Fill Your Intent To Lien Florida Form

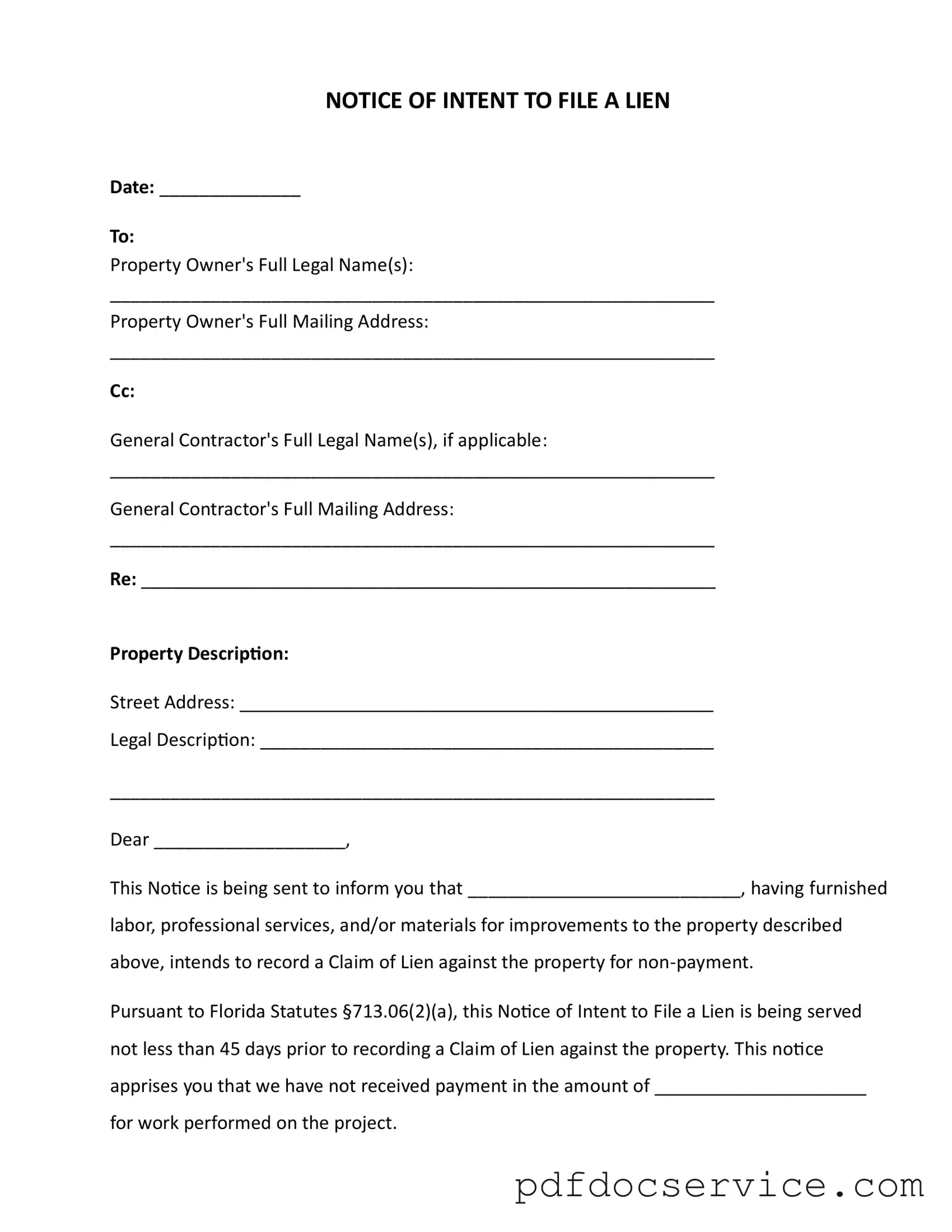

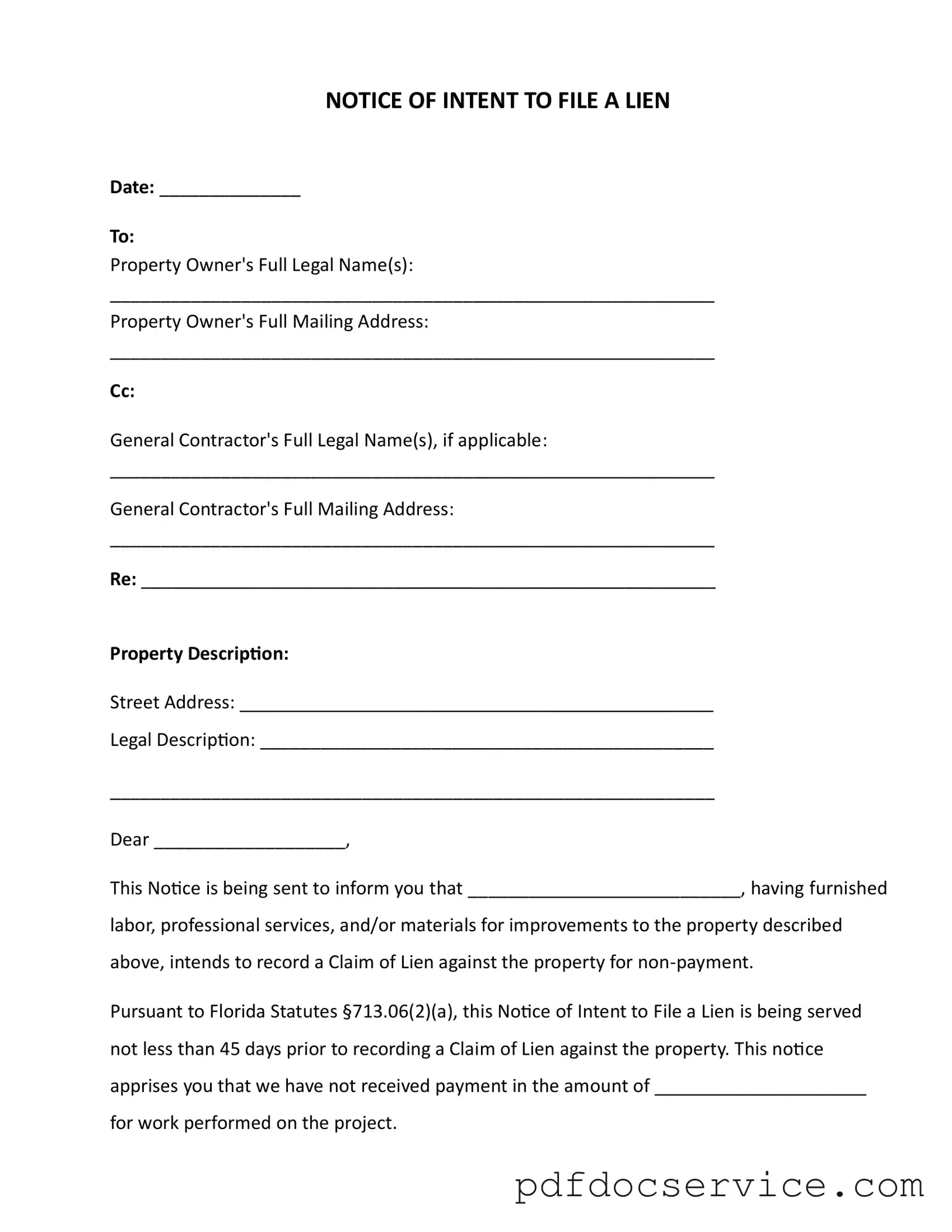

The Intent To Lien Florida form serves as a formal notification to property owners regarding an impending lien due to non-payment for services rendered. This document is essential for contractors, suppliers, and service providers who have not received payment for their contributions to property improvements. By filing this notice, they aim to inform property owners of their rights and the potential consequences of failing to address outstanding payments.

Open Intent To Lien Florida Editor

Fill Your Intent To Lien Florida Form

Open Intent To Lien Florida Editor

Open Intent To Lien Florida Editor

or

Get Intent To Lien Florida PDF

Finish the form now and be done

Finish Intent To Lien Florida online using simple edit, save, and download steps.