Fill Your Generic Direct Deposit Form

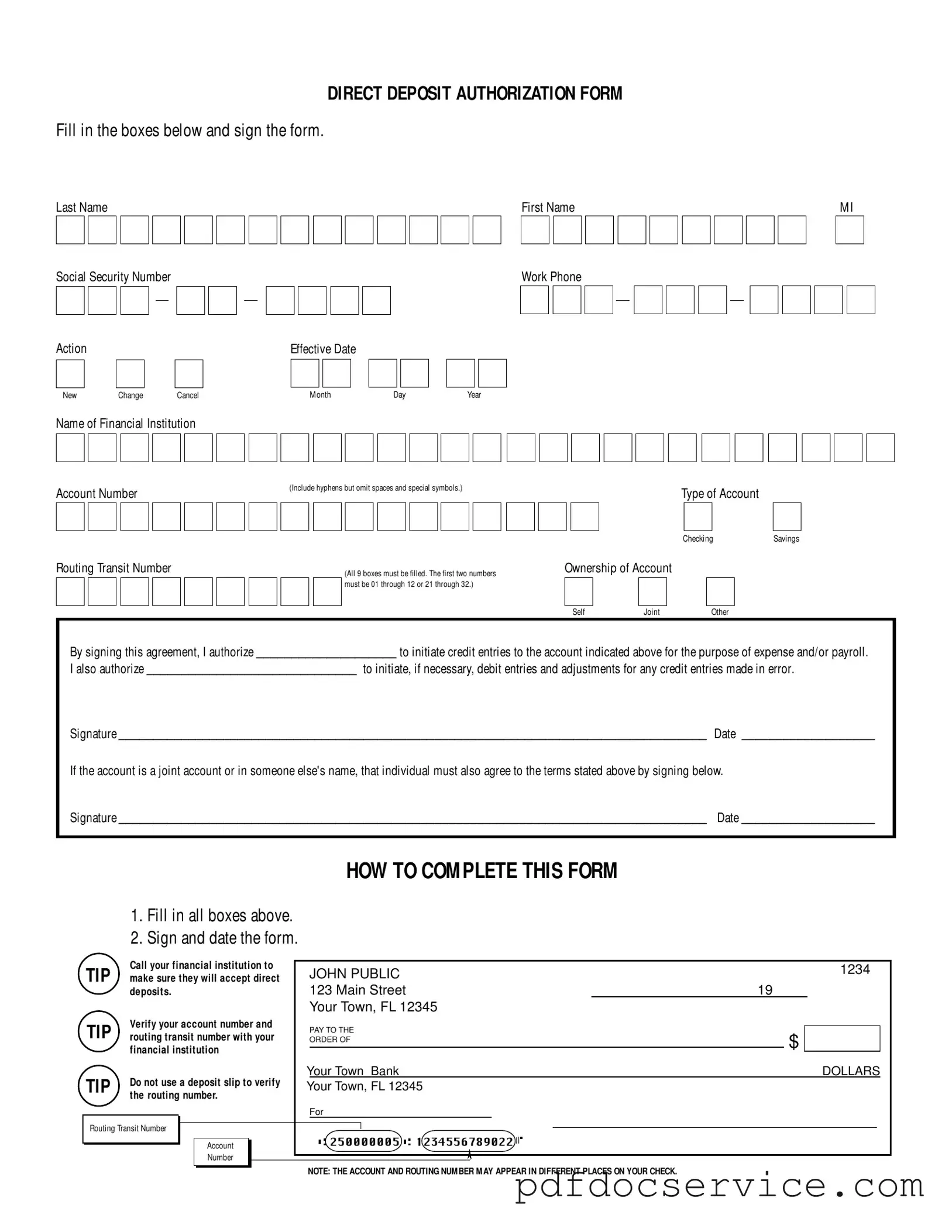

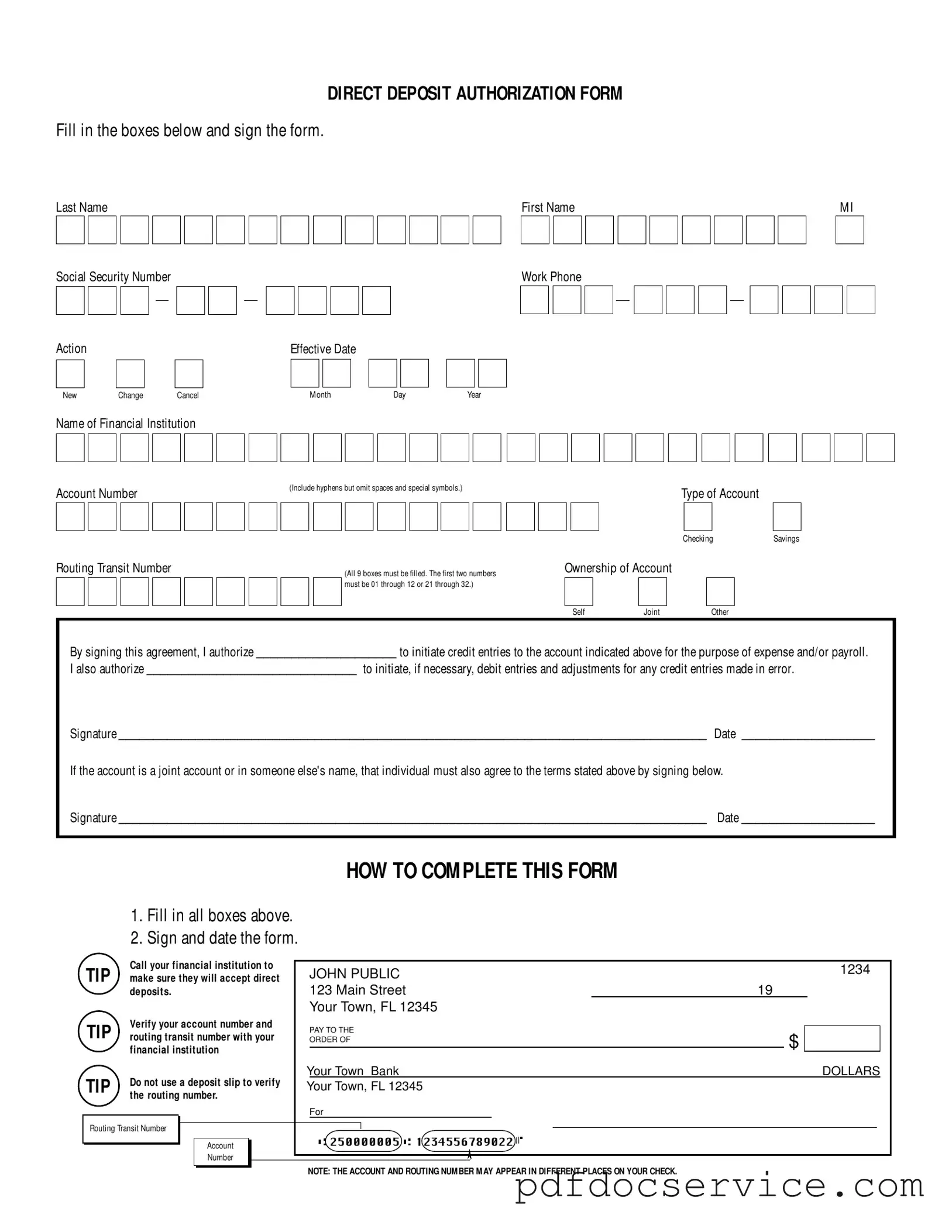

The Generic Direct Deposit Authorization Form is a document that allows individuals to authorize their employer or other entities to deposit funds directly into their bank accounts. Completing this form ensures timely and secure payment for salaries, reimbursements, or other financial transactions. Properly filling out the form is crucial for avoiding payment delays and ensuring that funds are directed to the correct financial institution.

Open Generic Direct Deposit Editor

Fill Your Generic Direct Deposit Form

Open Generic Direct Deposit Editor

Open Generic Direct Deposit Editor

or

Get Generic Direct Deposit PDF

Finish the form now and be done

Finish Generic Direct Deposit online using simple edit, save, and download steps.