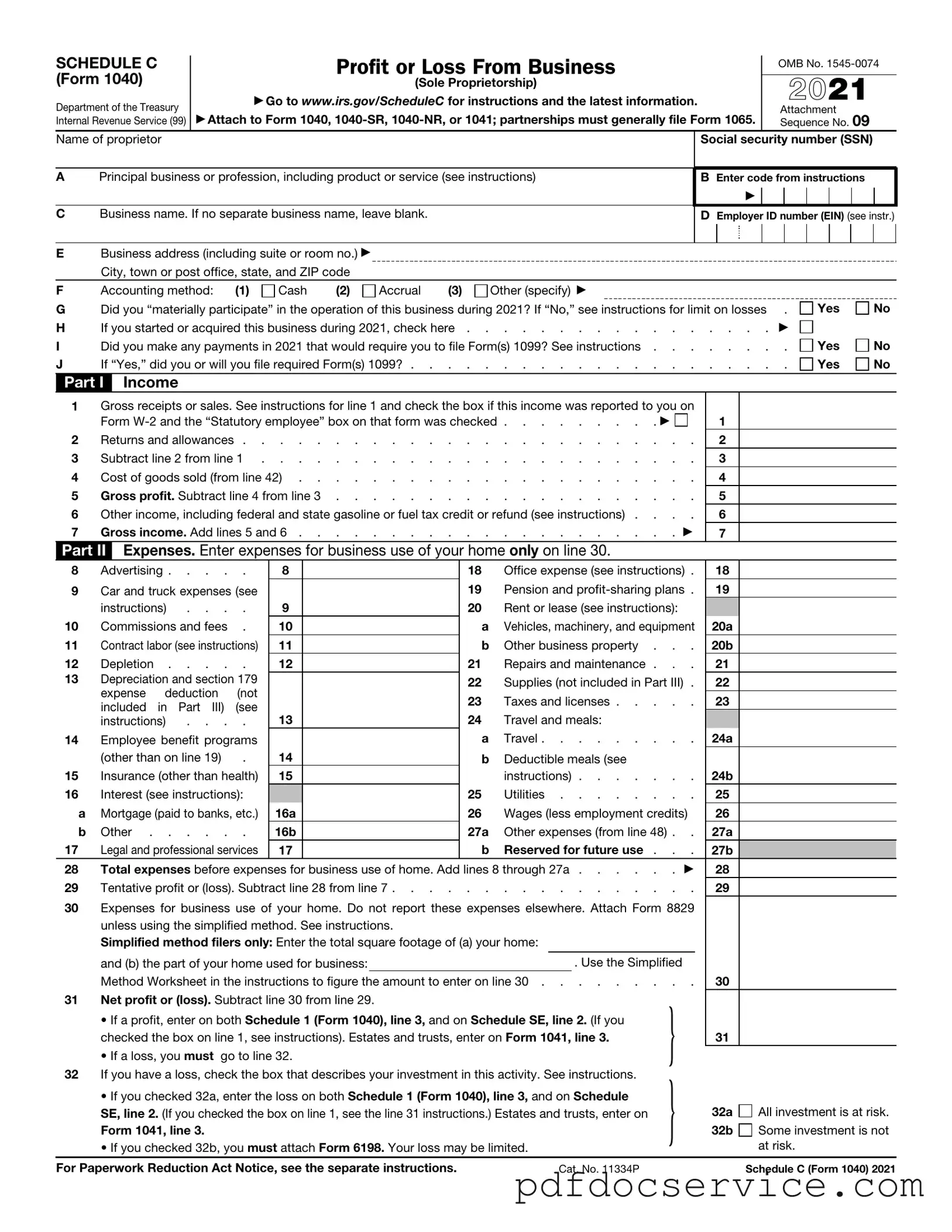

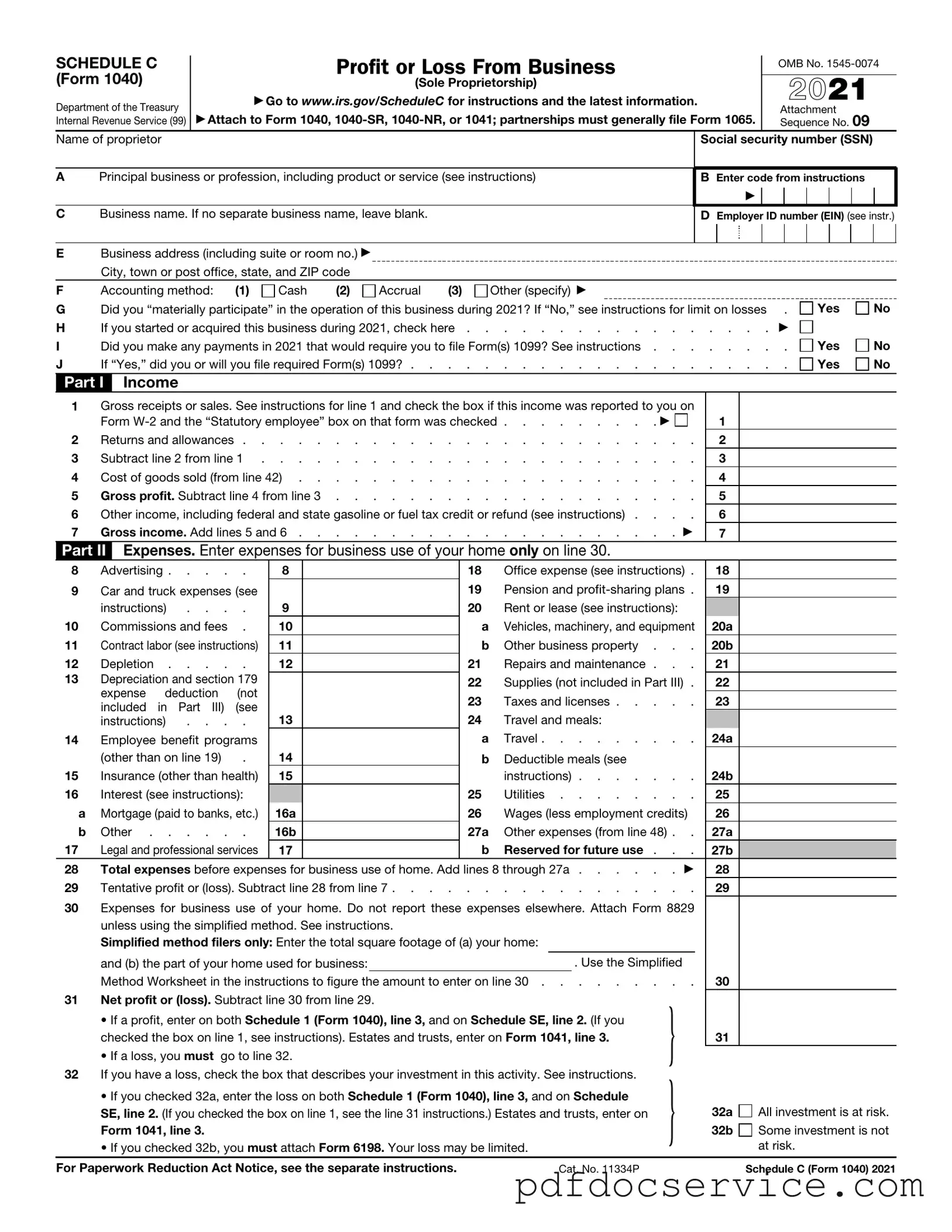

Fill Your IRS Schedule C 1040 Form

The IRS Schedule C 1040 form is a crucial document used by sole proprietors to report income and expenses from their business activities. This form provides a detailed breakdown of earnings, allowing individuals to calculate their net profit or loss. Understanding how to properly fill out Schedule C can significantly impact your tax obligations and financial health.

Open IRS Schedule C 1040 Editor

Fill Your IRS Schedule C 1040 Form

Open IRS Schedule C 1040 Editor

Open IRS Schedule C 1040 Editor

or

Get IRS Schedule C 1040 PDF

Finish the form now and be done

Finish IRS Schedule C 1040 online using simple edit, save, and download steps.