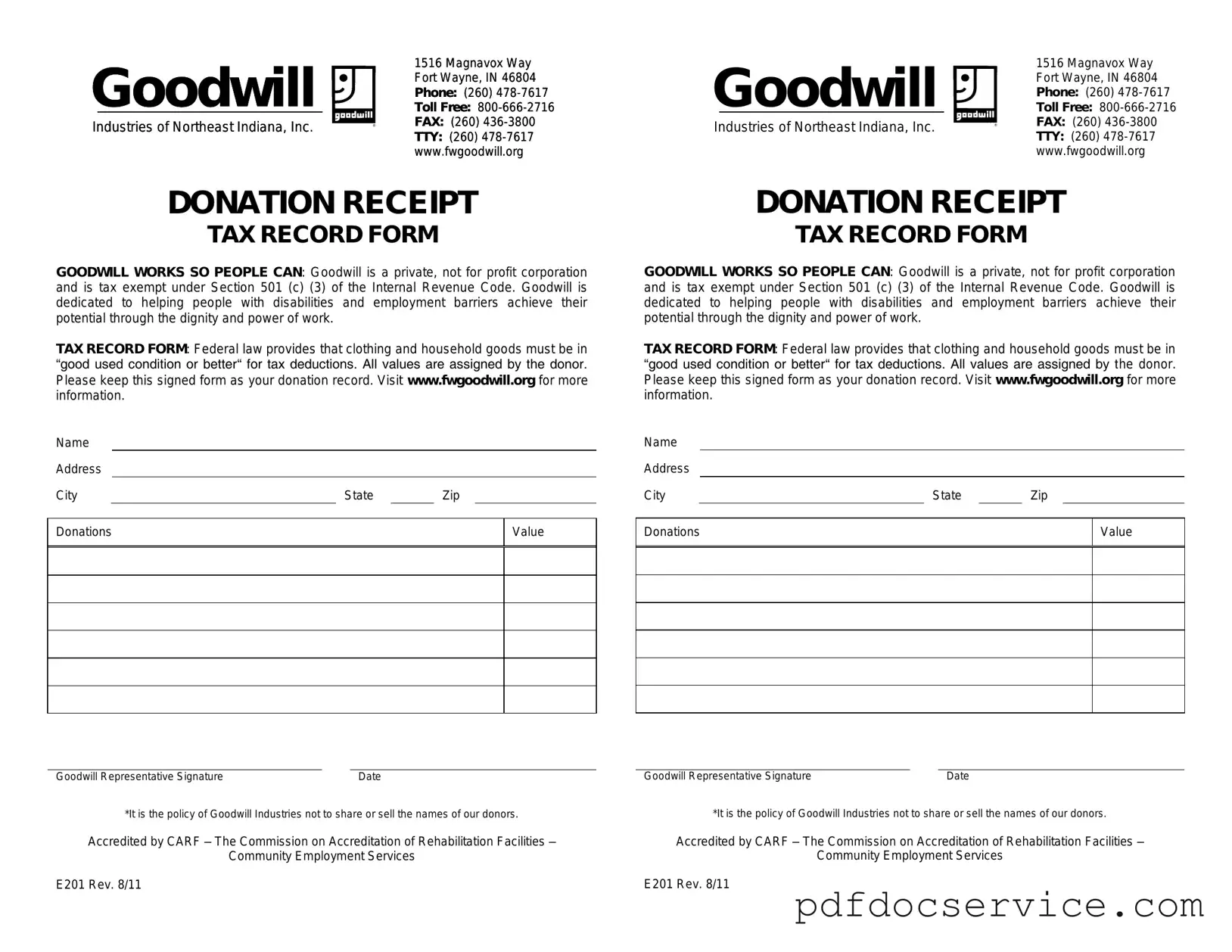

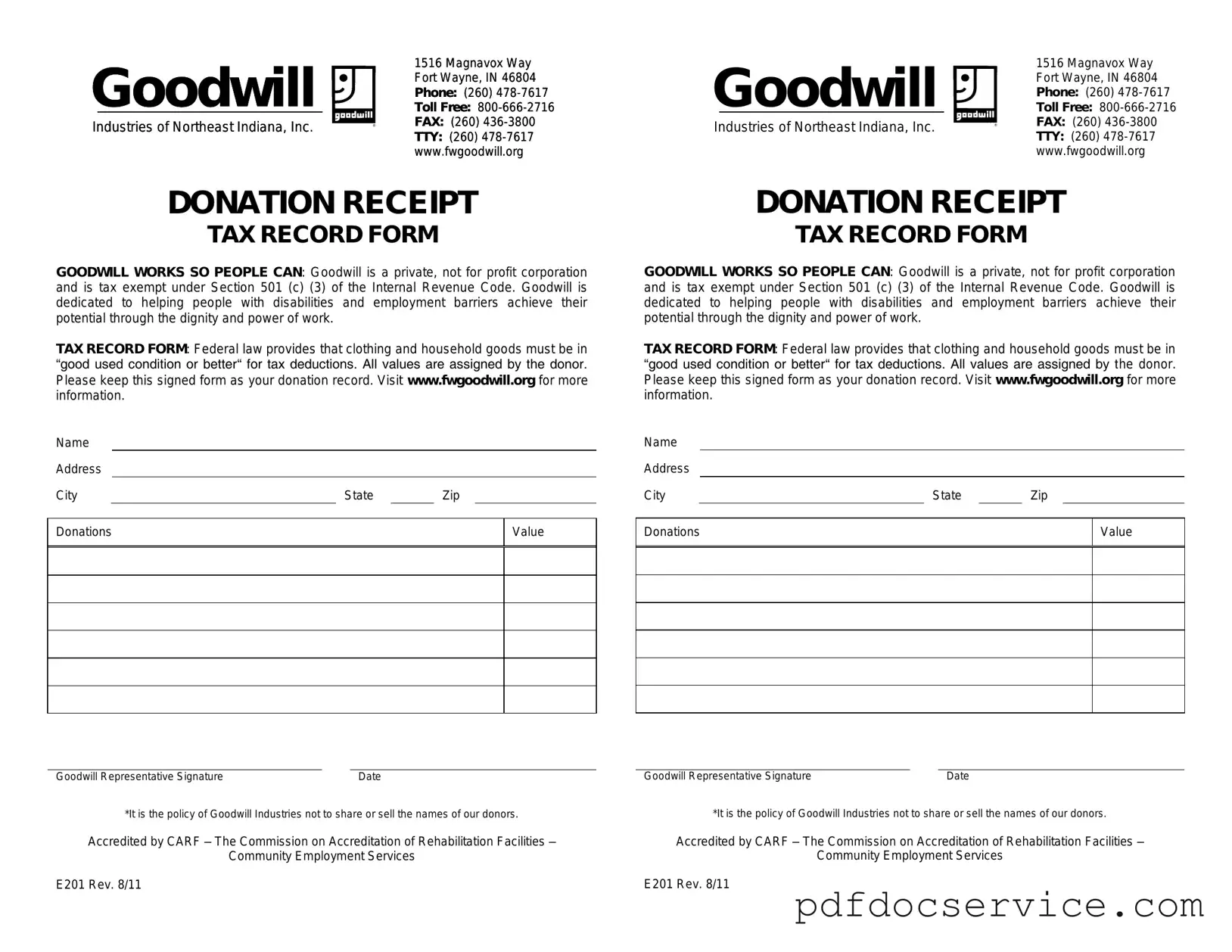

Fill Your Goodwill donation receipt Form

The Goodwill donation receipt form serves as a record for individuals who donate items to Goodwill Industries. This form not only acknowledges the donation but also provides essential details for tax purposes. Understanding how to properly fill out and use this receipt can benefit both the donor and the organization.

Open Goodwill donation receipt Editor

Fill Your Goodwill donation receipt Form

Open Goodwill donation receipt Editor

Open Goodwill donation receipt Editor

or

Get Goodwill donation receipt PDF

Finish the form now and be done

Finish Goodwill donation receipt online using simple edit, save, and download steps.