What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to transfer real estate to a designated beneficiary upon the owner's death. This deed does not require the property to go through probate, simplifying the transfer process for the beneficiary. It is important to note that the property owner retains full control of the property during their lifetime.

How do I create a Transfer-on-Death Deed?

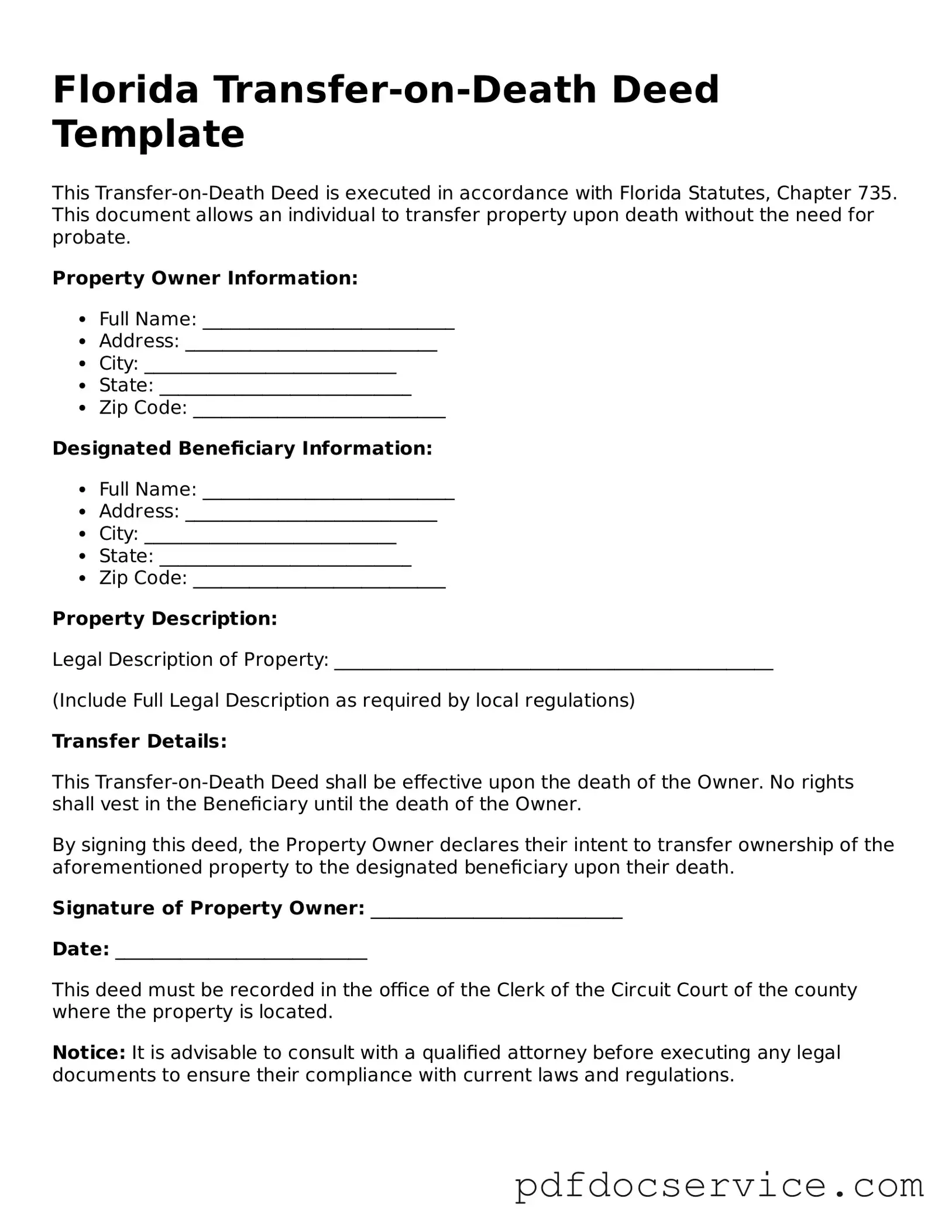

To create a TOD Deed in Florida, follow these steps:

-

Obtain the appropriate form, which can be found online or through legal resources.

-

Fill out the form with accurate information, including the property details and the beneficiary's information.

-

Sign the deed in the presence of a notary public.

-

Record the deed with the county clerk's office where the property is located to ensure it is legally recognized.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary in a TOD Deed. This includes family members, friends, or organizations. It is advisable to choose someone who is trustworthy and capable of managing the property after the owner's death.

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the property owner's death. To do this, the owner must create a new deed that explicitly revokes the previous one or simply record a new TOD Deed with different beneficiaries. It is essential to follow proper legal procedures to ensure the changes are valid.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the TOD Deed will become void concerning that beneficiary. The property owner may choose to name a new beneficiary or allow the property to pass according to their will or state intestacy laws if no will exists.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax implications for the property owner. However, the beneficiary may be subject to capital gains taxes if they sell the property after inheriting it. It is advisable to consult a tax professional to understand potential tax consequences fully.

Is legal assistance required to complete a Transfer-on-Death Deed?

While legal assistance is not strictly required to complete a Transfer-on-Death Deed, it can be beneficial. A legal professional can provide guidance on the process, ensure the deed is filled out correctly, and help avoid potential pitfalls. Individuals may choose to seek assistance, especially if they have complex situations or questions.