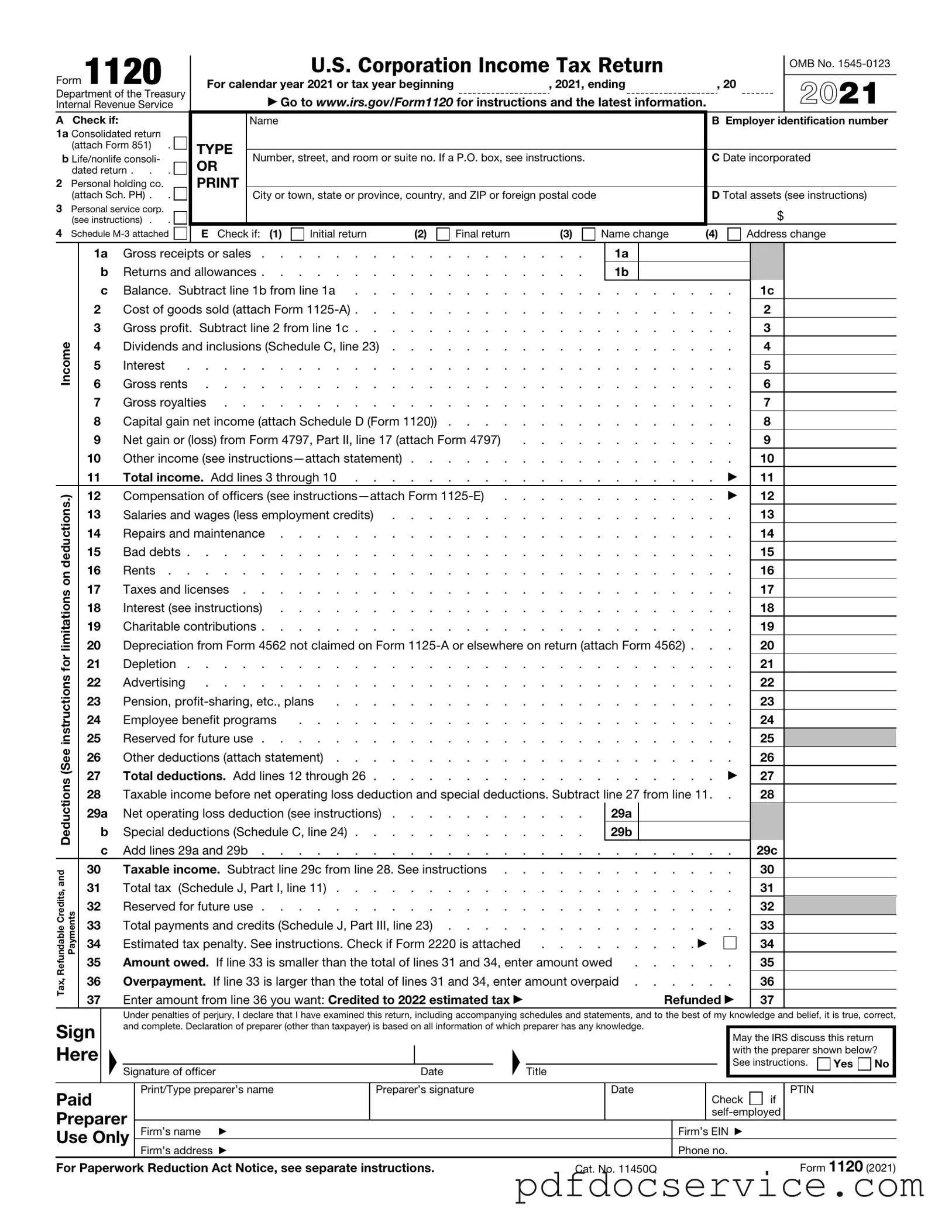

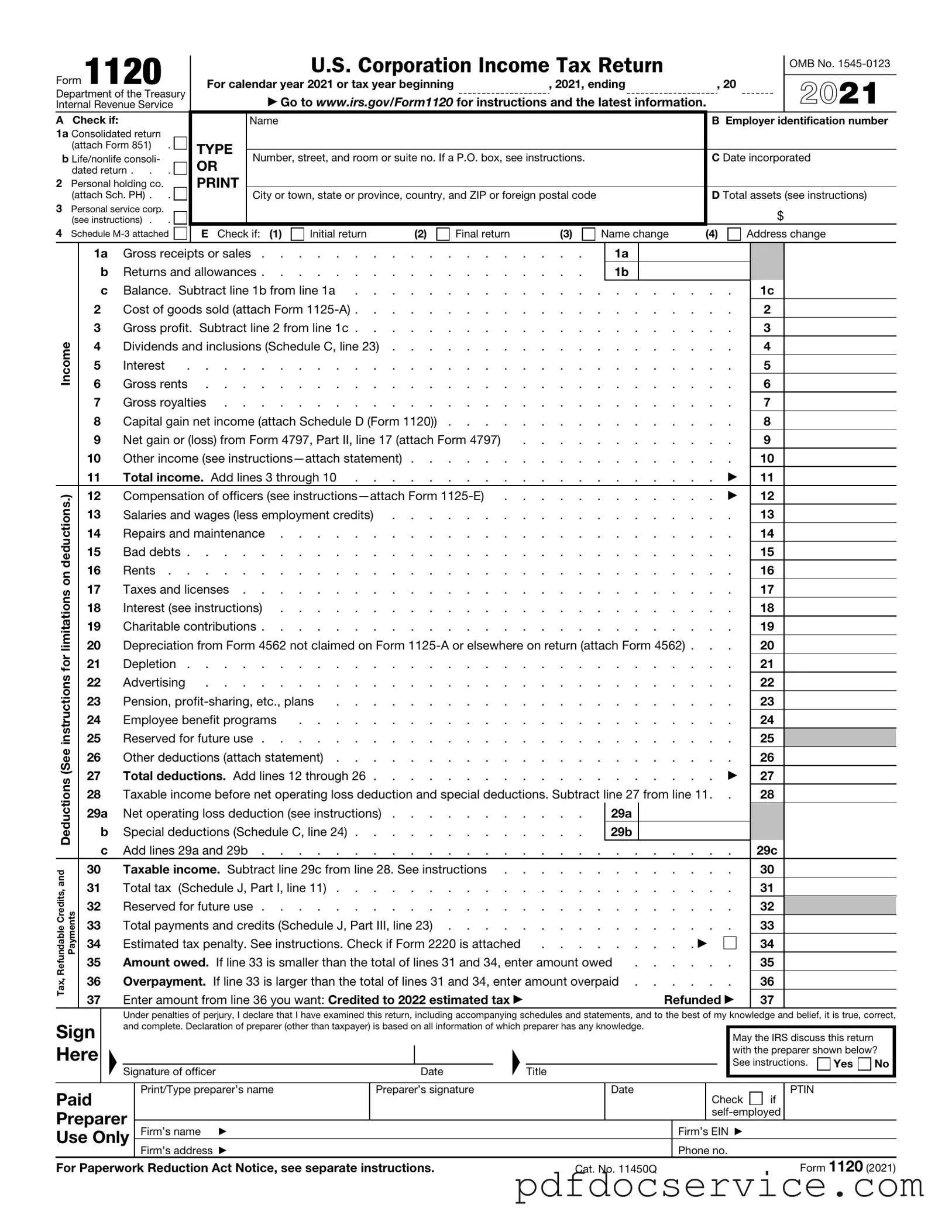

The IRS Form 1120 is the U.S. Corporation Income Tax Return. Corporations use this form to report their income, gains, losses, deductions, and credits. It is essential for C corporations, which are separate legal entities from their owners. The form helps the IRS determine the tax liability of the corporation for the tax year.

Any domestic corporation, including C corporations, must file Form 1120 if they have gross income of $1,000 or more during the tax year. This includes both active businesses and corporations that are inactive but still have income. Additionally, foreign corporations engaged in business in the United States are also required to file Form 1120-F, a related form.

Form 1120 is generally due on the 15th day of the fourth month after the end of the corporation's tax year. For most corporations that operate on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can file for an automatic six-month extension using Form 7004, but they must still pay any taxes owed by the original due date to avoid penalties and interest.

Form 1120 requires various types of information, including:

-

The corporation's name, address, and Employer Identification Number (EIN)

-

Income details, including gross receipts and sales

-

Deductions for business expenses, such as salaries, rent, and depreciation

-

Tax credits that the corporation may qualify for

-

Information about shareholders and ownership structure

All this information helps the IRS assess the corporation's tax obligations accurately.

If a corporation fails to file Form 1120 on time, it may face penalties. The penalty is typically based on the amount of tax due and the length of the delay. For each month or part of a month that the return is late, the penalty can be a percentage of the unpaid tax, up to a maximum amount. Additionally, interest will accrue on any unpaid taxes. Corporations should file even if they cannot pay the full amount owed to minimize penalties.

Yes, Form 1120 can be filed electronically through the IRS e-file system. E-filing is often faster and more secure than traditional paper filing. It also allows for quicker processing of the return and any refunds due. Corporations should ensure they use IRS-approved e-file software or work with a tax professional who can e-file on their behalf.