What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. This type of deed is often used to give real estate, personal property, or financial assets as a gift.

Who can create a Gift Deed?

Any person who is legally capable of transferring property can create a Gift Deed. This typically includes individuals who are of legal age and mentally competent. The donor (the person giving the gift) must have full ownership of the property they wish to gift.

What types of property can be transferred using a Gift Deed?

A Gift Deed can be used to transfer various types of property, including:

-

Real estate (land or buildings)

-

Vehicles

-

Cash or bank accounts

-

Personal belongings (jewelry, artwork, etc.)

Do I need to pay taxes on a Gift Deed?

Generally, the recipient of the gift may not have to pay income tax on the value of the gift. However, the donor may be subject to gift tax if the value of the gift exceeds a certain threshold set by the IRS. It’s advisable to consult a tax professional to understand the implications fully.

Is a Gift Deed revocable?

Once a Gift Deed is executed and delivered, it is usually considered irrevocable, meaning the donor cannot take back the gift. However, there are specific circumstances under which a gift may be contested or revoked, such as if the donor was not of sound mind when signing the deed.

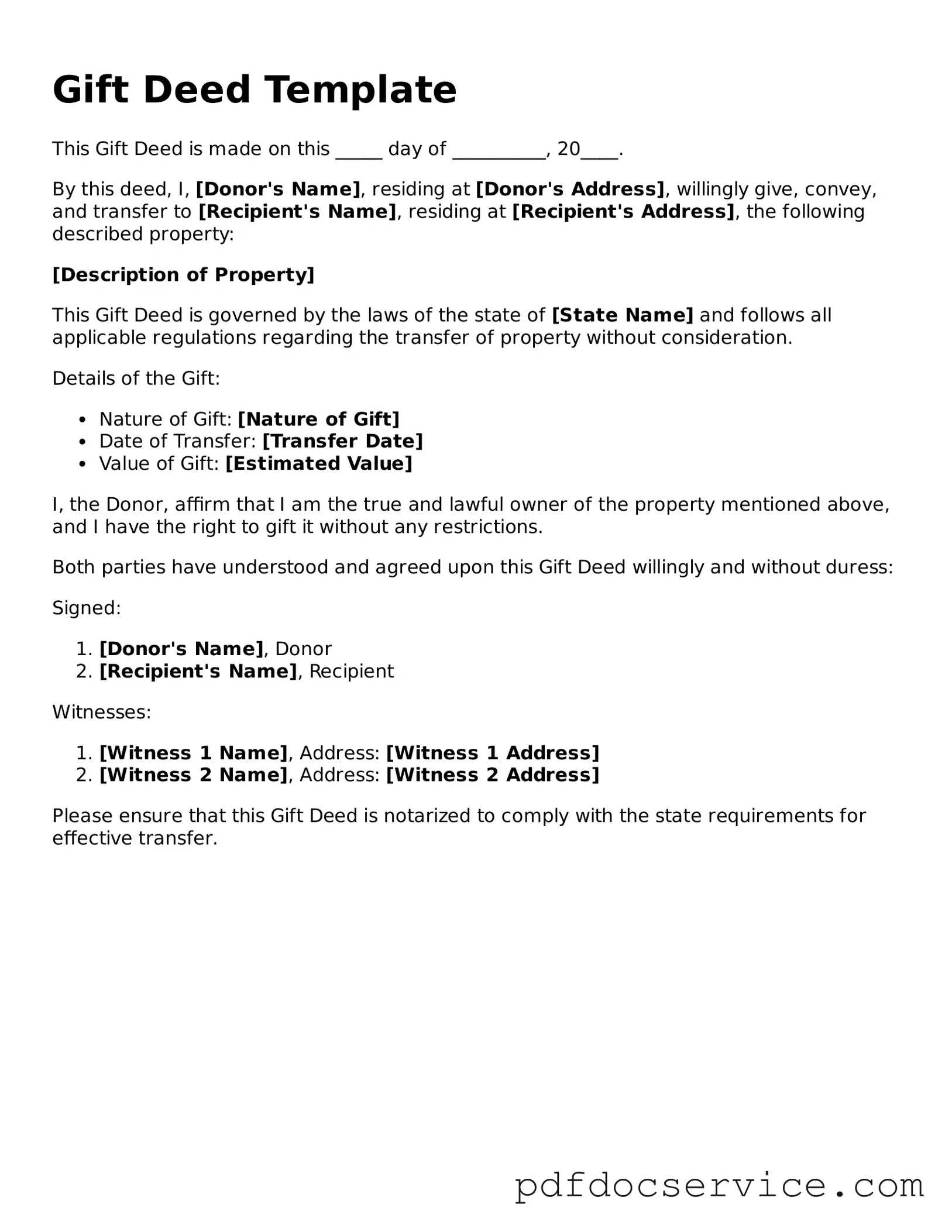

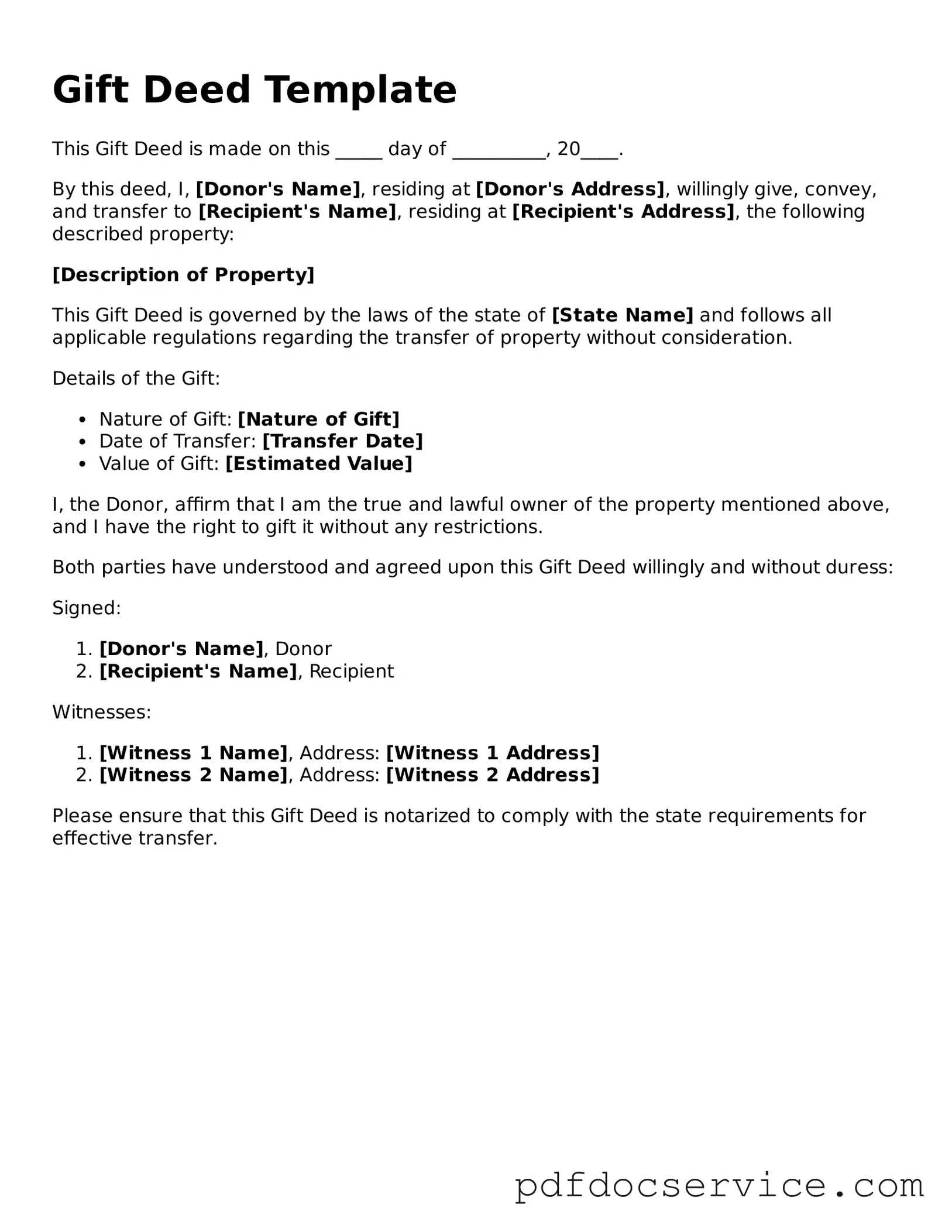

A Gift Deed should include the following information:

-

The names and addresses of both the donor and the recipient.

-

A detailed description of the property being gifted.

-

The date of the gift.

-

A statement indicating that the gift is made voluntarily and without consideration.

Do I need a witness to sign a Gift Deed?

While the requirements can vary by state, it is generally advisable to have at least one witness sign the Gift Deed. This can help provide evidence of the transaction if any disputes arise in the future.

Can a Gift Deed be recorded?

Yes, a Gift Deed can be recorded with the local county recorder's office. Recording the deed provides public notice of the transfer and can help protect the recipient's ownership rights against future claims.

What happens if the donor passes away after executing a Gift Deed?

If the donor passes away after executing a Gift Deed, the gift typically remains valid, and the recipient retains ownership of the property. However, it’s essential to ensure that the deed was properly executed and recorded to avoid potential disputes among heirs.

How can I create a Gift Deed?

Creating a Gift Deed involves drafting the document, ensuring all required information is included, and having it signed by the donor and any necessary witnesses. It’s often beneficial to consult with a legal professional to ensure that the deed complies with local laws and regulations.