What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their real estate to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed ensures that the property passes directly to the beneficiaries upon the owner's death, avoiding probate and simplifying the transfer process.

Who can benefit from using a Lady Bird Deed?

Individuals who wish to pass their property to family members or other beneficiaries without the complications of probate may find a Lady Bird Deed particularly beneficial. It is often used by elderly homeowners who want to ensure their property is transferred smoothly while retaining control and the right to live in the home for the rest of their lives.

What are the advantages of a Lady Bird Deed?

The advantages of a Lady Bird Deed include:

-

Avoidance of probate: The property automatically transfers to the beneficiaries upon the owner's death.

-

Retained control: The owner can sell, mortgage, or change the beneficiaries at any time.

-

Protection from creditors: In some cases, the property may be shielded from creditors' claims after the owner's death.

Are there any disadvantages to a Lady Bird Deed?

While a Lady Bird Deed offers many benefits, there are some potential drawbacks to consider:

-

Complexity: The deed must be drafted correctly to ensure it is valid, which may require legal assistance.

-

Tax implications: The property may not receive a step-up in basis for tax purposes, potentially leading to higher capital gains taxes for beneficiaries.

-

Medicaid eligibility: Transferring property using a Lady Bird Deed could affect eligibility for Medicaid benefits, depending on state laws.

How does a Lady Bird Deed differ from a traditional life estate deed?

The primary difference between a Lady Bird Deed and a traditional life estate deed lies in the level of control retained by the property owner. With a traditional life estate deed, the owner cannot sell or mortgage the property without the consent of the remaindermen (the beneficiaries). In contrast, a Lady Bird Deed allows the owner to retain full control over the property, including the ability to sell or mortgage it without needing permission from the beneficiaries.

