What is a Power of Attorney in Florida?

A Power of Attorney (POA) in Florida is a legal document that allows one person, known as the principal, to grant another person, known as the agent or attorney-in-fact, the authority to make decisions on their behalf. This can include financial, legal, or healthcare decisions, depending on how the document is structured.

Why should I consider creating a Power of Attorney?

Creating a Power of Attorney is important for several reasons:

-

It ensures that someone you trust can manage your affairs if you become unable to do so.

-

It can help avoid court interventions, such as guardianship, which can be time-consuming and costly.

-

It allows you to specify the powers you wish to grant, providing control over your affairs.

What types of Power of Attorney are available in Florida?

Florida recognizes several types of Power of Attorney, including:

-

Durable Power of Attorney:

Remains effective even if the principal becomes incapacitated.

-

Springing Power of Attorney:

Becomes effective only upon a specified event, such as incapacitation.

-

Healthcare Power of Attorney:

Specifically grants authority to make healthcare decisions on behalf of the principal.

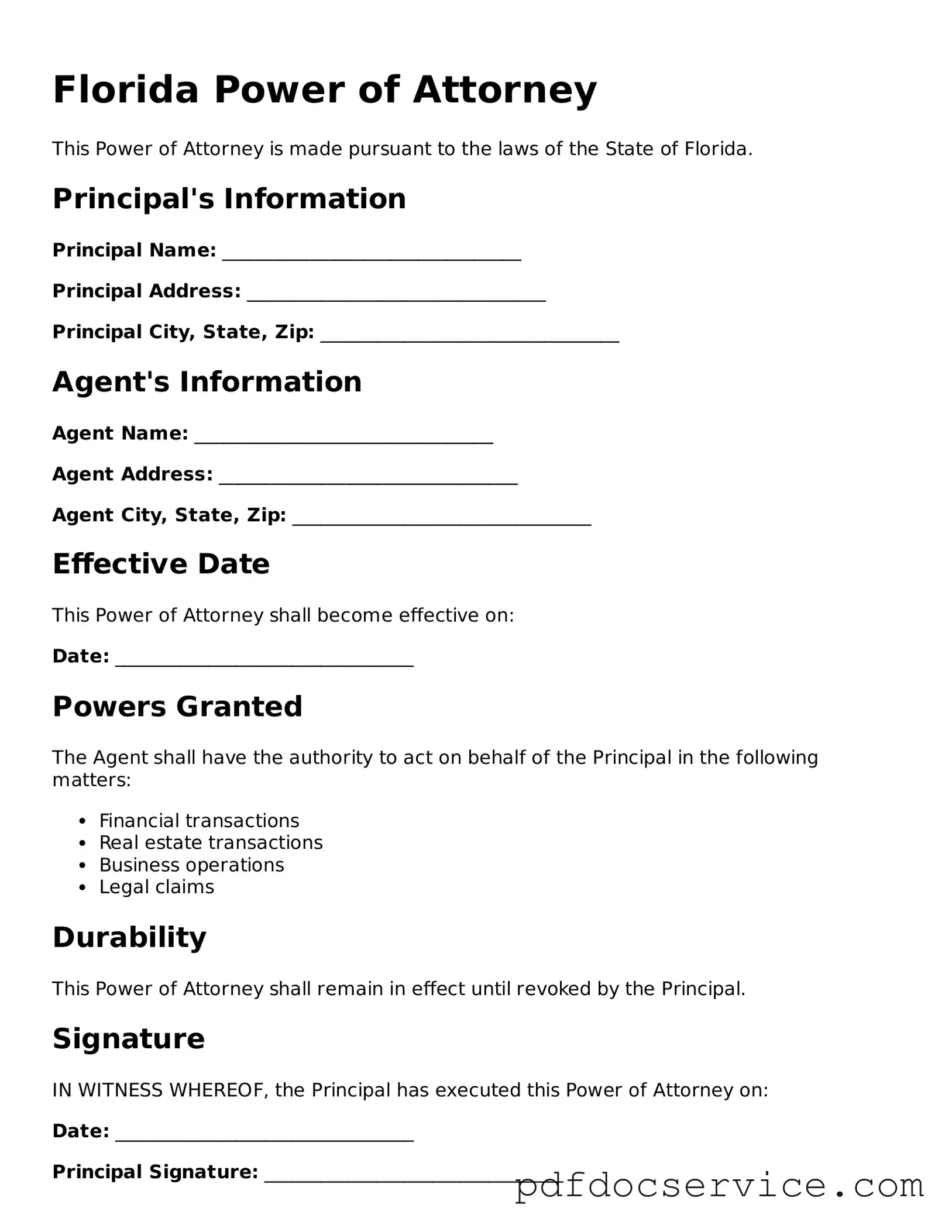

How do I create a Power of Attorney in Florida?

To create a Power of Attorney in Florida, follow these steps:

-

Choose a trusted individual to act as your agent.

-

Clearly outline the powers you wish to grant in the document.

-

Sign the document in the presence of a notary public and two witnesses.

Can I revoke a Power of Attorney in Florida?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To do this, you must create a written revocation document and notify your agent. It is also advisable to inform any institutions or individuals who may have relied on the original Power of Attorney.

What happens if I do not have a Power of Attorney and become incapacitated?

If you become incapacitated without a Power of Attorney in place, your loved ones may need to go through a legal process to obtain guardianship. This can be lengthy and expensive, and the court will decide who will manage your affairs, which may not align with your wishes.

Are there any limitations on the powers granted in a Power of Attorney?

Yes, a Power of Attorney can have limitations. You can specify which powers are granted and which are not. For example, you might allow your agent to manage financial accounts but not to make healthcare decisions. It’s essential to be clear about your intentions in the document.

Is a Power of Attorney valid if I move to another state?

A Power of Attorney created in Florida is generally valid in other states, but it’s wise to check the specific laws of the new state. Some states may have different requirements or may require a new document to be executed.

What are the responsibilities of an agent under a Power of Attorney?

An agent under a Power of Attorney has a fiduciary duty to act in the best interest of the principal. This includes:

-

Managing the principal's assets prudently.

-

Keeping accurate records of all transactions.

-

Communicating with the principal (if possible) about decisions made.

Can I include specific instructions in my Power of Attorney?

Yes, you can include specific instructions in your Power of Attorney. This can be particularly important for healthcare decisions or financial transactions. Clearly outlining your wishes helps ensure that your agent acts according to your preferences.