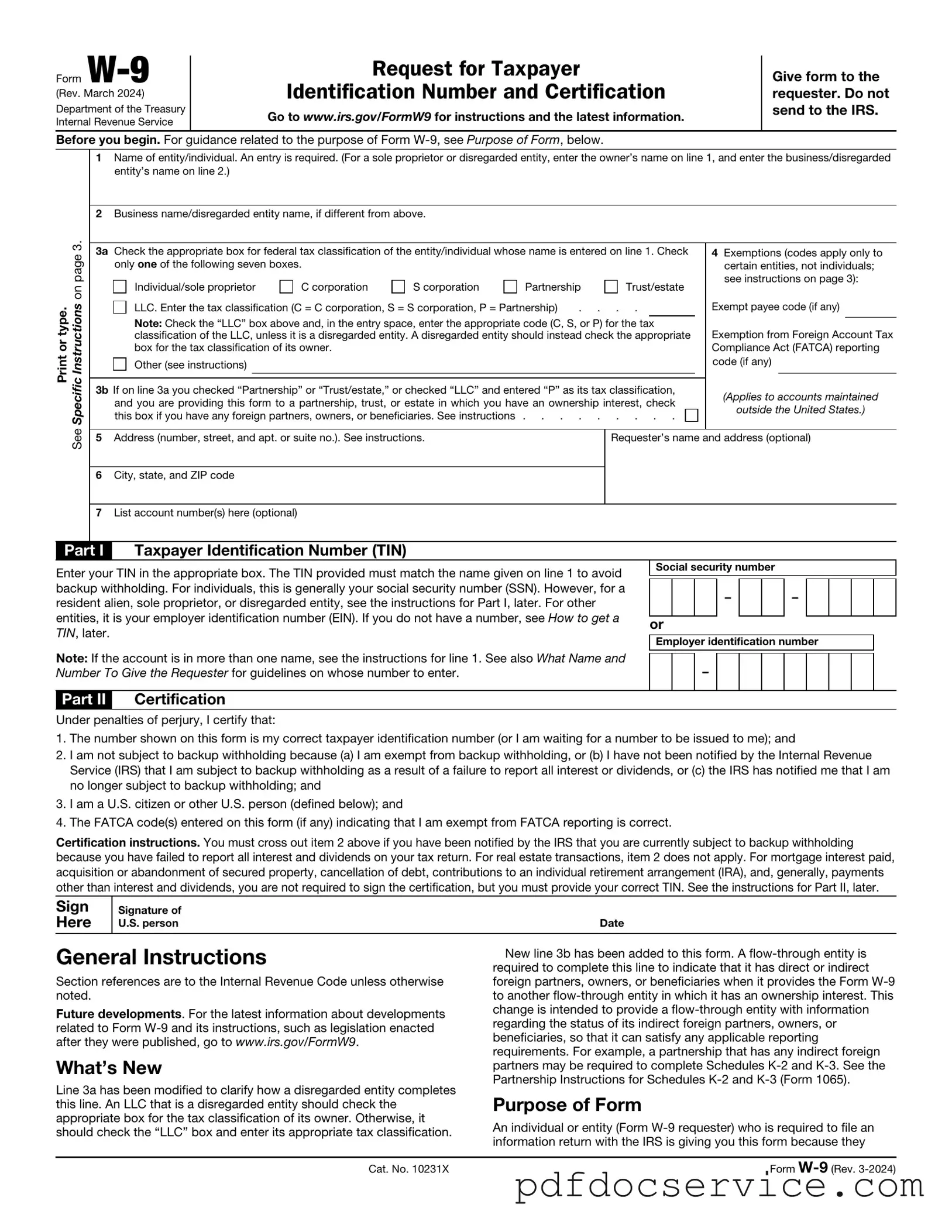

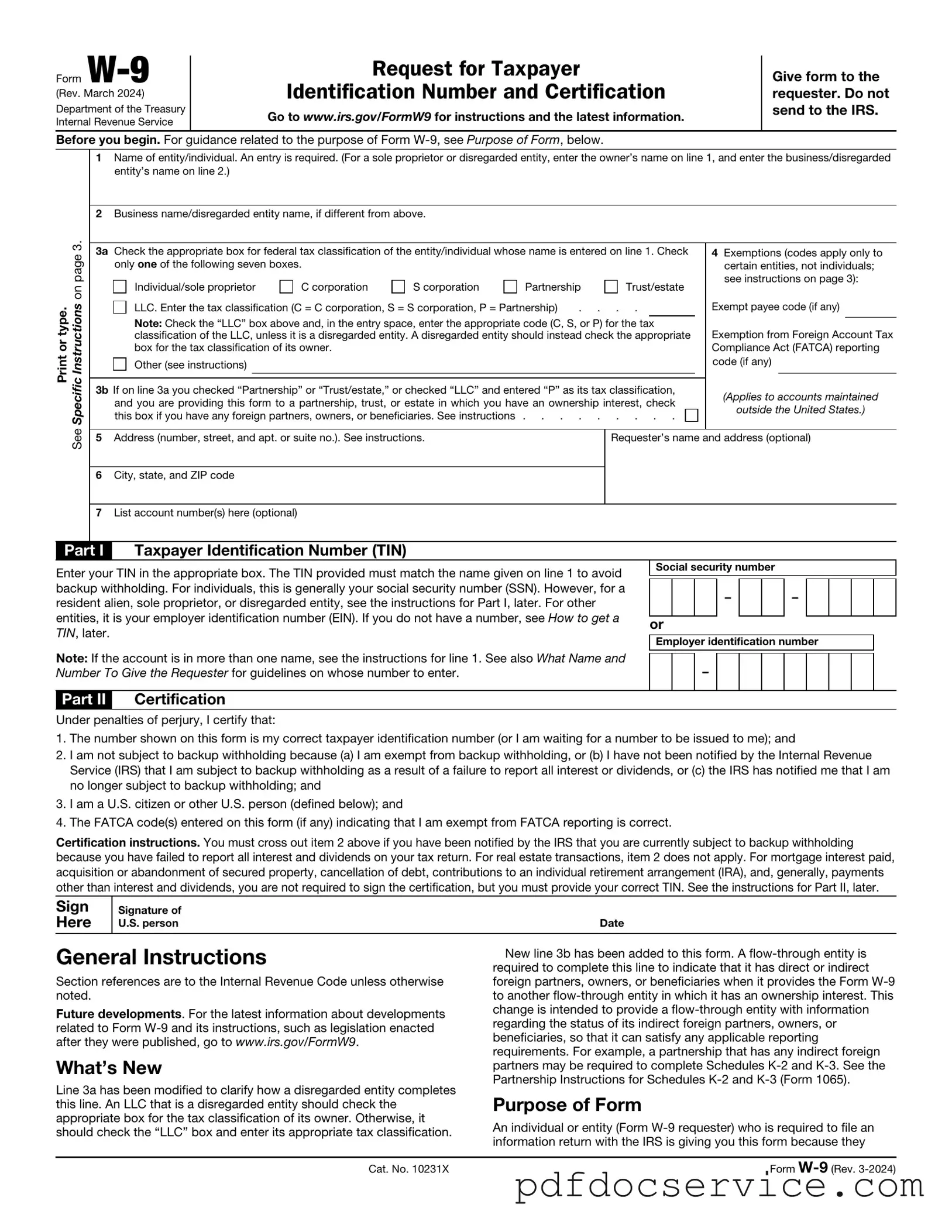

Fill Your IRS W-9 Form

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. This form is essential for freelancers, contractors, and vendors who need to report income received. By completing a W-9, individuals help ensure accurate tax reporting and compliance with federal regulations.

Open IRS W-9 Editor

Fill Your IRS W-9 Form

Open IRS W-9 Editor

Open IRS W-9 Editor

or

Get IRS W-9 PDF

Finish the form now and be done

Finish IRS W-9 online using simple edit, save, and download steps.