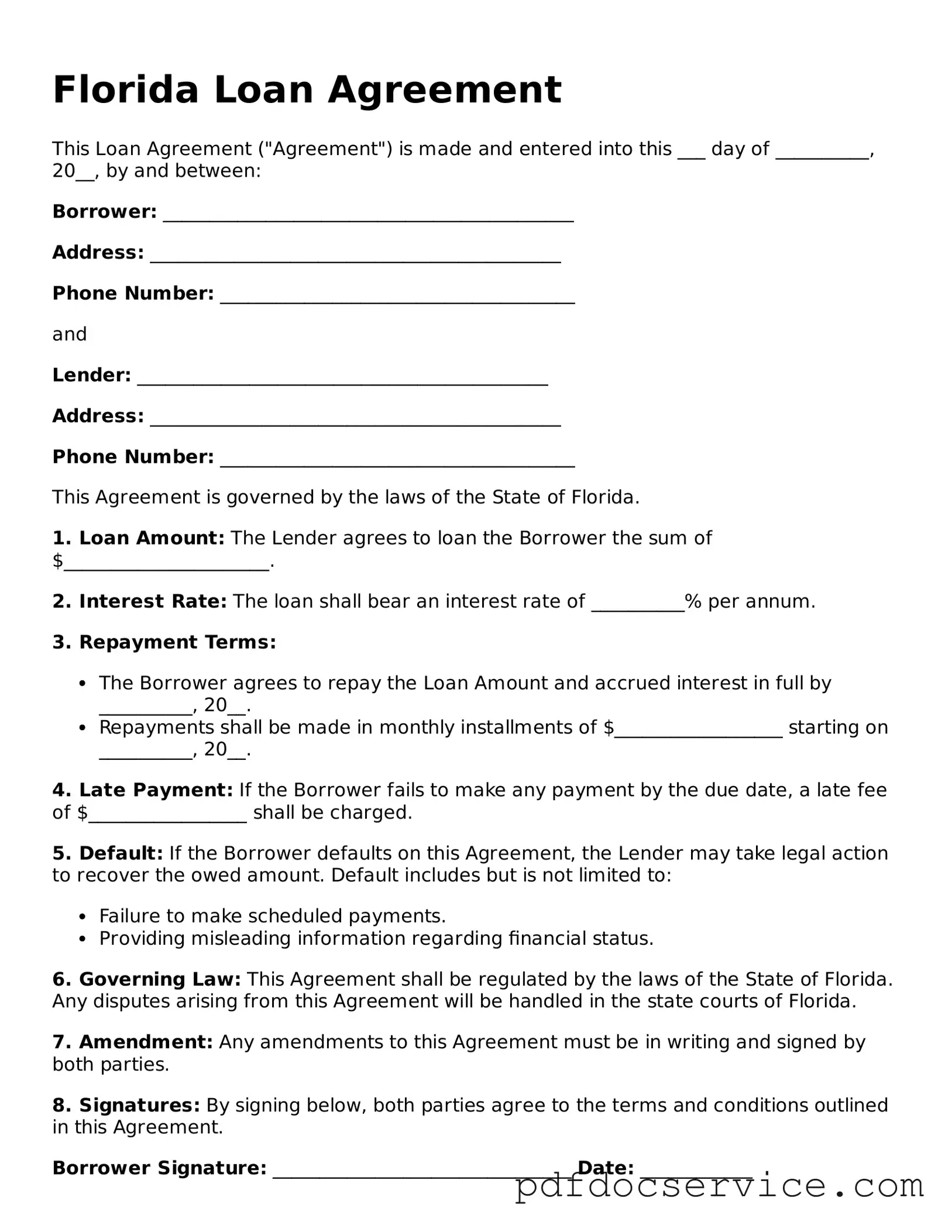

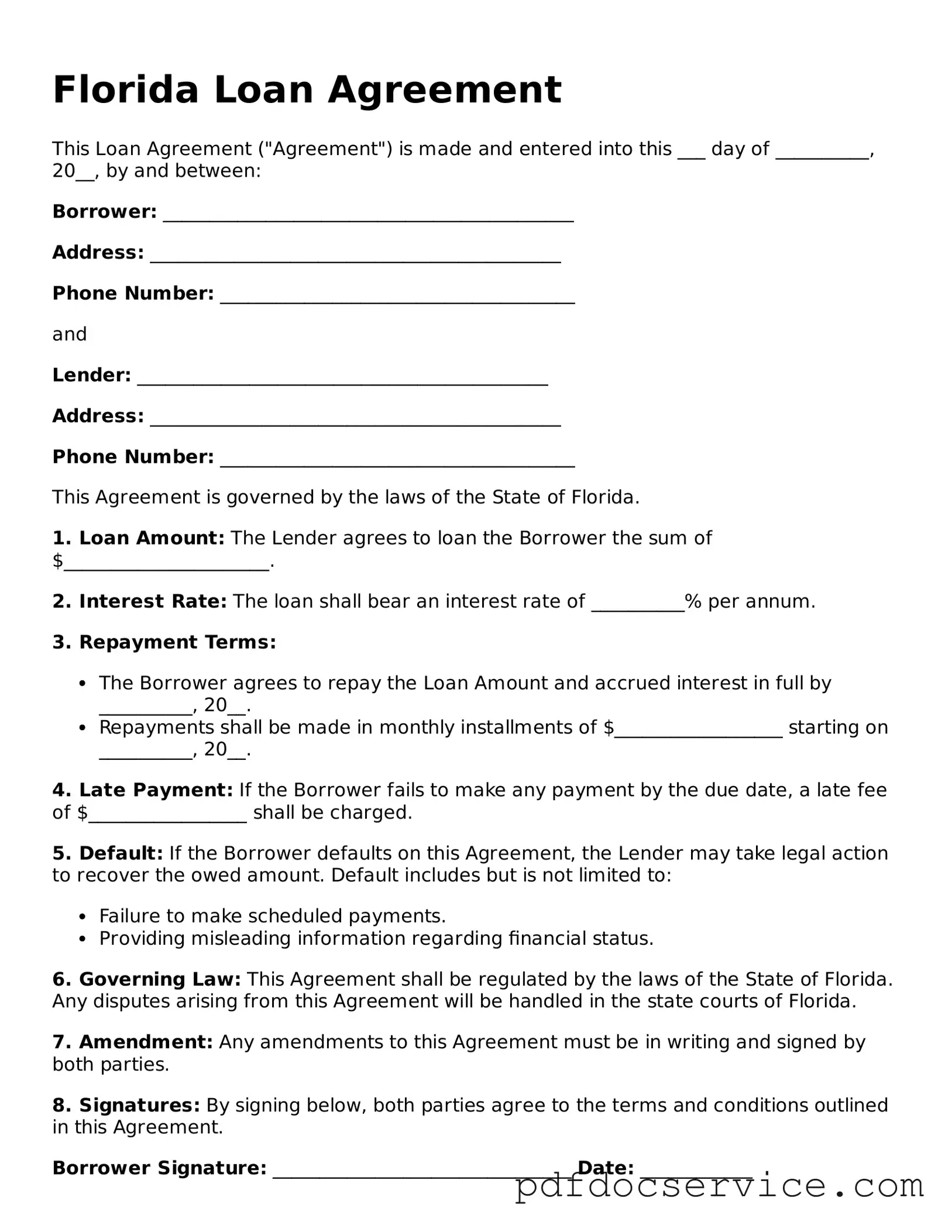

Printable Loan Agreement Template for Florida

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This essential tool helps both parties understand their rights and responsibilities, ensuring a clear framework for repayment. By using this form, individuals can protect their interests and facilitate a smoother lending process.

Open Loan Agreement Editor

Printable Loan Agreement Template for Florida

Open Loan Agreement Editor

Open Loan Agreement Editor

or

Get Loan Agreement PDF

Finish the form now and be done

Finish Loan Agreement online using simple edit, save, and download steps.