Fill Your Gift Letter Form

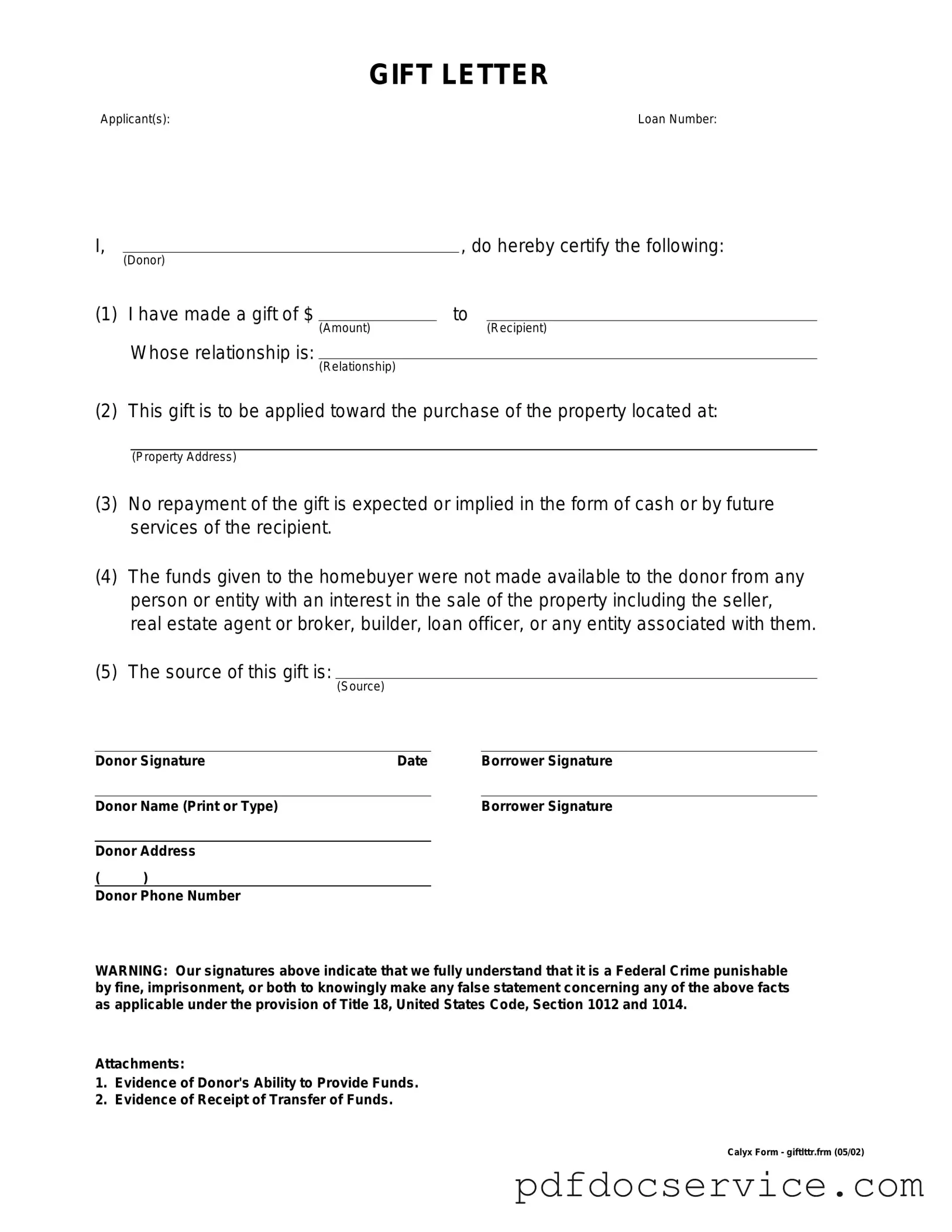

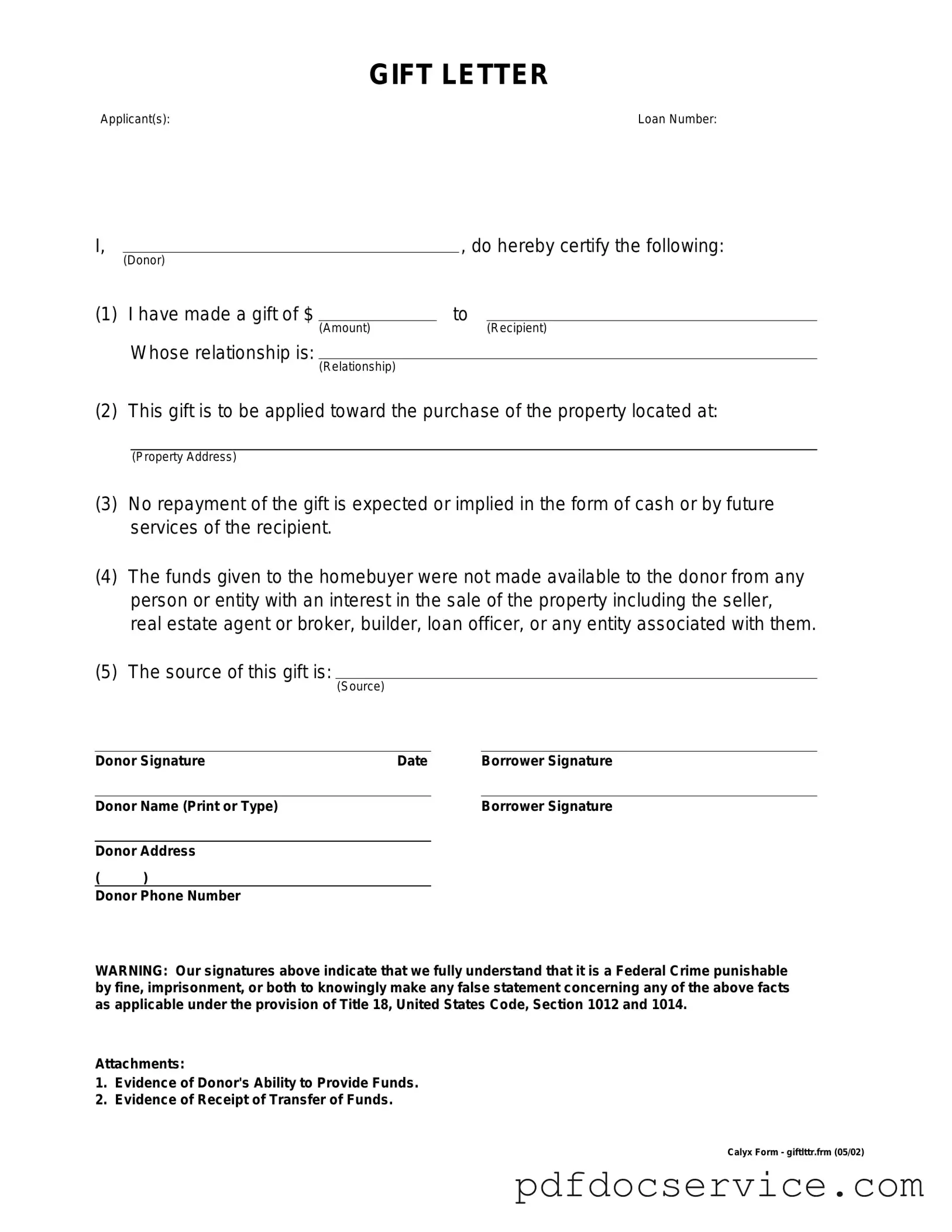

The Gift Letter form is a document used to confirm that a financial gift has been given without any expectation of repayment. This form is often required in real estate transactions to demonstrate that the funds are a gift, not a loan, which can impact mortgage approval. Understanding how to properly complete and use this form can make a significant difference in your financial dealings.

Open Gift Letter Editor

Fill Your Gift Letter Form

Open Gift Letter Editor

Open Gift Letter Editor

or

Get Gift Letter PDF

Finish the form now and be done

Finish Gift Letter online using simple edit, save, and download steps.