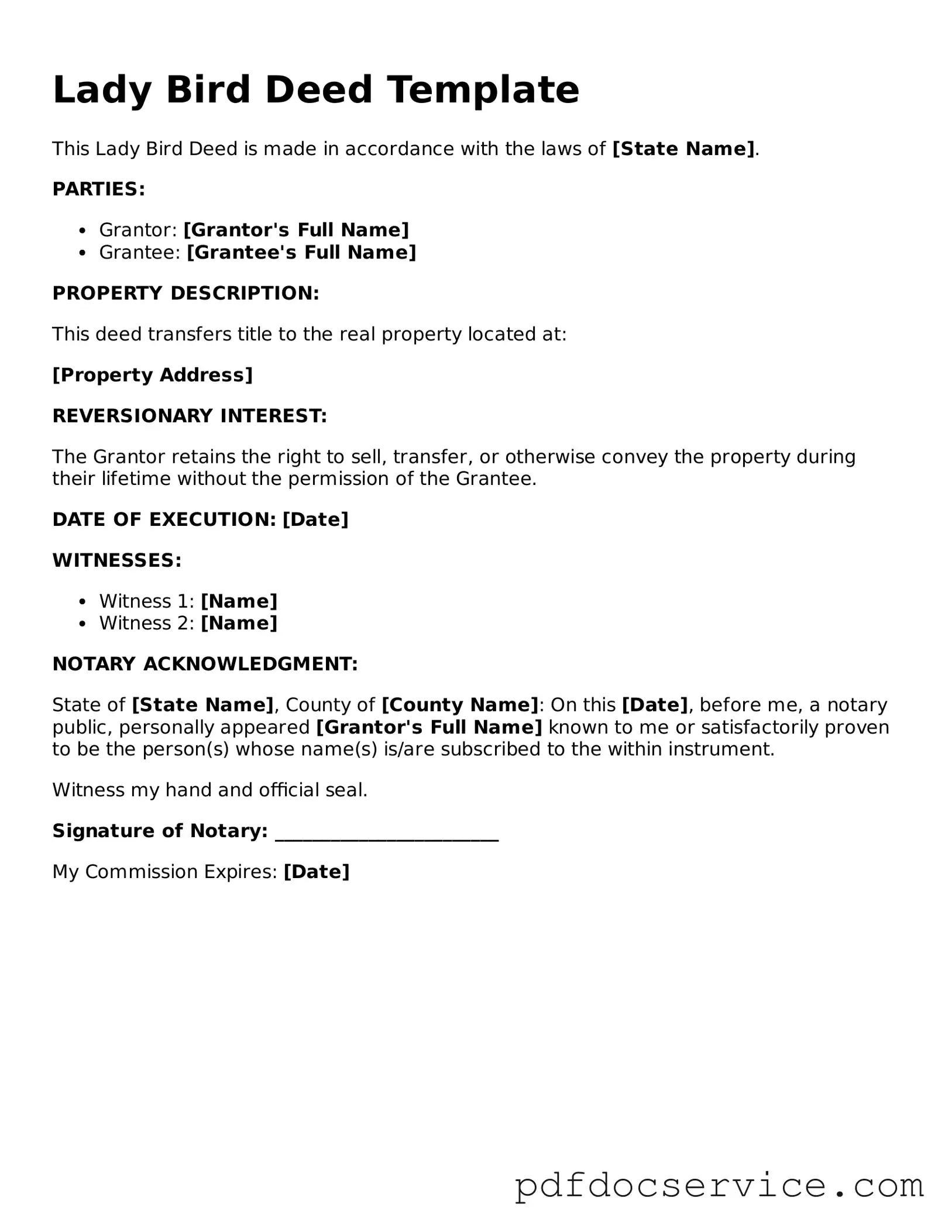

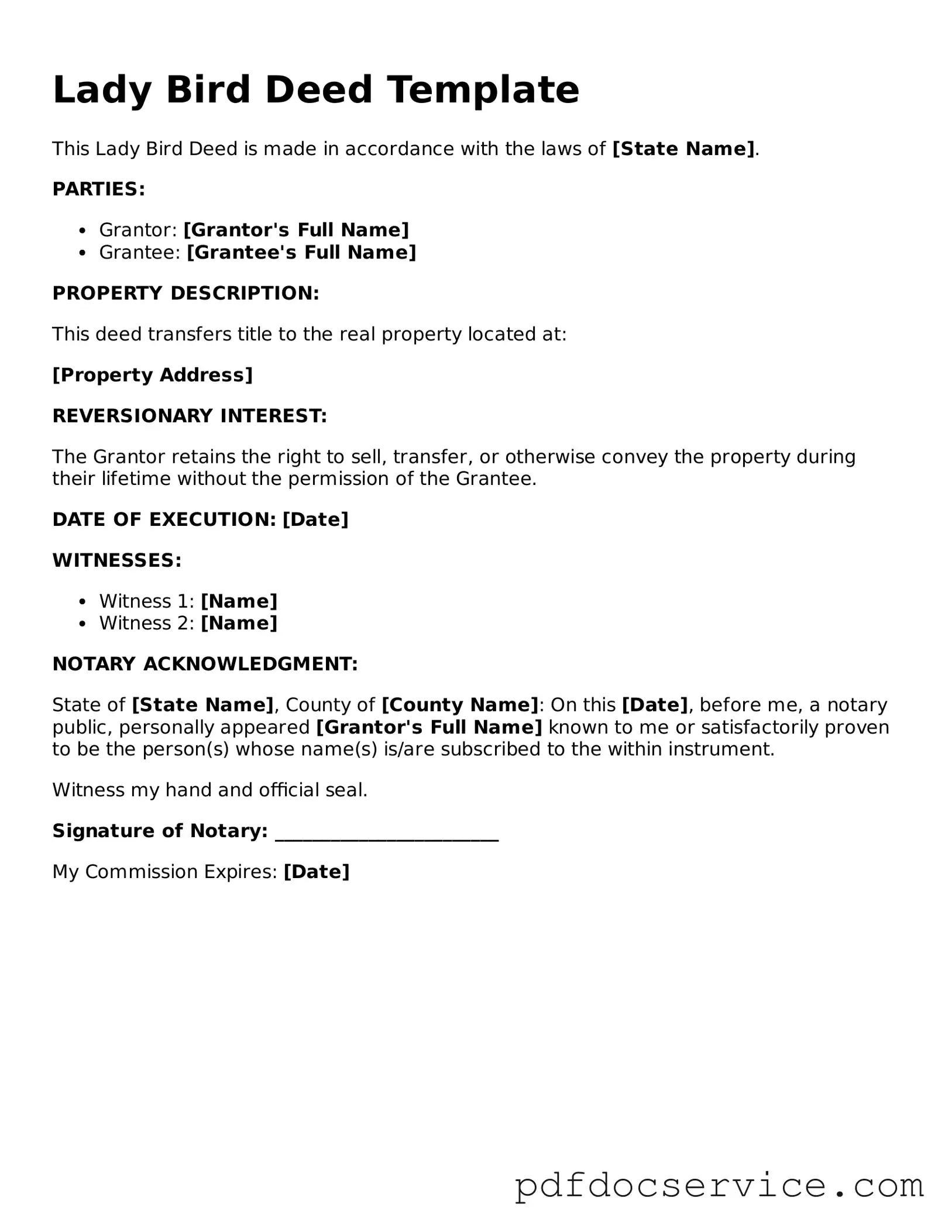

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, one typically follows these steps:

-

Consult with an attorney to ensure the deed is appropriate for your situation and complies with state laws.

-

Draft the deed, including the property description, the owner's name, and the names of the beneficiaries.

-

Sign the deed in the presence of a notary public.

-

Record the deed with the appropriate county office to make it legally effective.

Can I revoke a Lady Bird Deed?

Yes, a Lady Bird Deed can be revoked or modified at any time during the owner's lifetime. The property owner retains the right to change the beneficiaries or even cancel the deed entirely. This flexibility is one of the key benefits of using a Lady Bird Deed.

Is a Lady Bird Deed recognized in all states?

Not all states recognize Lady Bird Deeds. While they are commonly used in states like Florida and Texas, other states may have different laws regarding life estate deeds. It is essential to consult with a legal professional familiar with the laws in your state to determine if a Lady Bird Deed is a viable option for you.

What should I do if I have more questions about Lady Bird Deeds?

If you have further questions about Lady Bird Deeds or your specific situation, consider reaching out to an attorney who specializes in estate planning. They can provide personalized guidance and help you understand the implications of using a Lady Bird Deed for your estate planning needs.