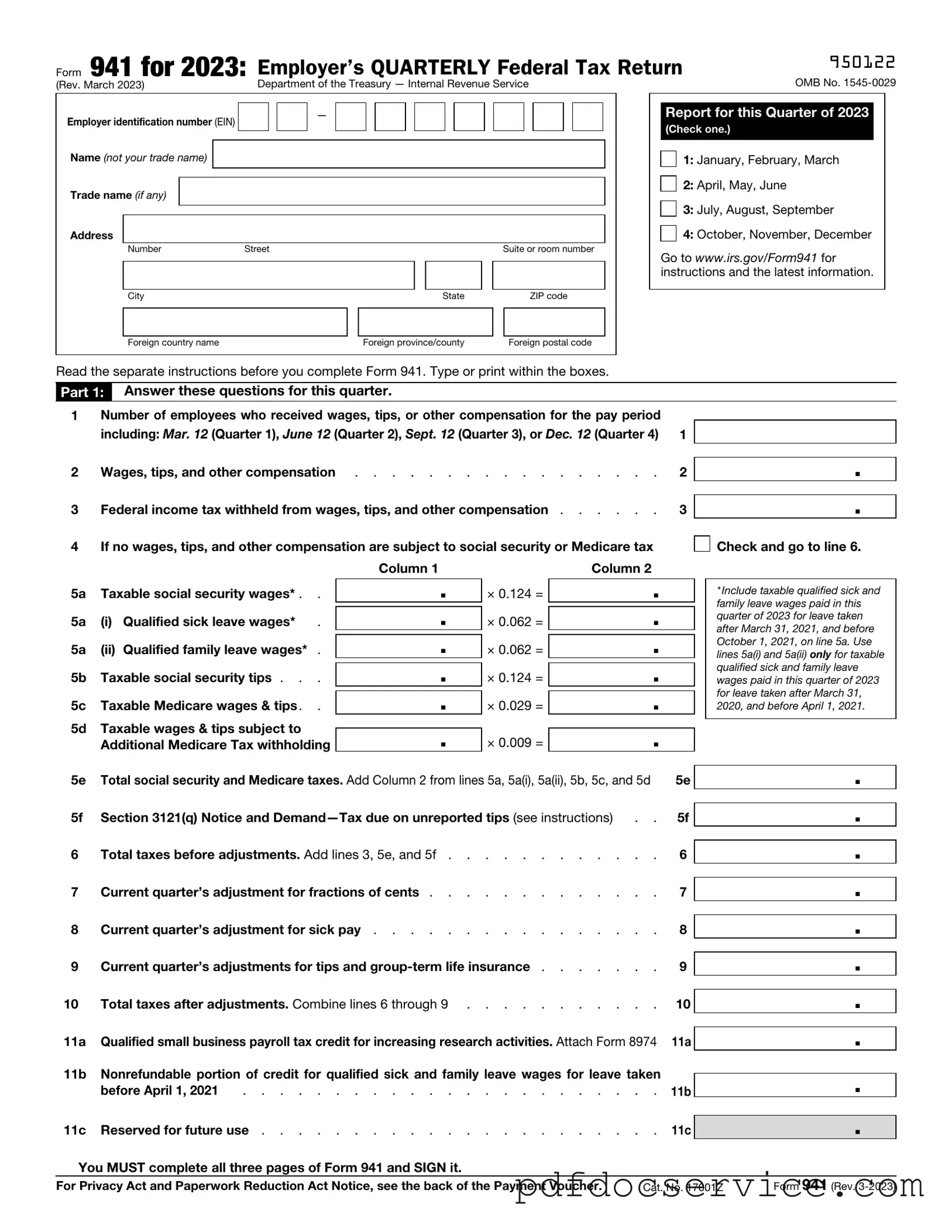

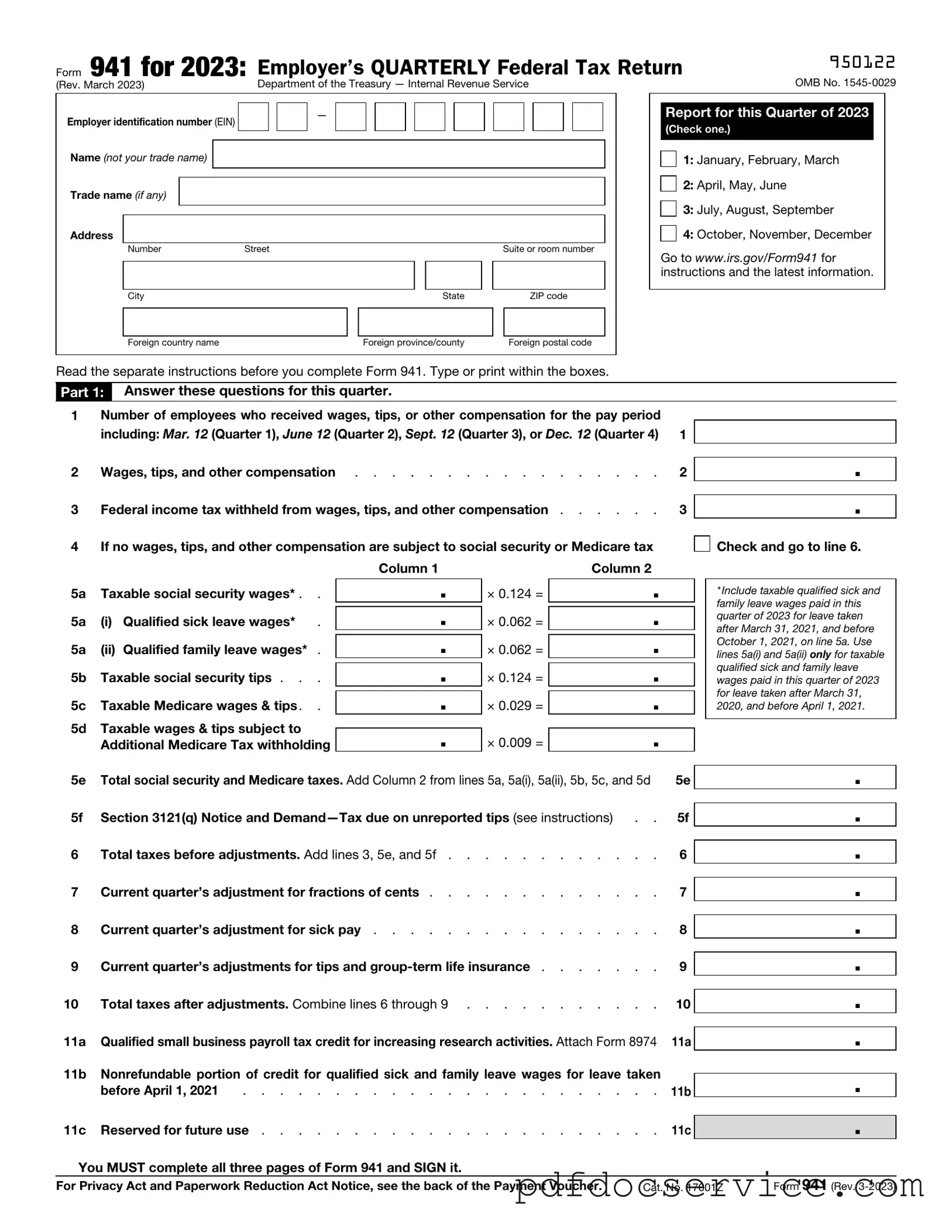

Fill Your IRS 941 Form

The IRS 941 form is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for ensuring compliance with federal tax obligations and helps the IRS track employment tax liabilities. Understanding how to accurately complete and submit the 941 form is crucial for all businesses with employees.

Open IRS 941 Editor

Fill Your IRS 941 Form

Open IRS 941 Editor

Open IRS 941 Editor

or

Get IRS 941 PDF

Finish the form now and be done

Finish IRS 941 online using simple edit, save, and download steps.