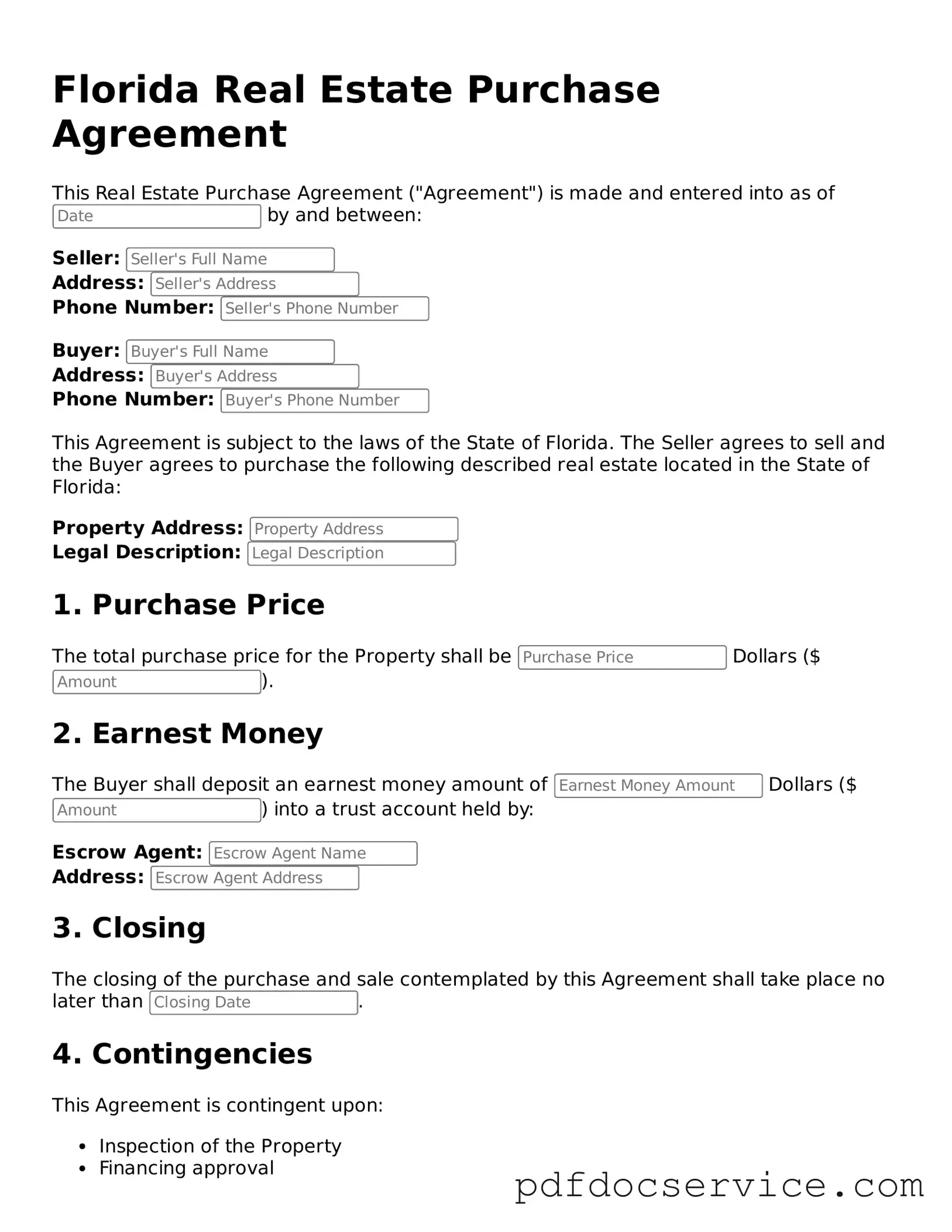

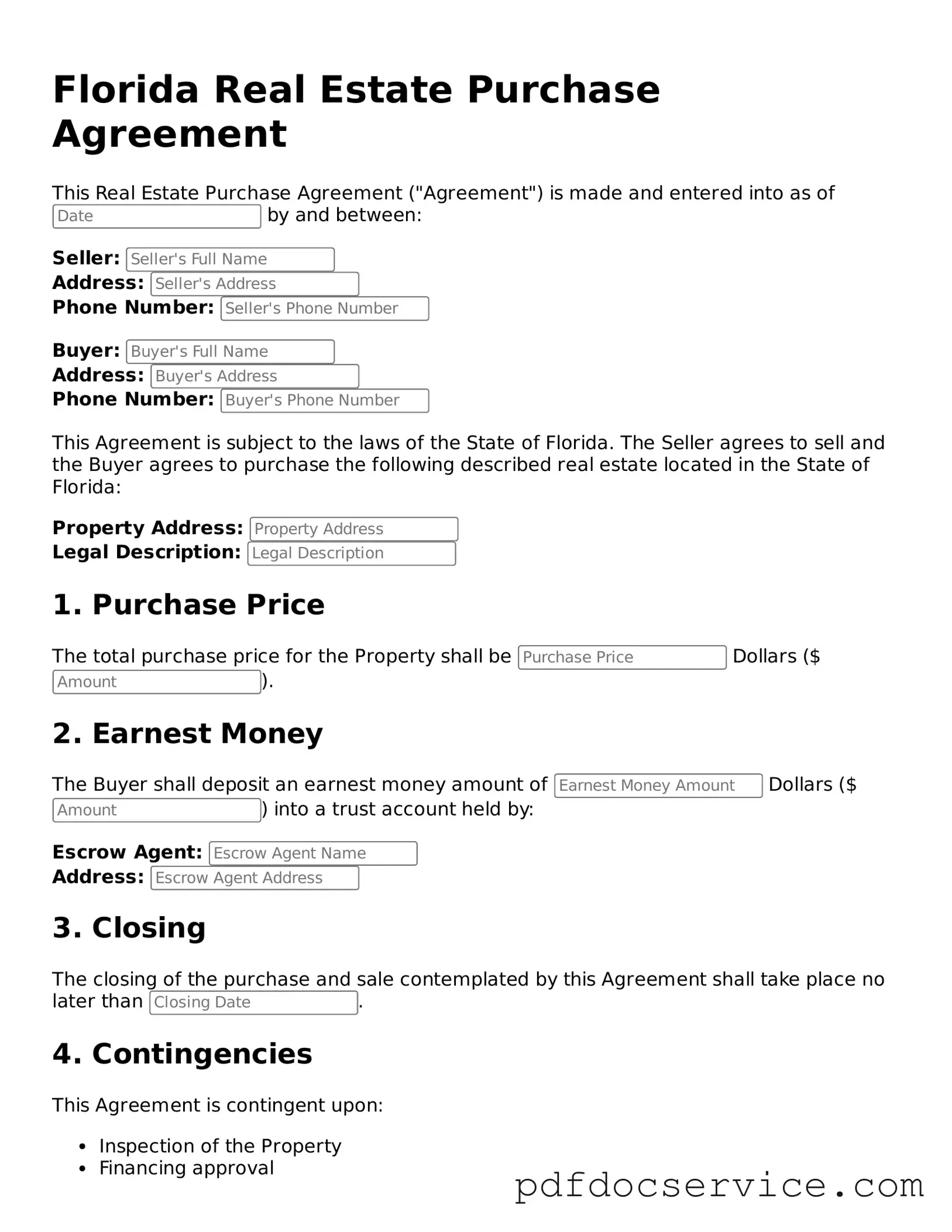

Printable Real Estate Purchase Agreement Template for Florida

The Florida Real Estate Purchase Agreement form is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller in Florida. This form serves as a crucial tool in real estate transactions, ensuring that both parties understand their rights and obligations. By detailing important aspects such as purchase price, contingencies, and closing dates, the agreement helps facilitate a smooth transfer of ownership.

Open Real Estate Purchase Agreement Editor

Printable Real Estate Purchase Agreement Template for Florida

Open Real Estate Purchase Agreement Editor

Open Real Estate Purchase Agreement Editor

or

Get Real Estate Purchase Agreement PDF

Finish the form now and be done

Finish Real Estate Purchase Agreement online using simple edit, save, and download steps.