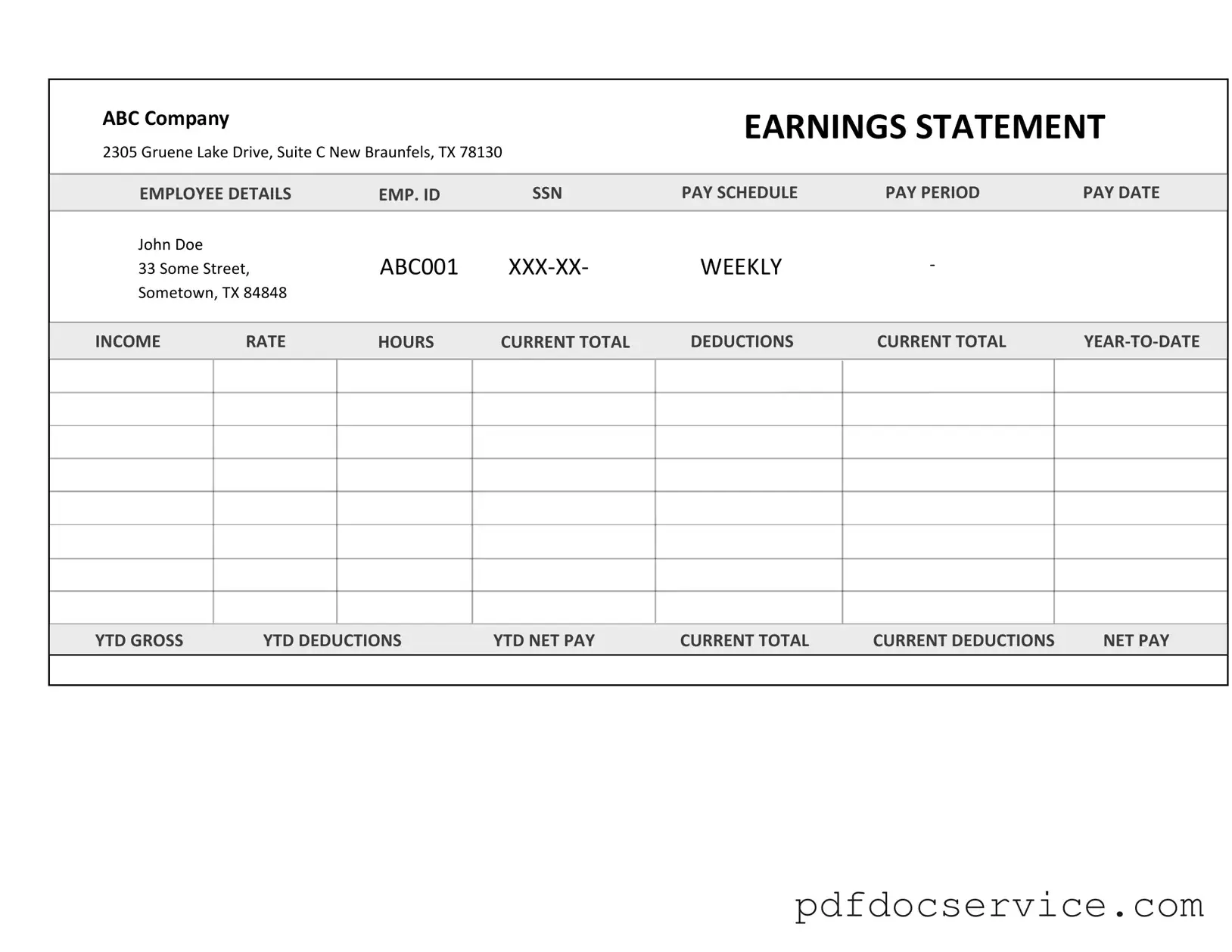

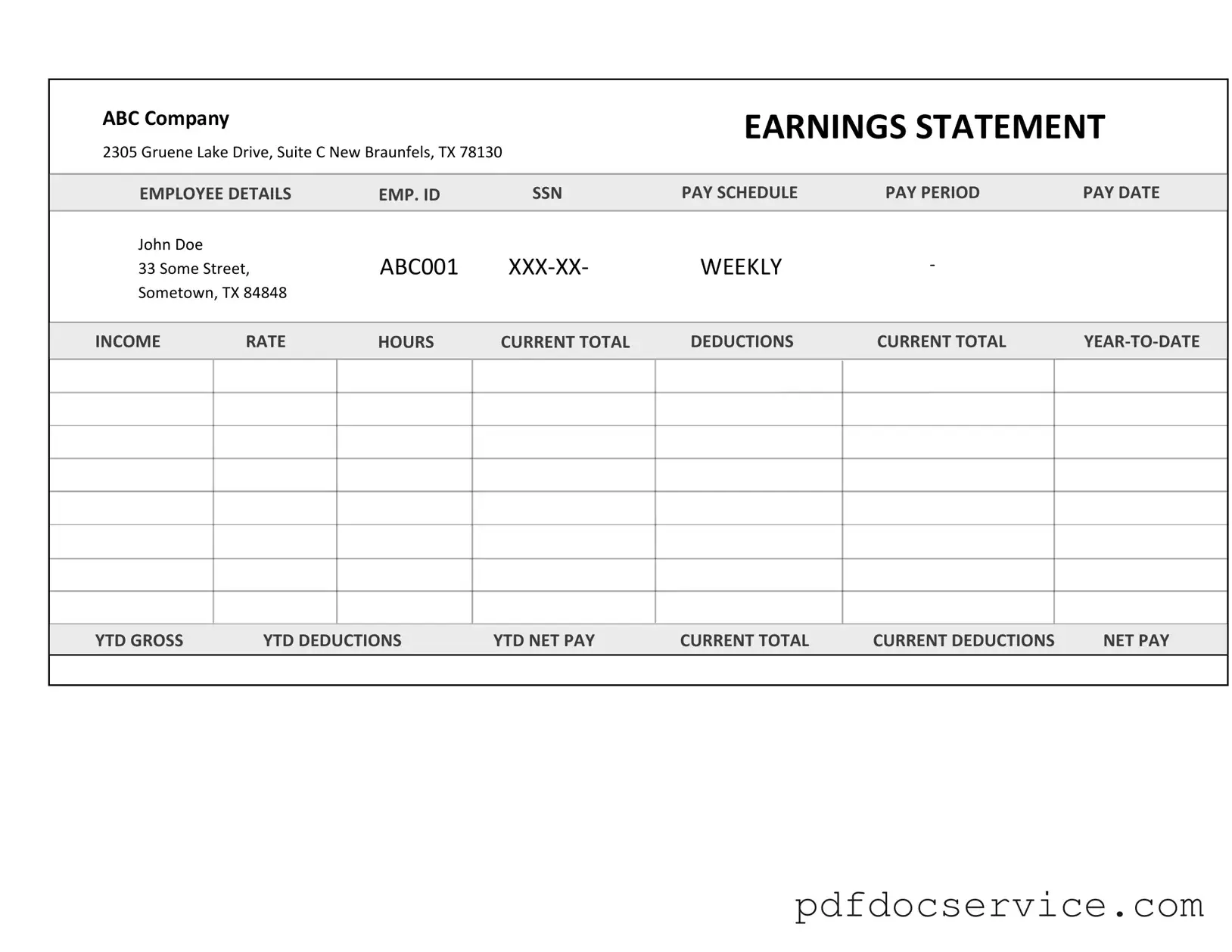

Fill Your Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form serves as a crucial document that outlines the earnings and deductions for individuals working as independent contractors. This form provides transparency and clarity regarding payment details, ensuring that contractors understand their compensation. By utilizing this form, both contractors and clients can maintain accurate financial records, fostering a professional working relationship.

Open Independent Contractor Pay Stub Editor

Fill Your Independent Contractor Pay Stub Form

Open Independent Contractor Pay Stub Editor

Open Independent Contractor Pay Stub Editor

or

Get Independent Contractor Pay Stub PDF

Finish the form now and be done

Finish Independent Contractor Pay Stub online using simple edit, save, and download steps.